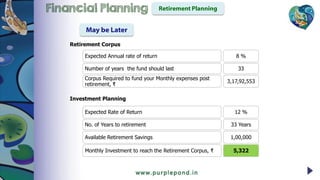

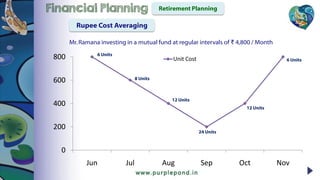

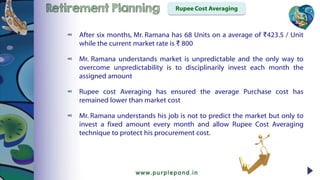

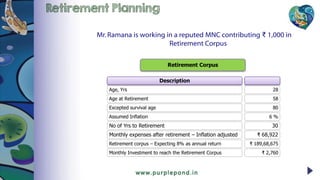

The document provides a comprehensive guide on retirement planning, emphasizing the importance of early investment, financial discipline, and leveraging the power of compounding. It highlights Mr. Ramana's retirement goals, estimated expenses, and necessary monthly savings to achieve his desired retirement corpus. The text also explains key concepts such as rupee cost averaging and the significance of financial planning in ensuring long-term financial security.