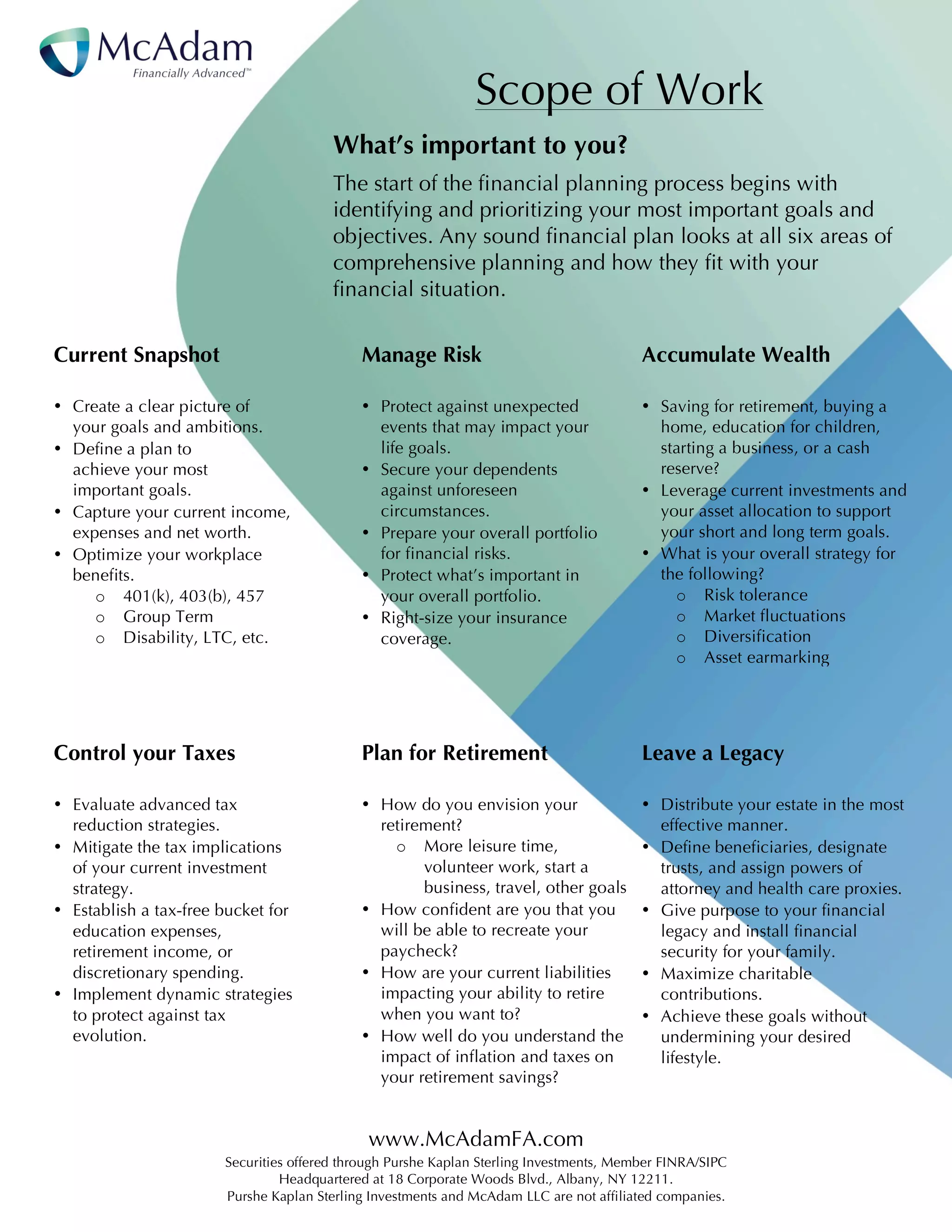

The document outlines the six key areas of a comprehensive financial plan: current snapshot, manage risk, accumulate wealth, control taxes, plan for retirement, and leave a legacy. It provides details on what each area involves, such as creating a clear picture of goals, capturing current income and expenses, protecting against financial risks, leveraging investments to support goals, evaluating tax strategies, planning for how retirement will look, and distributing an estate effectively. The overall scope is to develop a plan that addresses all of these essential areas and fits an individual's unique financial situation and priorities.