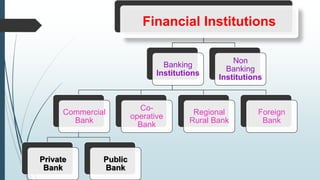

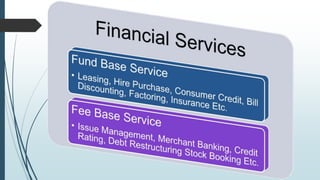

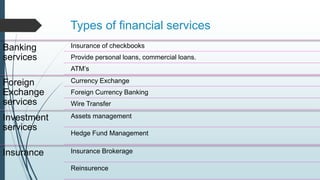

The document discusses the key components of a financial system. It defines a financial system as the process by which money flows between investors, lenders and borrowers through financial institutions, markets, instruments and services. It identifies the main functions of a financial system as providing payment and settlement systems, and mobilizing and allocating funds. The major components are financial institutions like banks, non-banking institutions, and financial markets including money markets, capital markets, and hybrid instruments. Financial services include banking, insurance, foreign exchange, and investment services.