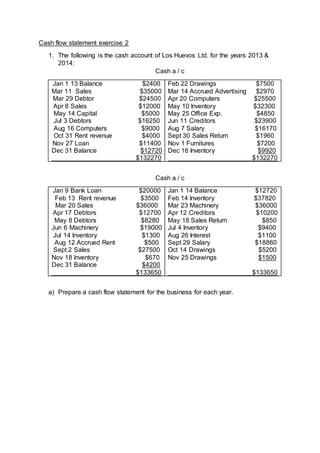

The cash flow statements show that Los Huevos Ltd had negative cash flows in 2013 but positive cash flows in 2014. Cash balances increased from $-12720 to $-4200 due to positive operating cash flows of $12220 and financing cash flows of $13300 in 2014. To further improve cash flows, the company could use machinery for longer, reduce drawings, and reduce salary expenses. A cash flow statement serves to evaluate a business's ability to generate cash flows, service debts, and expand operations. It is possible for a business to be profitable but have negative cash flows or vice versa due to the impact of investing and financing activities.