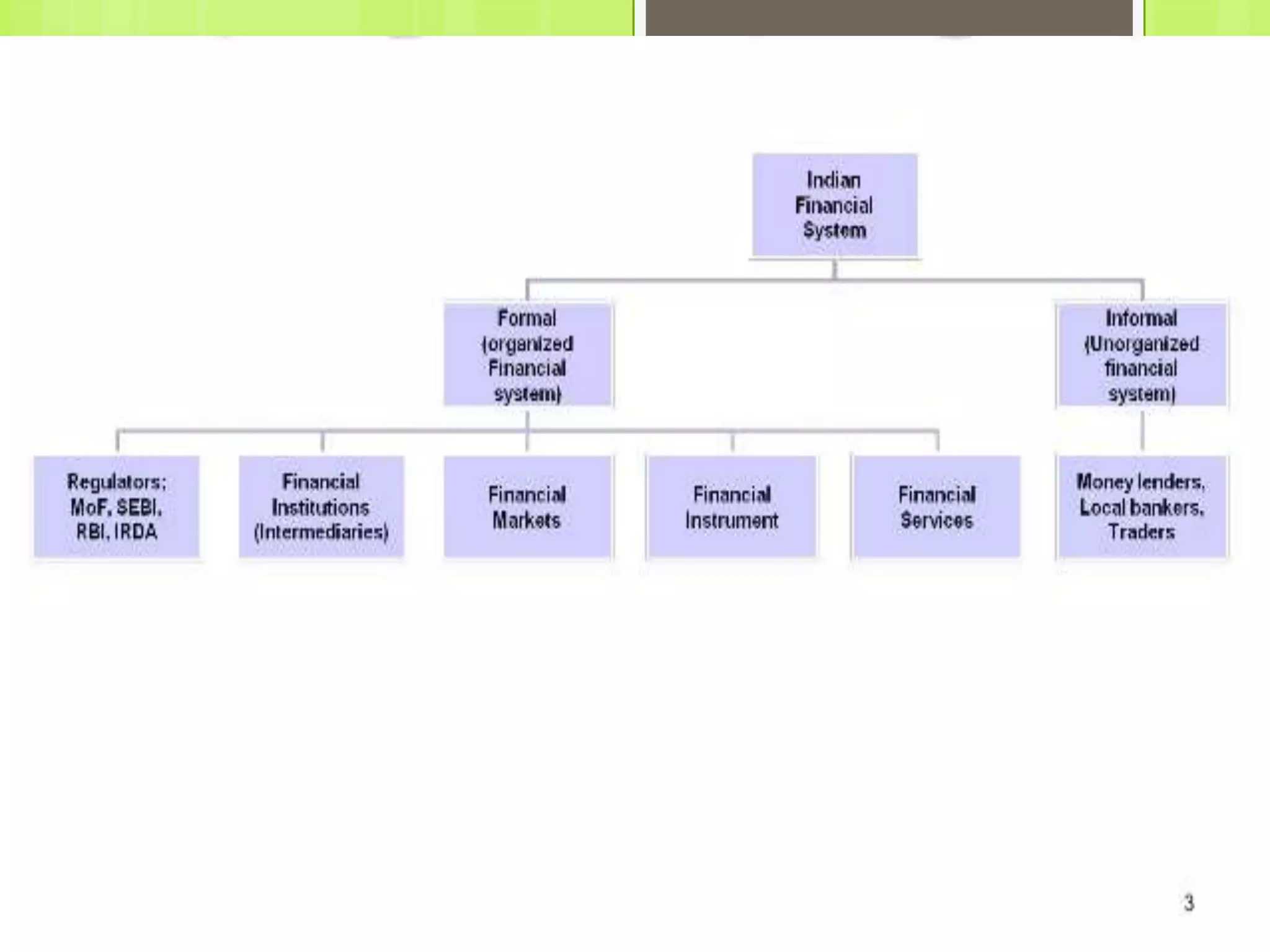

The document provides an overview of the financial system and policies in India. It discusses:

