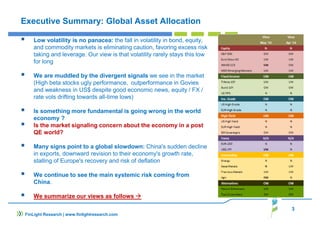

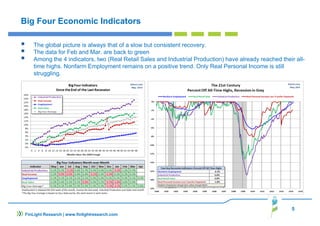

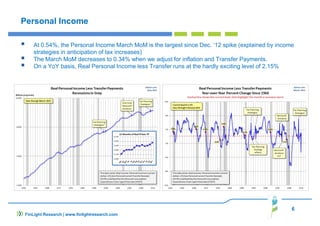

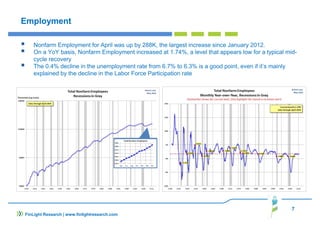

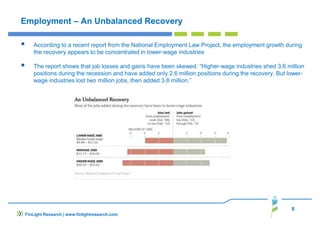

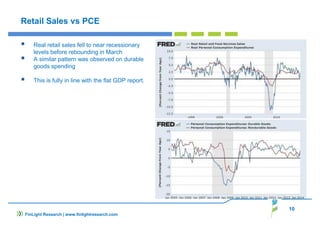

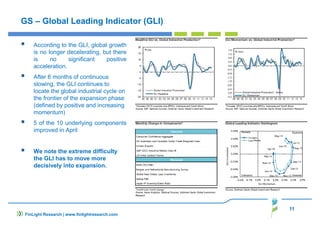

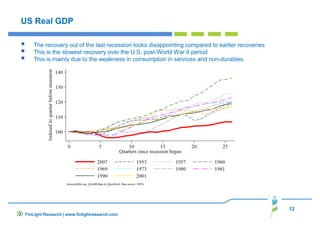

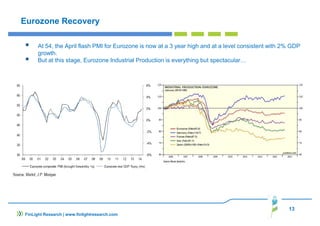

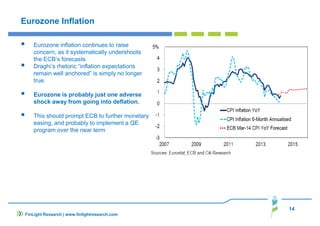

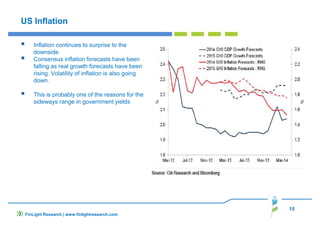

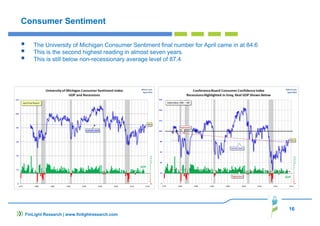

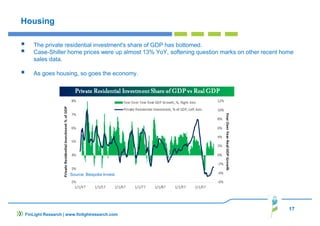

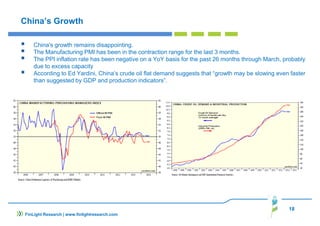

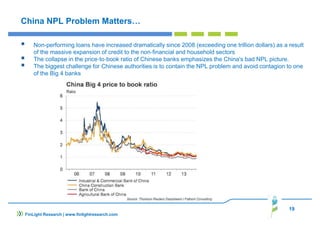

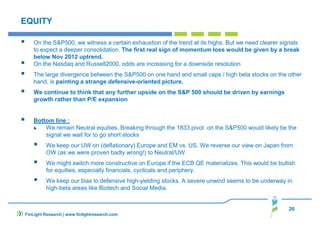

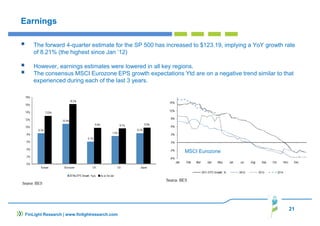

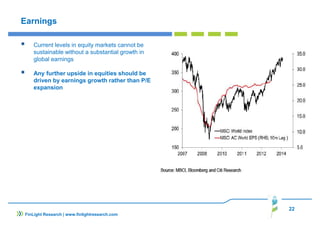

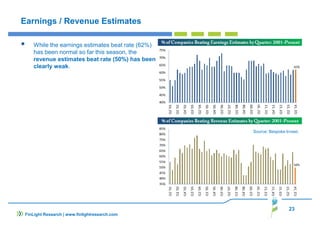

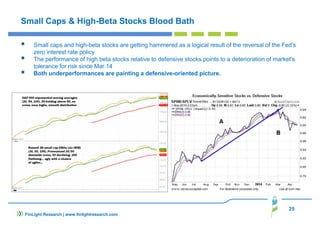

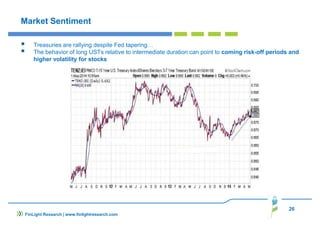

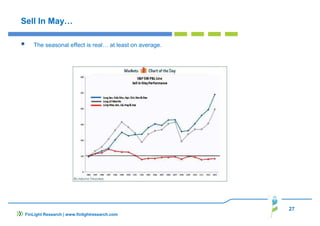

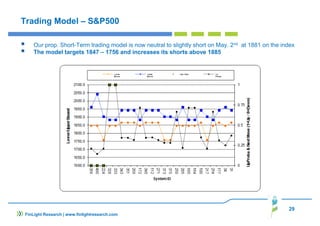

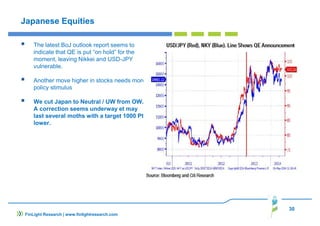

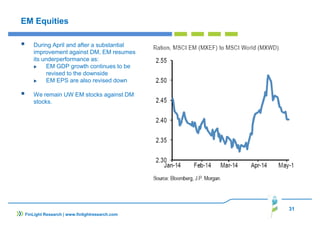

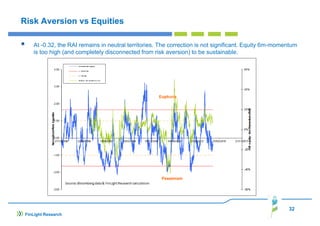

