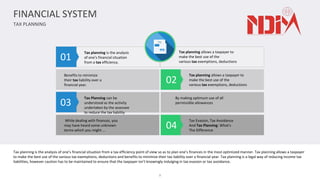

The document provides an overview of various components of personal finance including financial statements, tax planning, adequate protection in bankruptcy, investment goals, and estate planning. It emphasizes the importance of understanding financial positions through balance sheets, cash flow, and income statements, alongside strategies for tax efficiency and estate management. The aim is to equip individuals with the knowledge to effectively manage their financial situation and future planning.