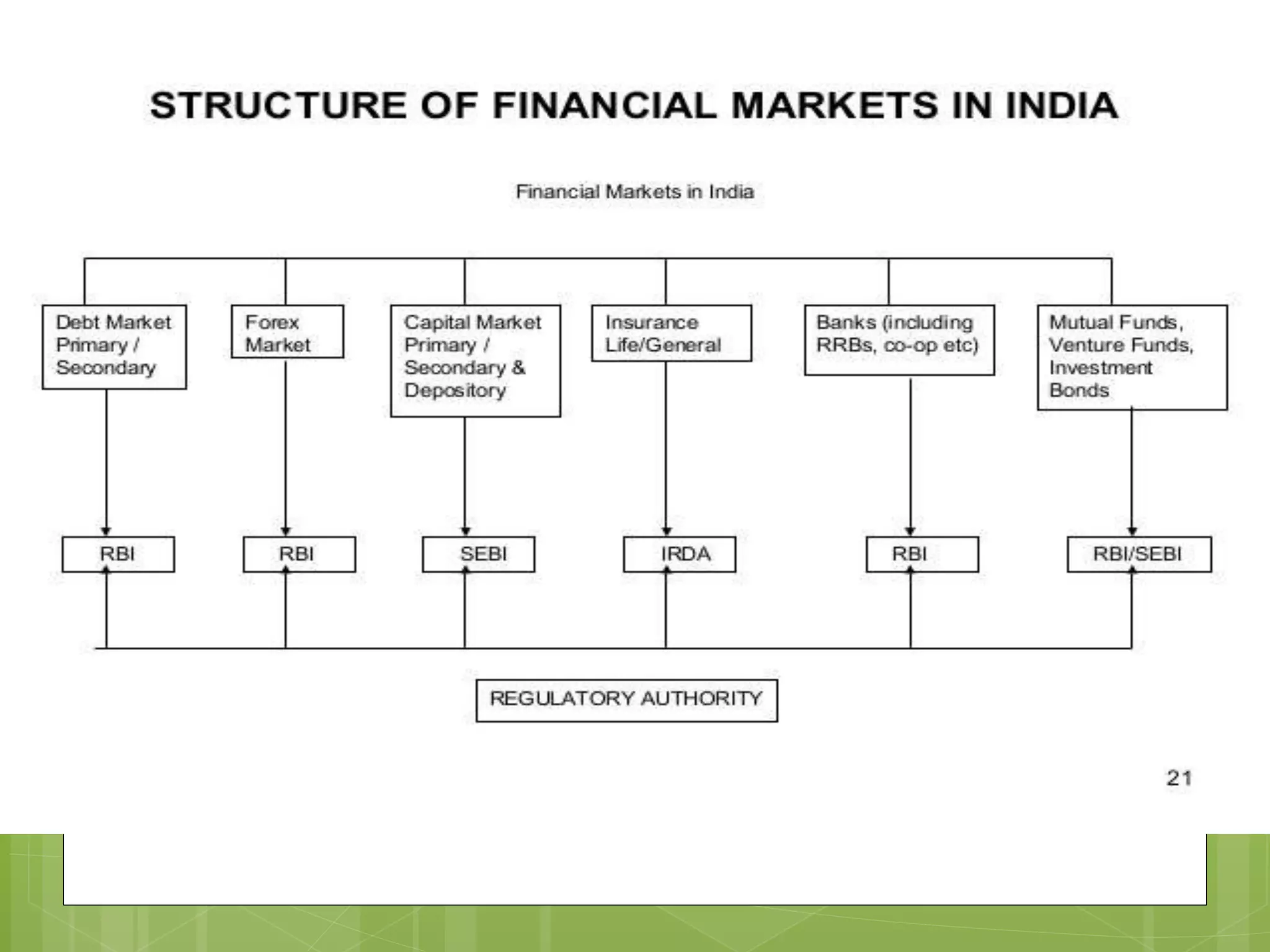

1) The key components of India's financial system including formal/informal sectors and financial markets/instruments.

