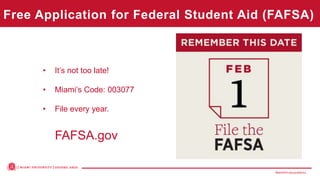

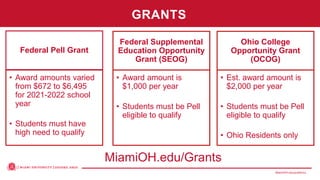

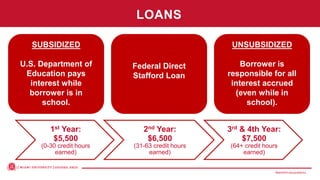

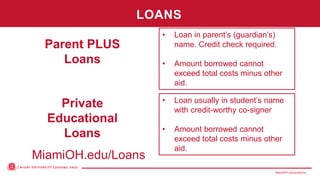

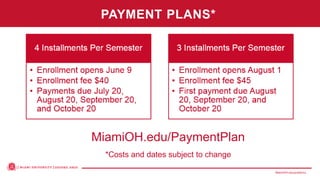

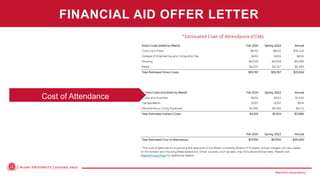

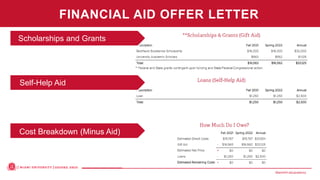

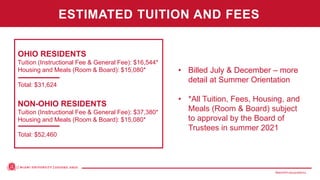

This document discusses options for financing a Miami University education, including scholarships, grants, loans, and on-campus employment. It provides details on merit scholarships, the FAFSA application, grants like the Pell Grant, federal student loans, private loans, Parent PLUS loans, and on-campus jobs. The document also outlines estimated costs of attendance for Ohio residents and non-residents, explains the financial aid offer letter, payment plans, and Miami's tuition promise guarantee.