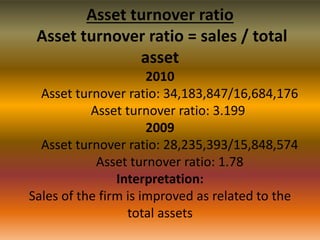

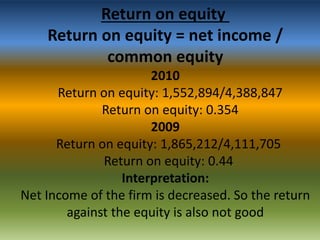

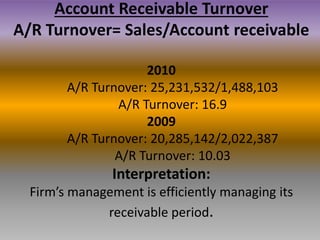

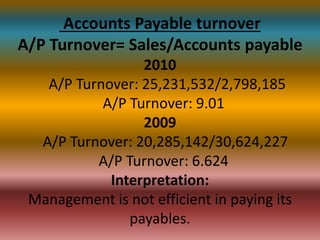

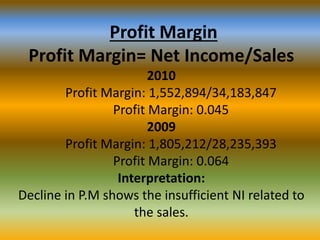

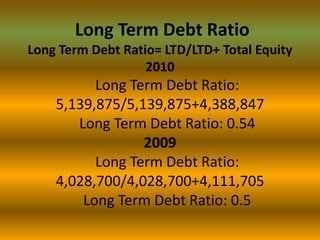

Nestle Pakistan Limited is a subsidiary of Nestle S.A. that manufactures and sells food products across Pakistan. The document provides an overview of Nestle's product portfolio and brands, which include beverages, cereals, dairy, and confectionery. It also presents Nestle's mission statement, financial ratios from 2009-2010, and a SWOT analysis. Key highlights are that Nestle aims to provide high quality nutrition suitable for Pakistani lifestyles, and it has a strong presence across the country through its manufacturing and distribution network.