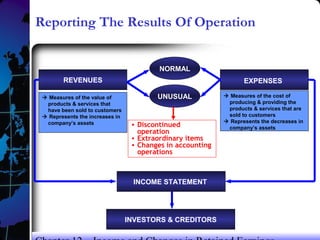

This document provides an overview of accounting principles related to income and changes in retained earnings. It discusses key topics like the components of the income statement and how they affect retained earnings, calculating earnings per share, dividends and how they impact retained earnings, prior period adjustments, and comprehensive income. The document includes examples and outlines to explain accounting entries and calculations for various transactions that can occur.