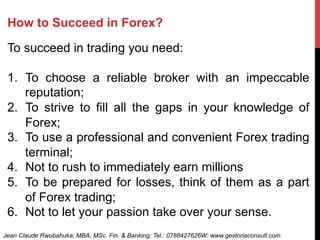

The document provides an overview of forex trading, its history, and essential concepts, including currency pairs and market participants. It explains the advantages of trading in the forex market, such as high liquidity, continuous operation, and low transaction costs. Additionally, it outlines key strategies for success in forex trading and emphasizes the importance of choosing reliable brokers and continuing education.