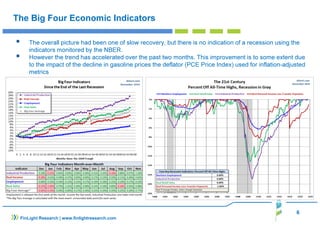

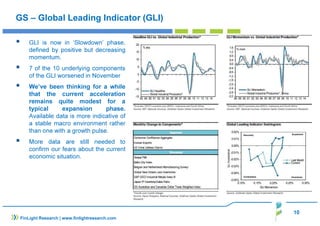

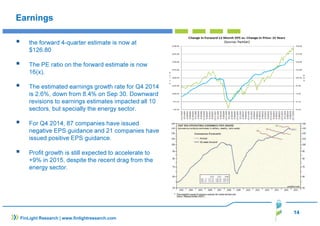

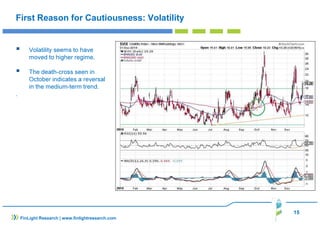

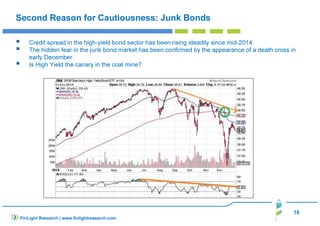

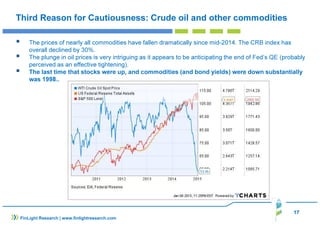

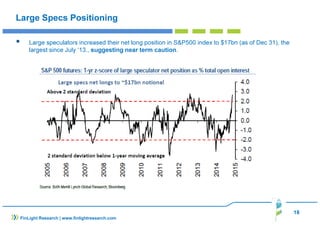

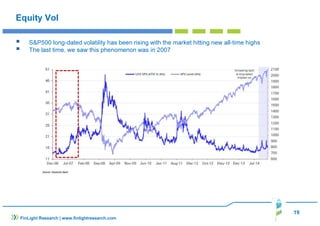

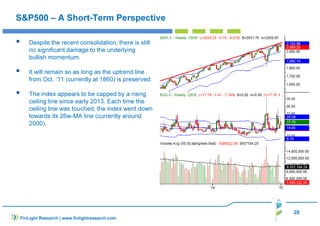

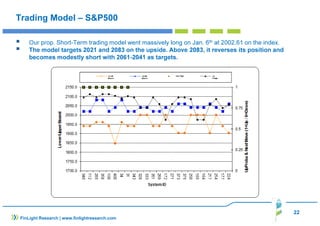

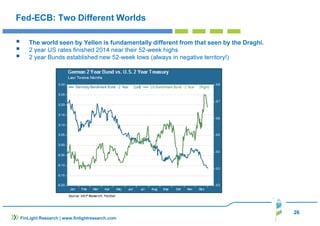

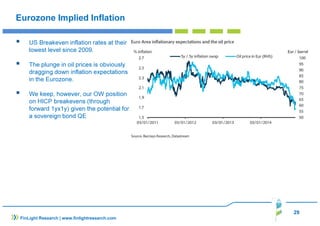

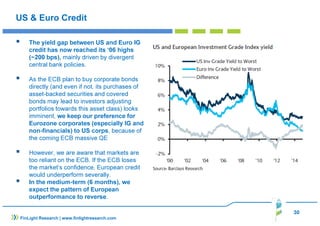

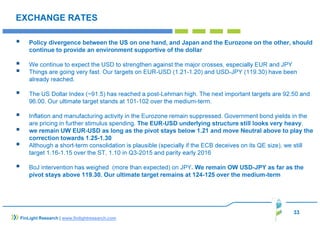

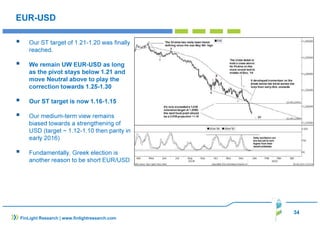

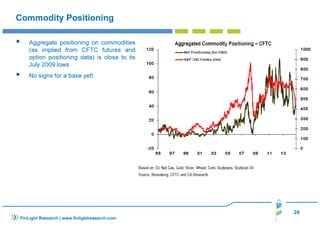

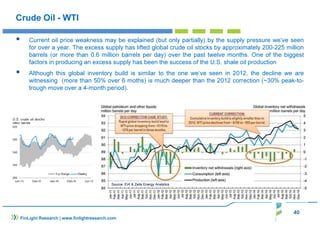

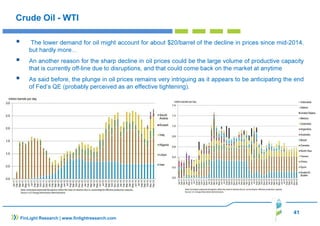

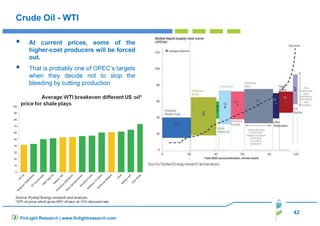

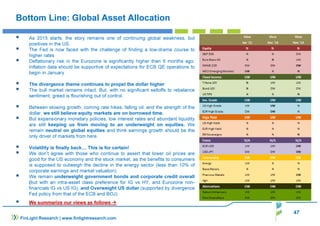

As of January 2015, the document outlines a cautious outlook on global equities amid concerns over rising volatility, falling oil prices, and the implications of upcoming Federal Reserve rate hikes. It highlights a divergence in economic conditions across the US and Eurozone, with a preference for US dollar strength and lower government yields, while warning that oil price declines may negatively impact growth, particularly in energy sectors. The research concludes that while equity markets remain intact, their current valuations and lack of significant sell-offs suggest they may be vulnerable to shifts in economic policies.