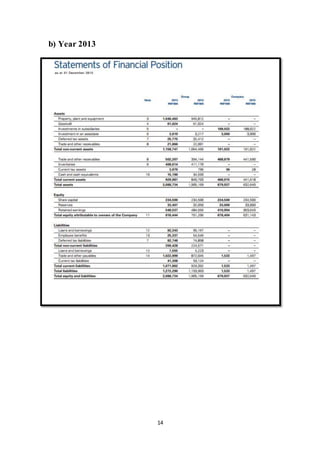

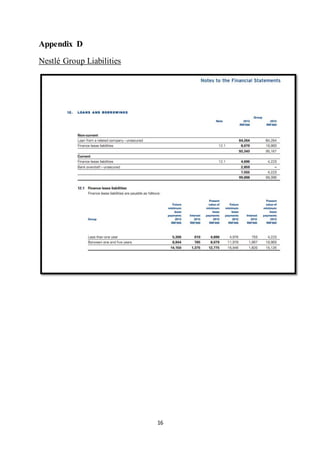

This document analyzes the financial ratios of Nestlé for the years 2012 and 2013. It calculates various profitability, stability, and turnover ratios based on information from Nestlé's annual reports. The profitability ratios show that Nestlé's net profit margin and gross profit margin increased from 2012 to 2013, while its return on equity slightly decreased. The stability ratios indicate that Nestlé's working capital and interest coverage improved, while its total debt ratio increased slightly. The document concludes that Nestlé's share price of RM69.58 per share, with an earnings per share of RM239.53, gives it a high price-to-earnings ratio of 29.05, making its shares too expensive for conservative investors.