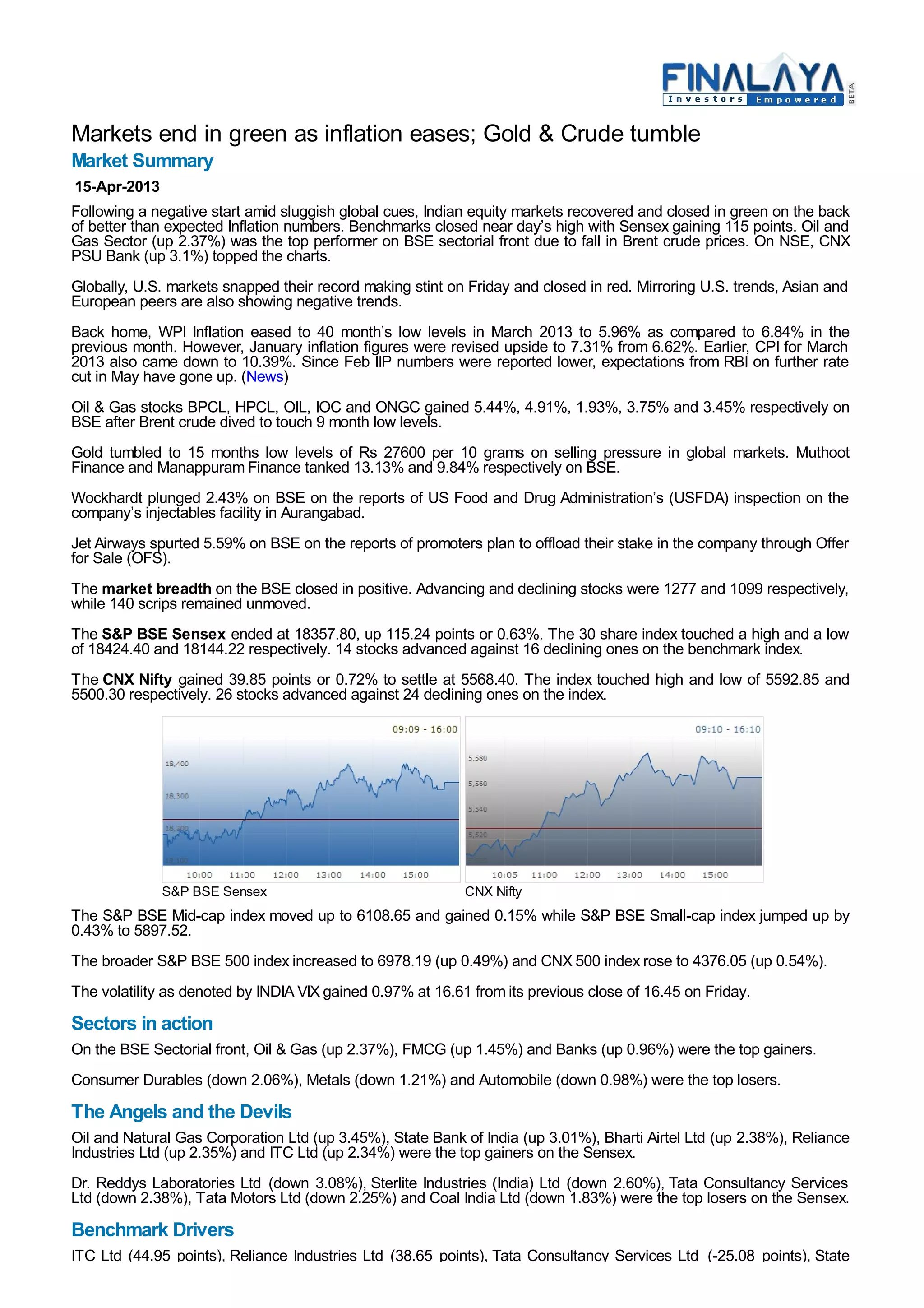

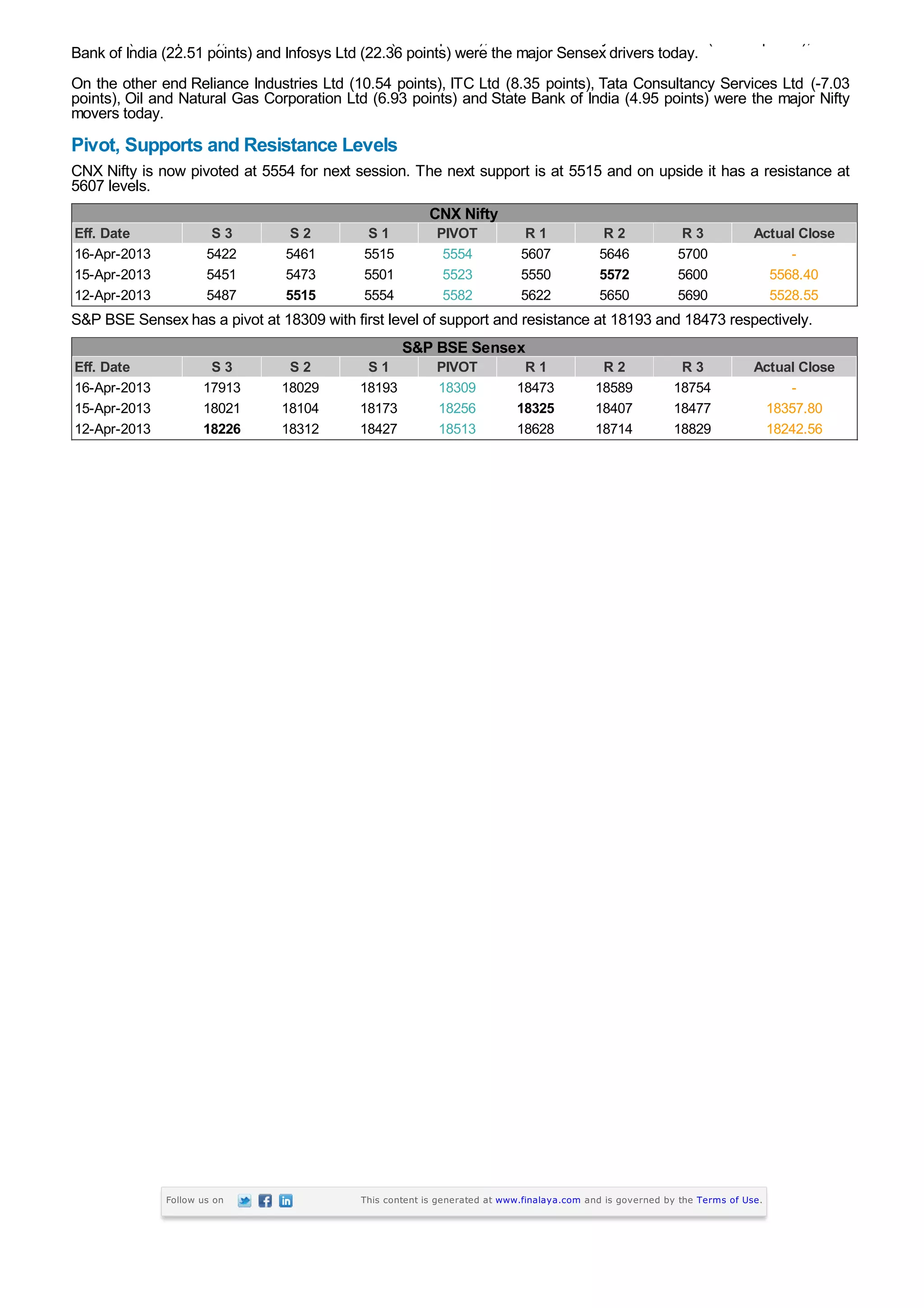

Indian markets ended higher as inflation eased more than expected. The Sensex gained 115 points and the Nifty rose 40 points. Oil and gas stocks rose with crude prices falling, while gold prices fell to a 15-month low. Overall market breadth was positive with more advancing stocks than declining.