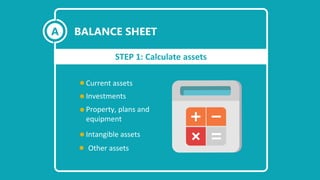

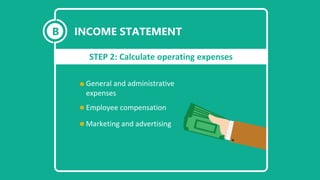

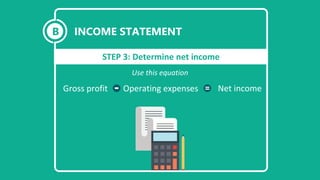

The document outlines how to prepare a year-end financial report, detailing the necessary components such as assets, liabilities, net worth, revenues, and expenses. It provides a step-by-step approach for calculating these elements and emphasizes the importance of financial statements like the income statement and balance sheet. The process is aimed at informing stakeholders about the company's financial performance over the past year.