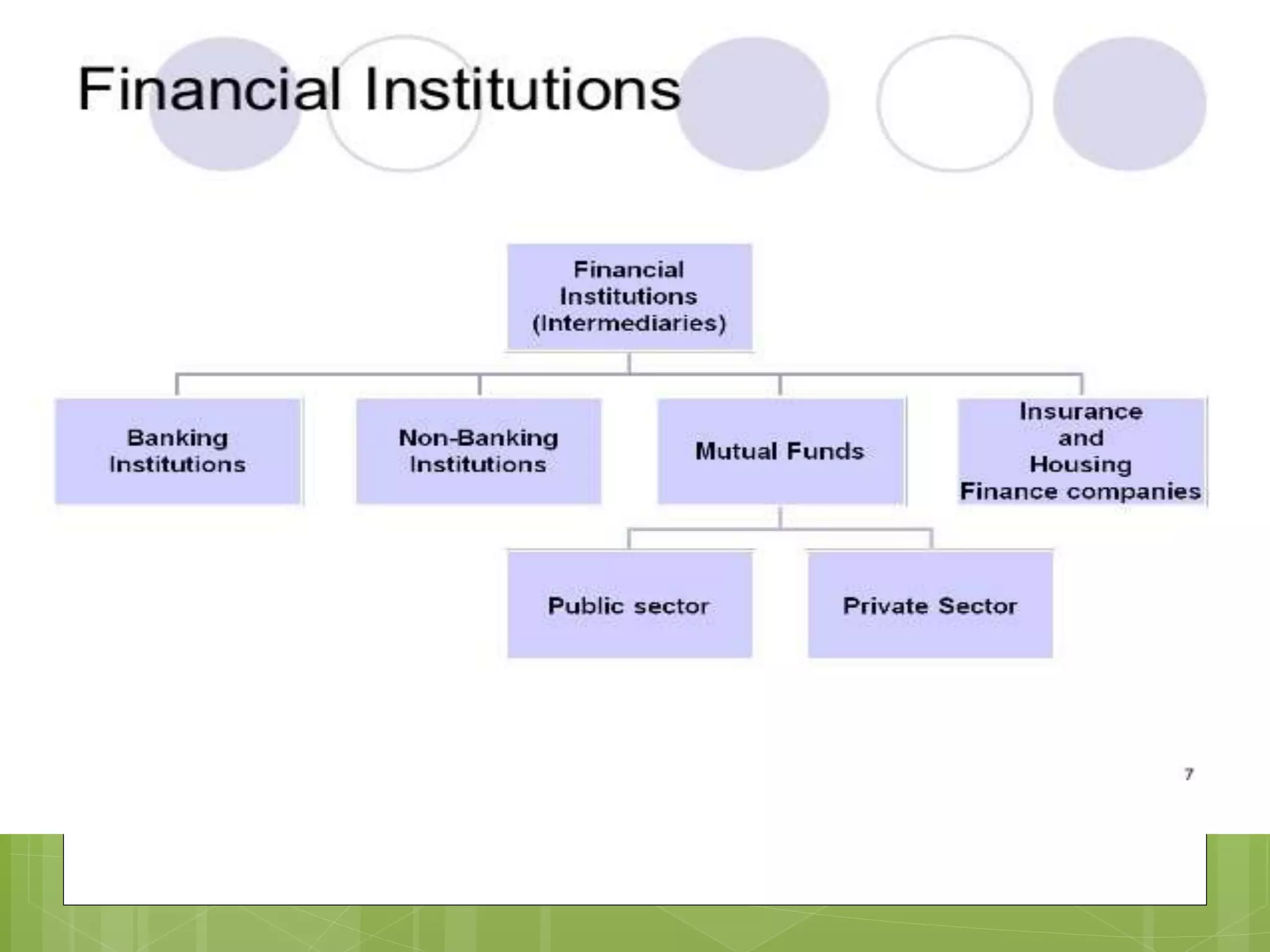

2) The roles of financial institutions in raising funds and deploying capital for individuals and businesses.

3) The objectives and tools of India's monetary policy set by the Reserve Bank of India to maintain price stability and economic growth through techniques like open market operations, cash reserve ratios, and interest rates.

4) The objectives and instruments of India's fiscal policy including the government's revenue and expenditure budgets which can be used to influence the economy through taxation and public spending.