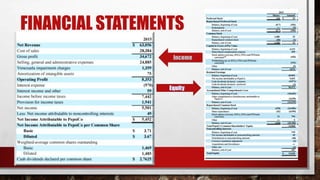

Caleb Bradham created Pepsi-Cola in the late 1890s in North Carolina. PepsiCo was formed in 1961 through the merger of Pepsi-Cola and Frito-Lay. PepsiCo's goal is to continue innovating, meeting customer demands, and enhancing consumer experiences globally. Its mission is to provide delicious, affordable foods and beverages while helping people lead healthier lives. PepsiCo generates strong cash flows from global snacks and beverages and rewards shareholders through growing dividend payouts and share repurchases.