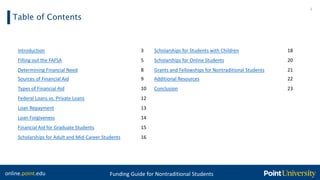

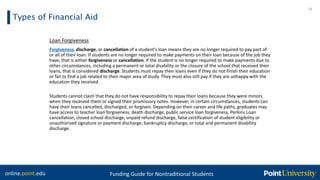

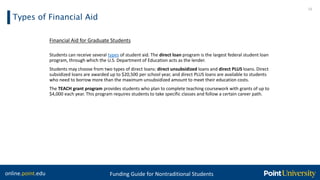

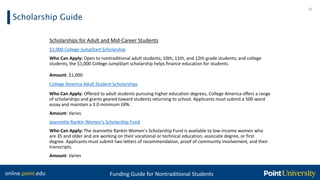

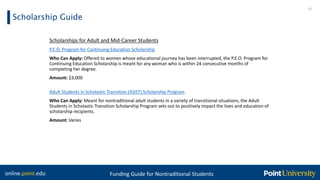

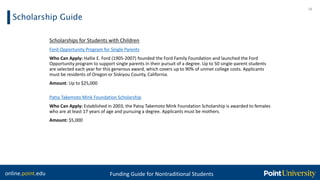

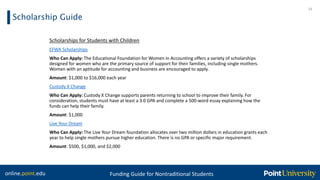

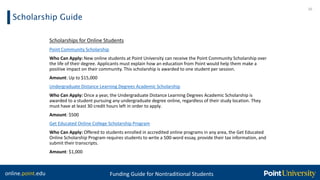

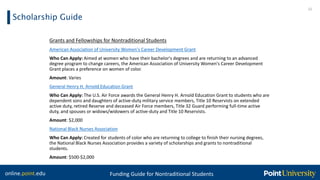

This document provides a guide to various sources of financial aid available to nontraditional students, including scholarships, grants, loans, and work-study programs from federal, state, and private sources. It discusses how to fill out the FAFSA, determine financial need, compare federal vs. private loans, understand loan repayment and forgiveness options, and find scholarships targeted towards specific groups like students with children, mid-career students, and online students. The guide provides details on many specific scholarship programs and their eligibility requirements.