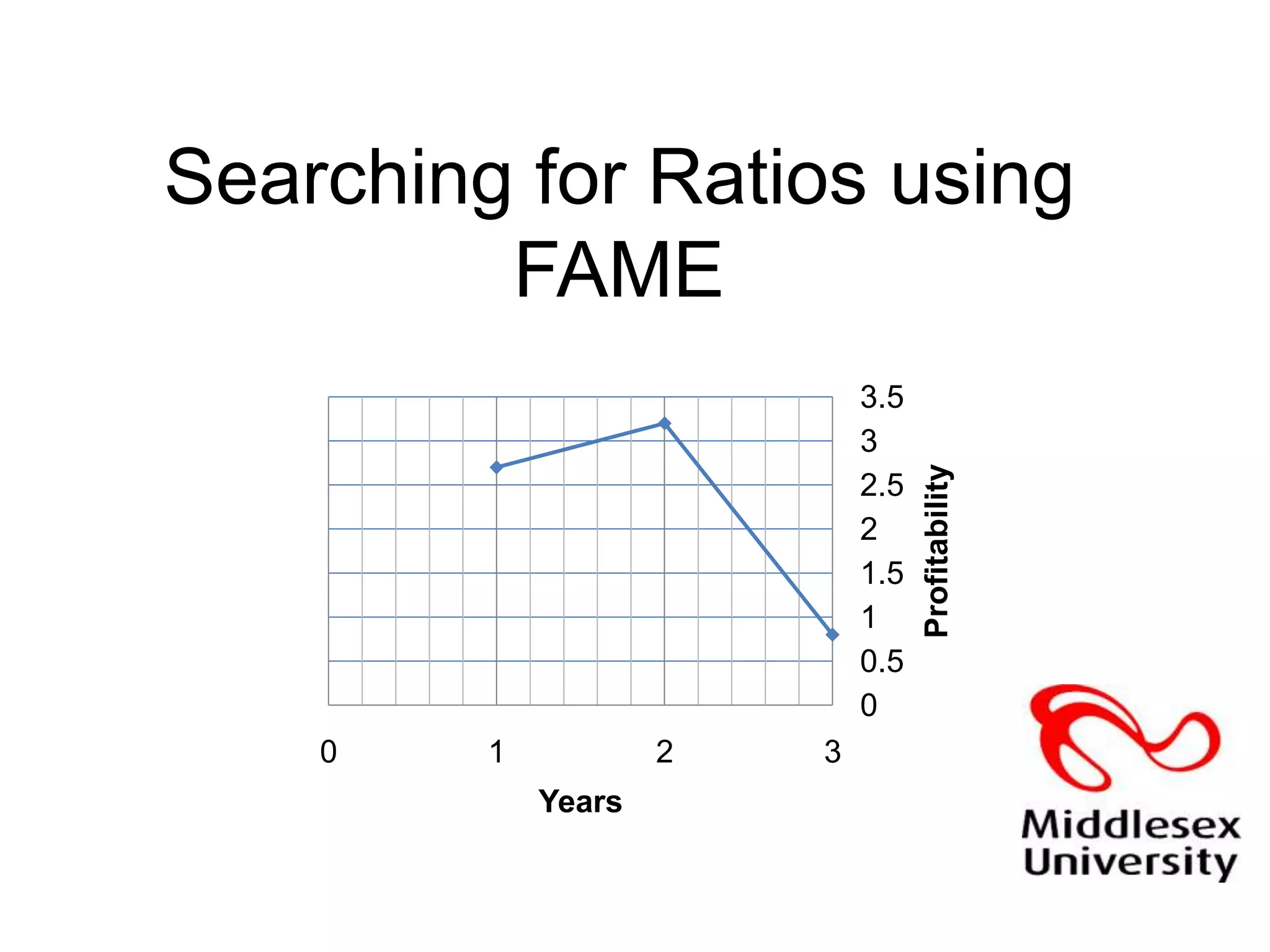

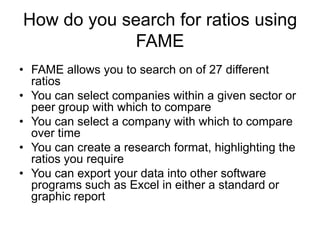

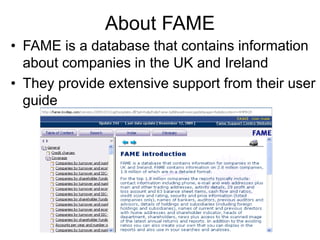

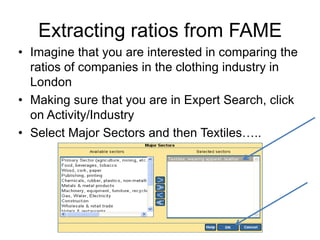

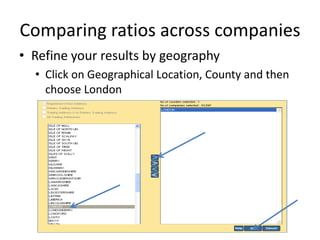

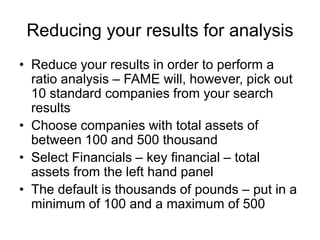

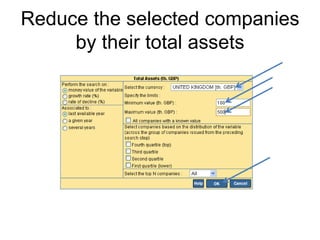

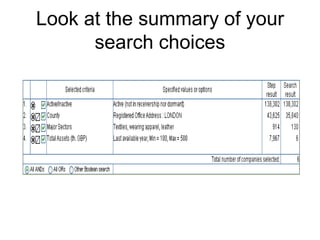

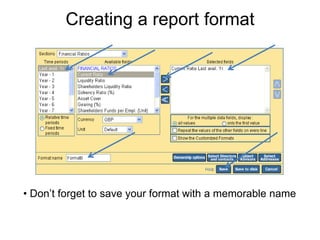

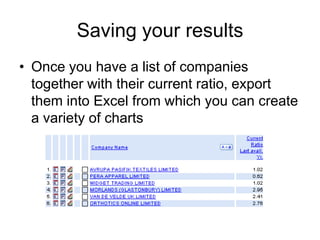

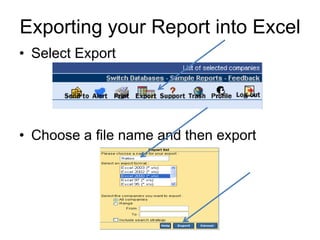

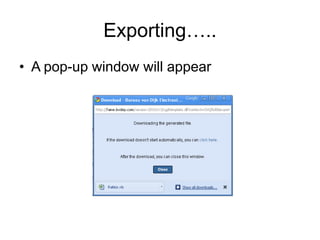

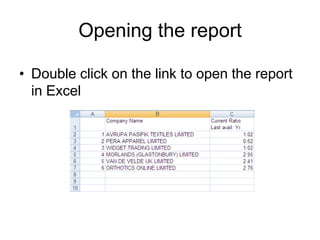

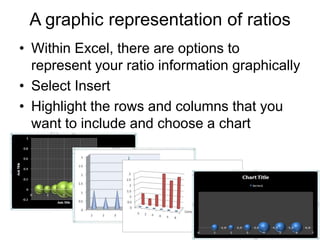

This document provides information on how to search for and analyze ratios using the FAME database. It explains that ratios can be used to assess a company's liquidity, solvency, efficiency and profitability. It also outlines the main types of ratios, including liquidity, solvency, efficiency and profitability ratios. Finally, it describes how to search for companies on FAME based on industry, location and other financial metrics, how to create a report format to extract specific ratios, and how to export the results into Excel for further analysis and charting.