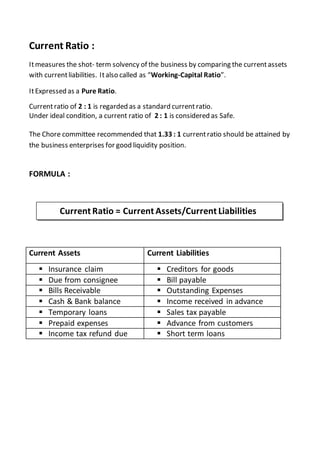

The document discusses the concept of window dressing in financial management, highlighting methods used to manipulate financial statements to present a more favorable position than reality. It also outlines key financial ratios such as the current ratio, quick ratio, and stock to working capital ratio, which are used to assess a company's short-term solvency and liquidity. Standard values for these ratios are noted, emphasizing their importance for assessing a business's financial health.