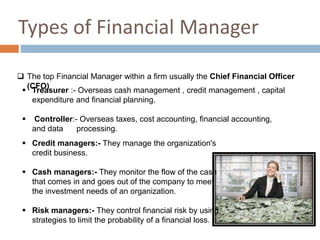

Financial managers are responsible for the financial health of an organization. They prepare financial reports and statements, direct investment activities, develop long-term financial strategies and plans, monitor finances to ensure legal compliance, analyze market trends to find opportunities for expansion, and help management make important financial decisions. Common roles of financial managers include chief financial officer, treasurer, controller, credit manager, cash manager, and risk manager. Key responsibilities include estimating capital needs, determining the optimal capital structure, choosing sources of funding, procuring funds, utilizing funds prudently, managing cash flow, disposing of profits, and evaluating financial performance.