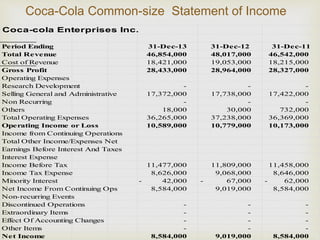

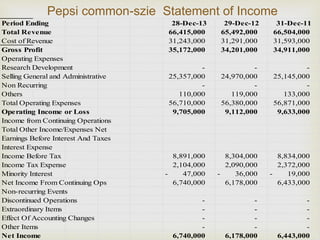

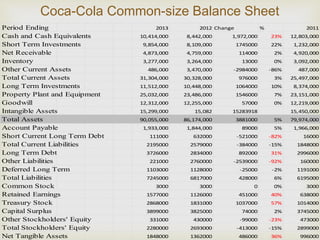

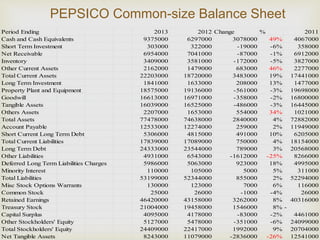

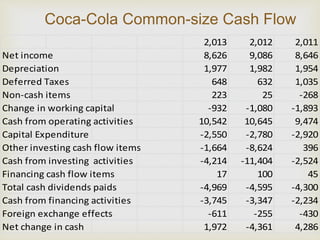

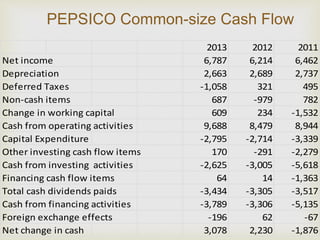

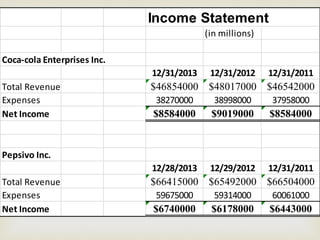

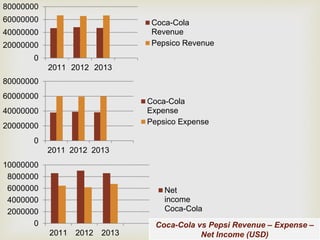

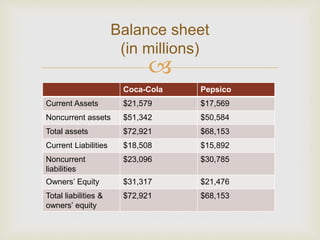

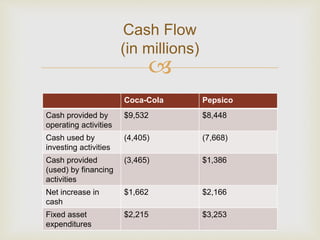

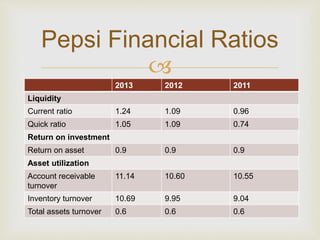

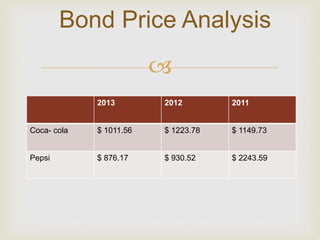

This document analyzes and compares the financial performance of Coca-Cola and PepsiCo over three years from 2011-2013. It includes common-size income statements and balance sheets, comparative income statements and balance sheets, calculated financial ratios, and bond price analysis for both companies. The analysis shows that while both companies experienced revenue growth over the period, Coca-Cola had higher net income and stronger liquidity and return on asset ratios compared to PepsiCo.