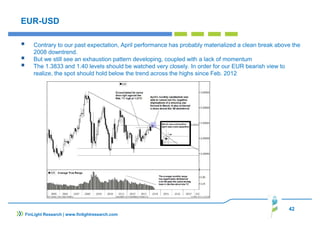

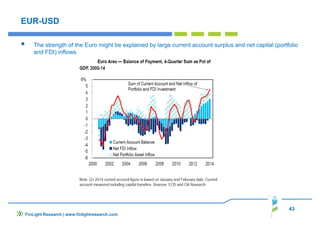

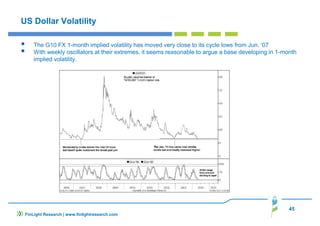

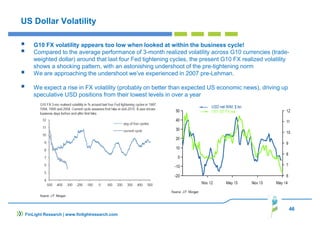

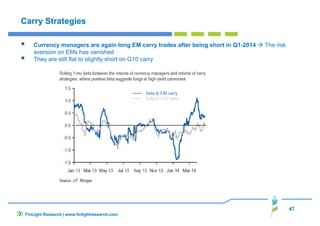

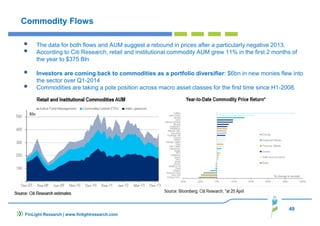

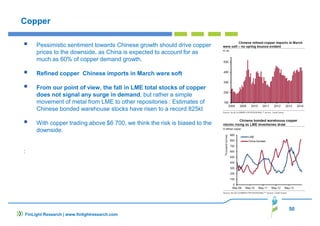

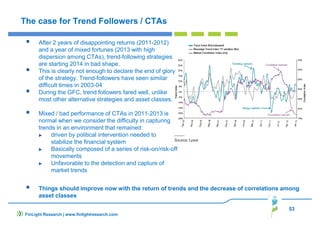

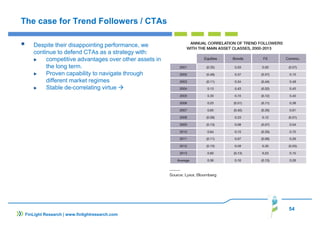

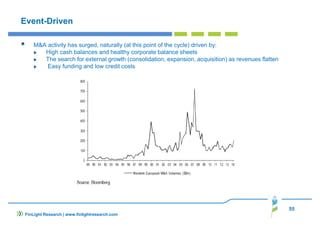

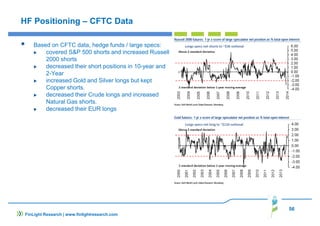

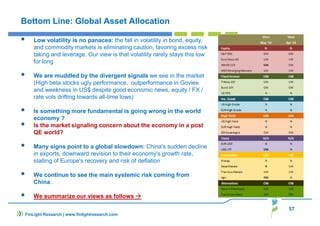

The document discusses market perspectives in May 2014, particularly criticizing the Federal Reserve's aggressive fiscal policies and highlighting the low volatility in markets leading to increased risk-taking. It points to various signals indicating a potential global economic slowdown, with particular emphasis on China's disappointing growth and systemic risks. Additionally, it presents mixed economic indicators in the U.S. and Europe, and expresses caution regarding equities, suggesting that further gains should be driven by earnings growth rather than price-to-earnings expansion.

![“The Fed has lost any semblance, any wispy remnant of humility,

introspection, caution and historical perspective. It is all cameras and

applause […]

The Fed (along with other central banks) is fully immersed in fiscal

policy, arrogating more and more responsibility for the functioning of

the global economy, picking winners and losers in purchasing financial

assets, directing the allocation of credit and making ever-bolder

predictions ever-further into the unknowable future. […]

In effect, it is achieving total political power in a political vacuum,

without the accountability of being elected. […]

If you open a faucet in the winter and only a trickle comes out,

what do you do? Easy! Open it wider. In fact, open ALL the

faucets! Brilliant! Now they are all trickling. But when the pipe

blockage comes unstuck or the ice melts, you will have a flood”

Hedge-fund manager Paul Singer

2

FinLight Research | www.finlightresearch.com](https://image.slidesharecdn.com/marketperspectives-may2014-140707020334-phpapp01/85/FinLight-Research-Market-Perspectives-May-2014-2-320.jpg)