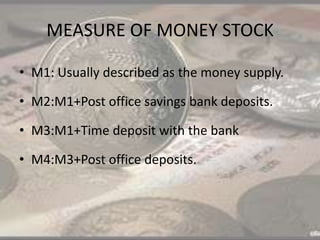

This document discusses monetary and fiscal policy in India. It defines monetary policy as how the central bank controls money supply through interest rates to maintain price stability and economic growth. It describes various monetary policy tools used by the Reserve Bank of India including bank rate, open market operations, statutory liquidity ratio, cash reserve ratio, repo rate, and reverse repo rate. The document also defines fiscal policy as government policy regarding taxation and expenditures. It outlines objectives of fiscal policy such as development, employment, income distribution, and economic activity. Instruments of fiscal policy include taxation, expenditure, and methods of funding deficits.