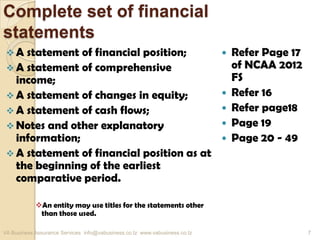

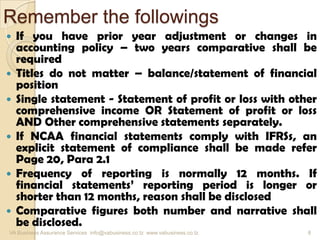

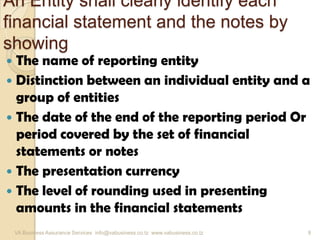

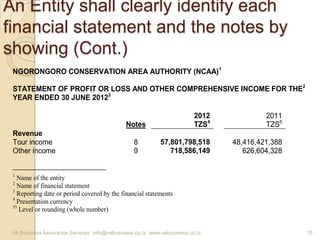

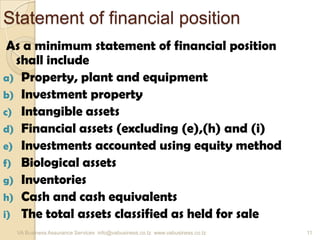

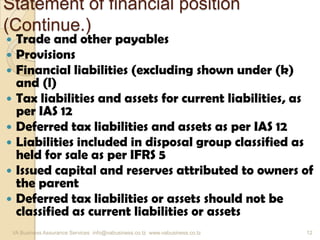

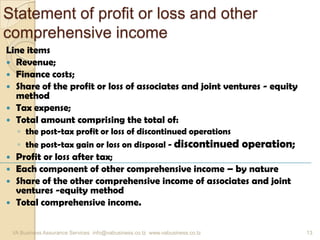

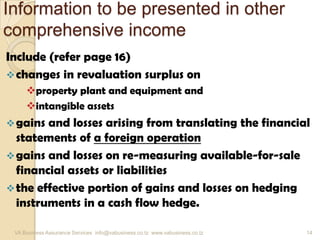

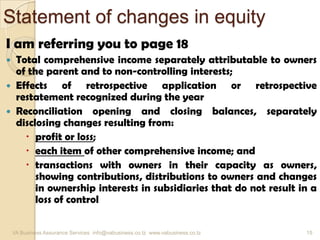

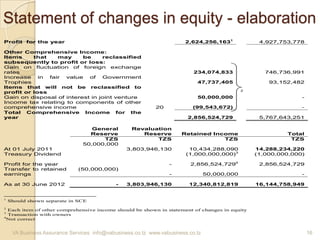

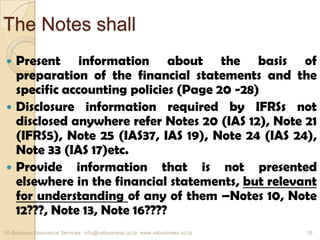

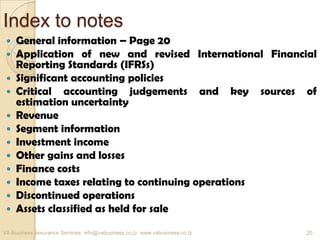

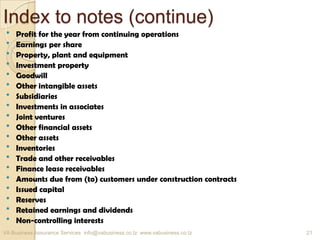

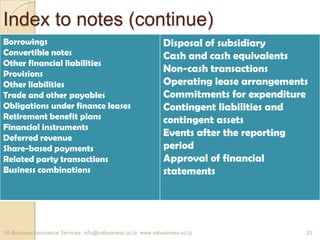

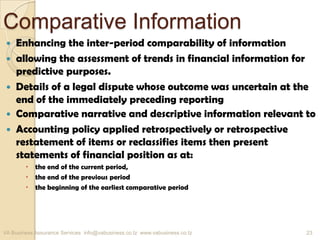

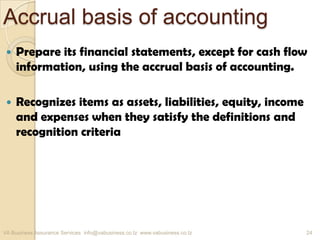

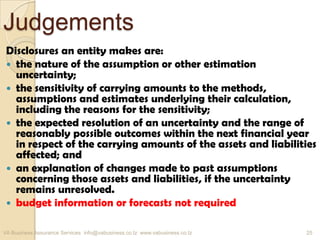

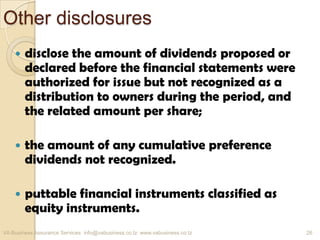

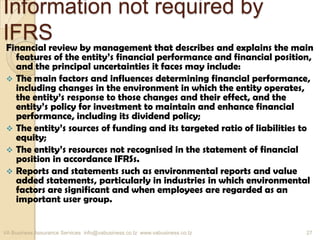

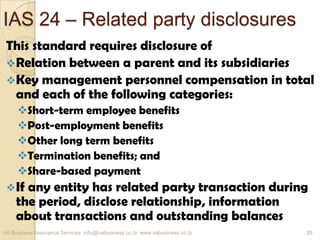

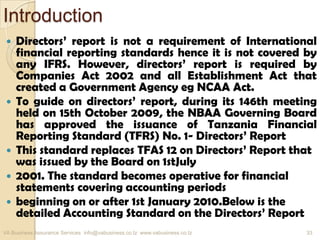

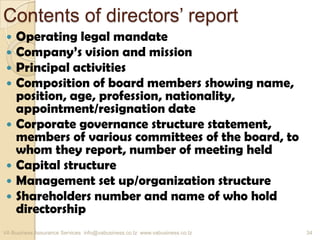

The document outlines the framework for general-purpose financial statements in compliance with various International Accounting Standards (IAS) and Tanzania Financial Reporting Standards (TFRS), focusing on requirements for presentation, disclosures, and reporting. It emphasizes the purpose and elements of financial statements, including financial position, performance, and cash flows, as well as additional considerations such as related party disclosures and directors' reports. Key features include compliance, materiality, and the necessity for comparative information in financial reporting.