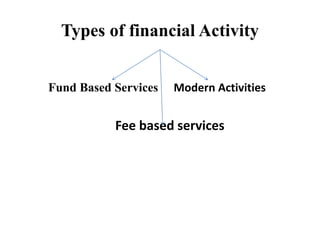

Financial services can be defined as the products and services offered by institutions like banks for various financial transactions and money management. They include activities that transform savings into investment and provide capital market services, money market services, retail services, and wholesale services. Financial services are intangible, customer-oriented, simultaneous in production and delivery, perishable, proactive, link investors and borrowers, and aid in distributing risks. They include fund-based activities like underwriting shares and bonds, money market instruments, and foreign exchange, as well as fee-based activities like managing capital issues and advising corporate clients. Financial services are important because they support vibrant capital markets, expand financial activities, benefit governments, promote economic development and growth, maximize