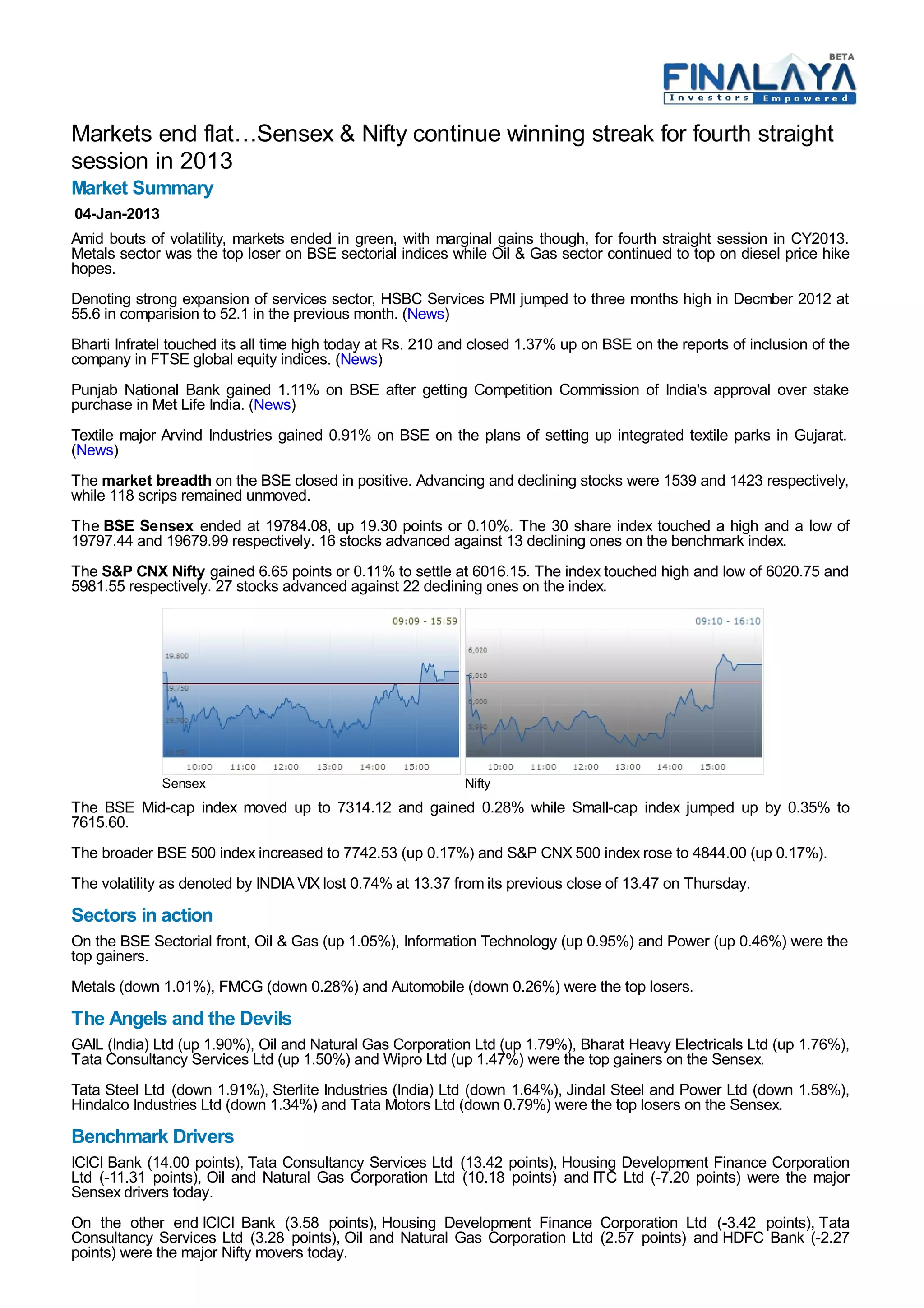

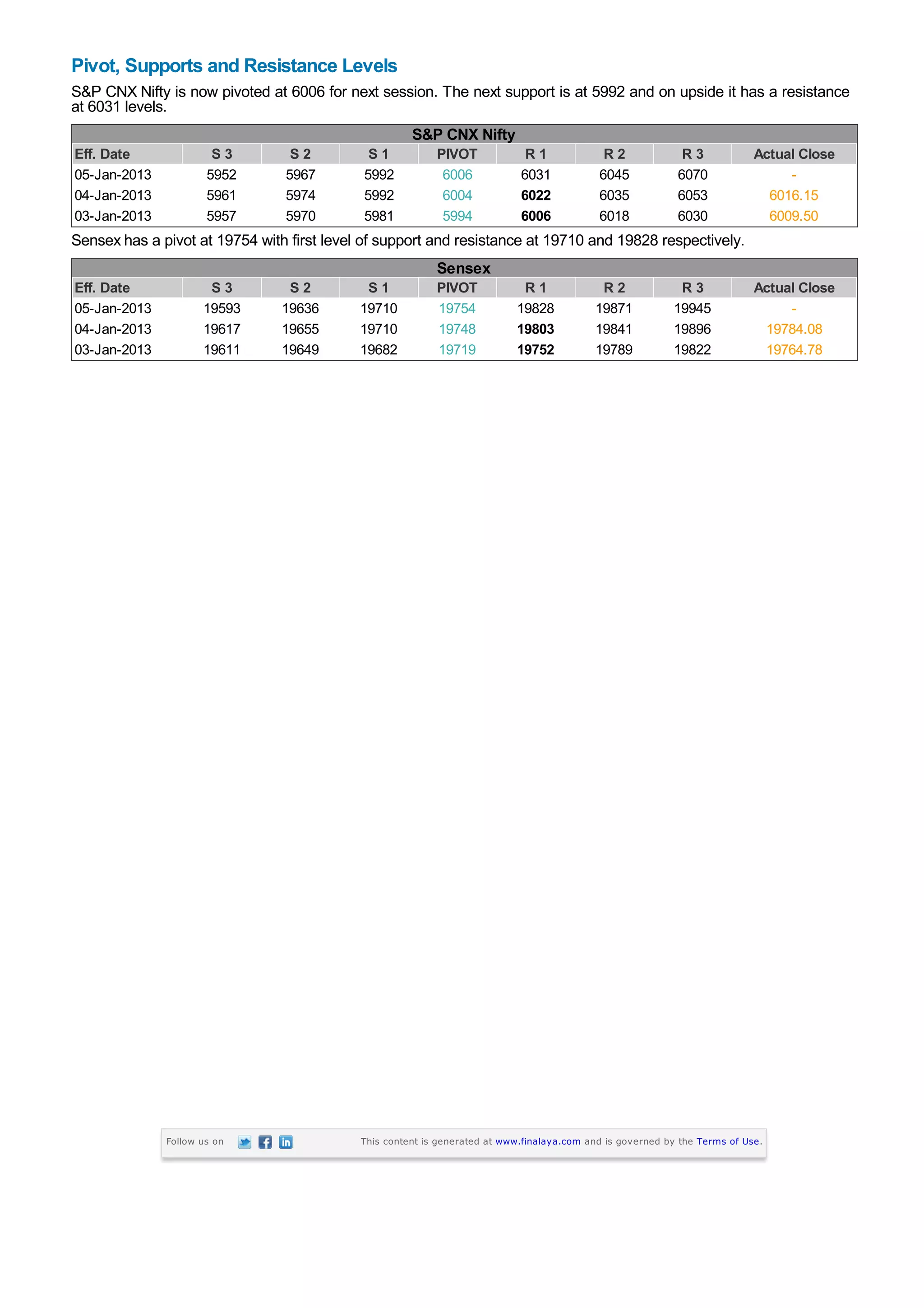

On January 4, 2013, Indian markets ended flat with the Sensex increasing by 19.30 points and Nifty by 6.65 points amid volatility, marking a fourth consecutive day of gains. Key sectors included oil & gas, which rose due to diesel price hike hopes, while metals were the biggest losers. Bharti Infratel and Punjab National Bank saw significant stock gains after positive news, while the overall market showed a positive breadth with advancing stocks outnumbering declines.