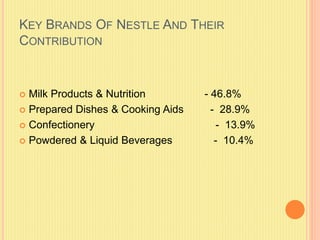

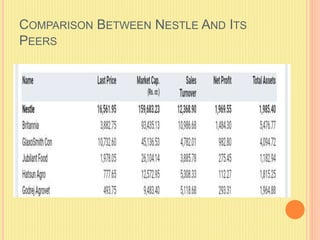

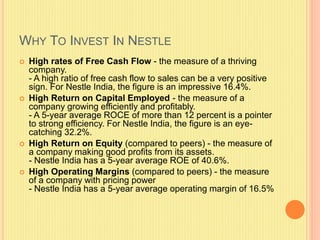

Nestlé, founded in 1866, established its first factory in India in 1961 and has a diverse portfolio with significant contributions from milk products, prepared dishes, and confectionery. The company exhibits strong financial metrics, including a free cash flow of 16.4% and a return on equity of 40.6%, indicating efficient and profitable operations. The document concludes with a brief mention of the company's performance in the June 2020 quarter.