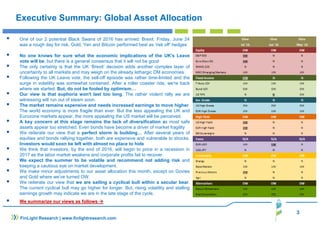

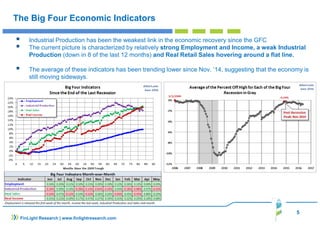

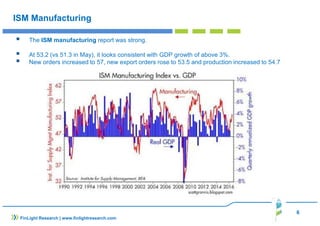

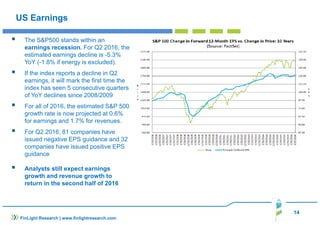

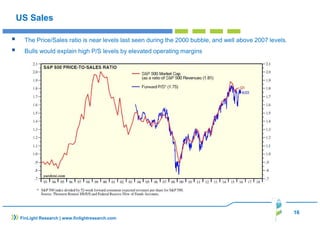

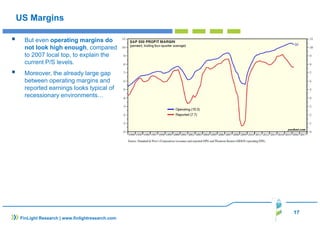

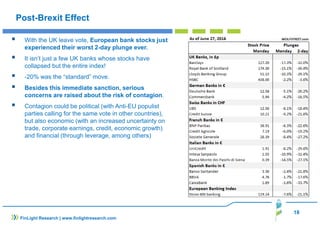

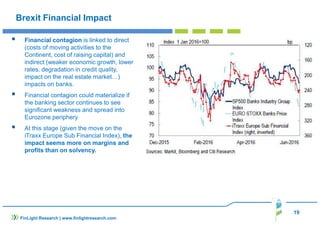

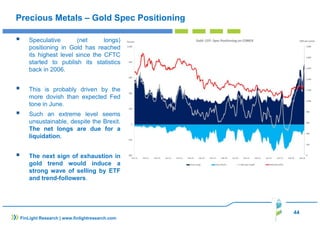

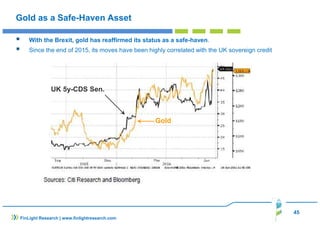

The document discusses the aftermath of Brexit, predicting increased market uncertainty and potential economic downturns, with an emphasis on cautious investment strategies. It highlights the fragility of global markets, particularly the US and European economies, while noting that despite optimism, serious concerns about corporate earnings and economic growth persist. The report ultimately recommends a defensive approach to asset allocation given the current economic indicators and market conditions.