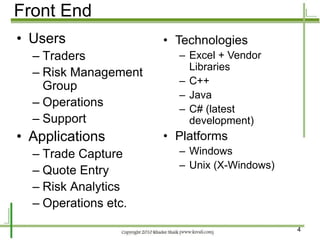

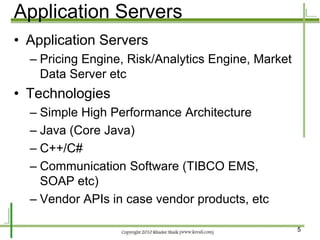

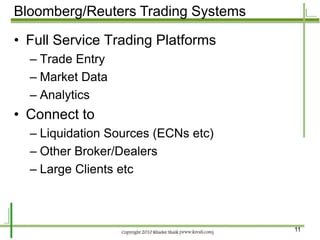

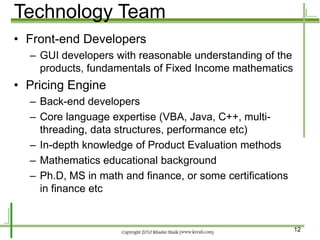

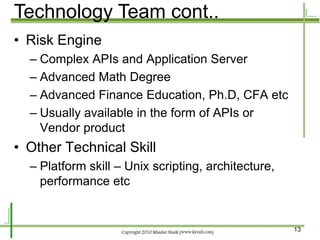

This document discusses the architecture of a fixed income trading platform. It outlines the key components including the front-end for traders, application servers to handle pricing, risk analytics and market data, databases to store information, and a multi-tier architecture with communication protocols. Considerations for design include scalability, processor power for calculations, and ensuring the platform is powerful yet stable and reliable. The technology team requirements and roles of quants are also summarized.