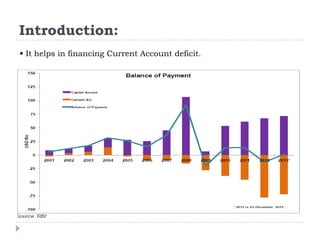

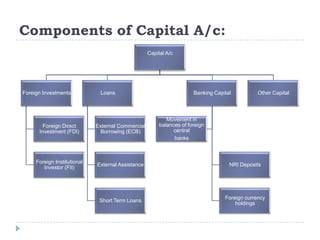

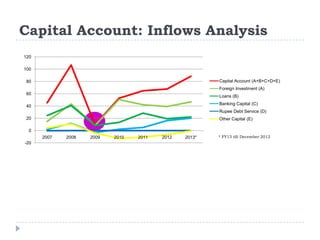

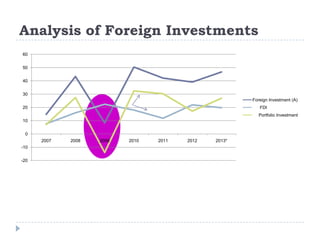

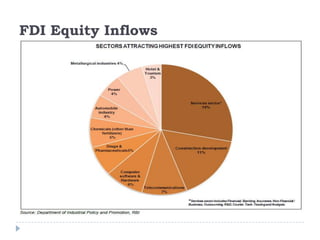

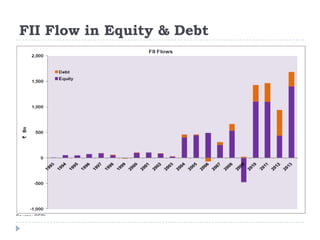

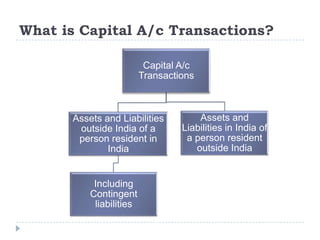

This document discusses foreign capital inflows and their impact on the Indian economy. It begins by defining capital inflows and explaining how they help finance domestic investment needs and current account deficits. It then outlines the components of capital account transactions, including foreign investments like FDI, FII, and loans. Graphs show trends in total capital inflows and the components of foreign investment and loans from 2007-2013. The document analyzes the impact of foreign investments on sectors, employment, and economic growth. It concludes by recommending measures to attract more stable capital inflows while strengthening macroeconomic stability and competitiveness.