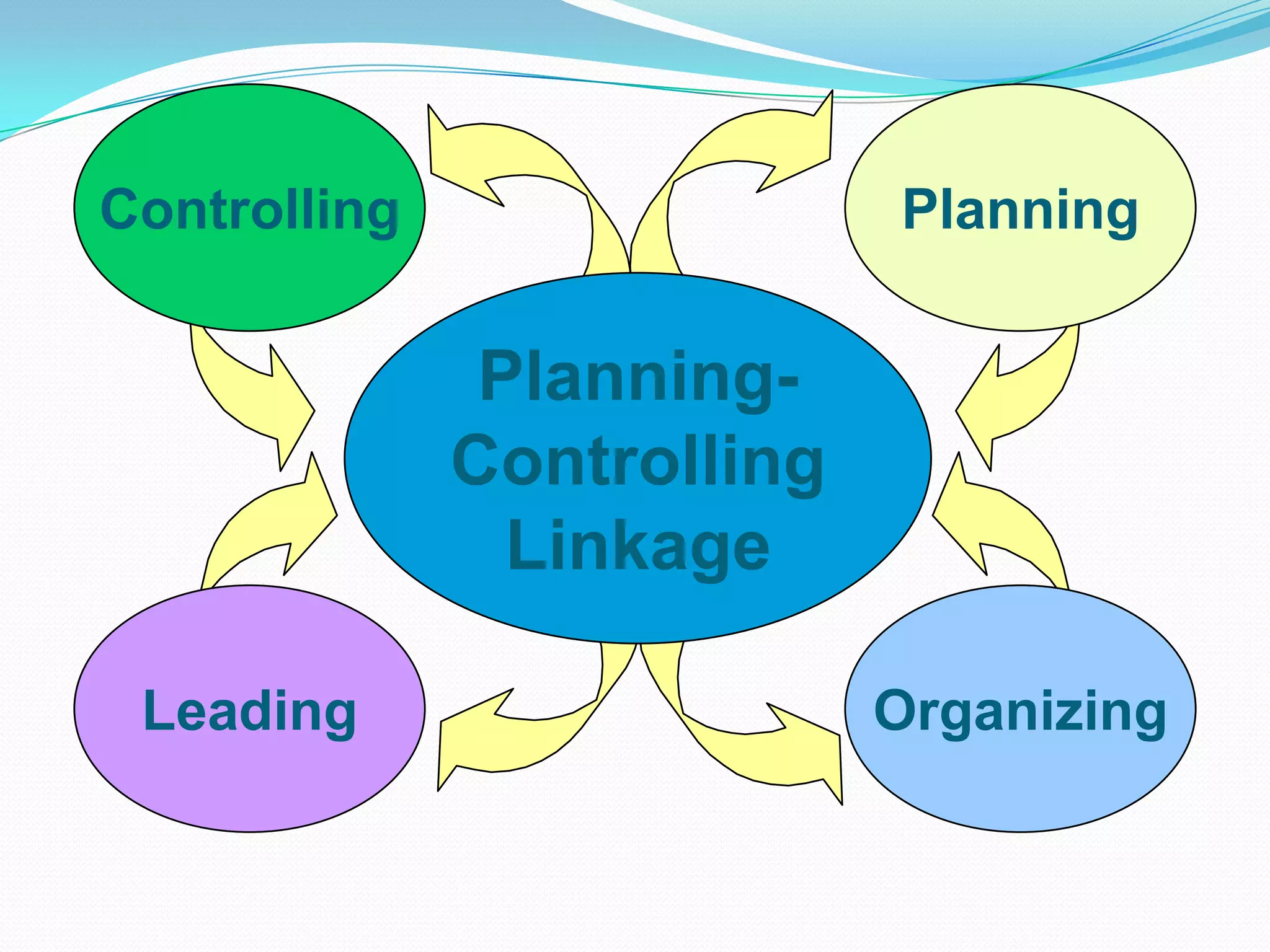

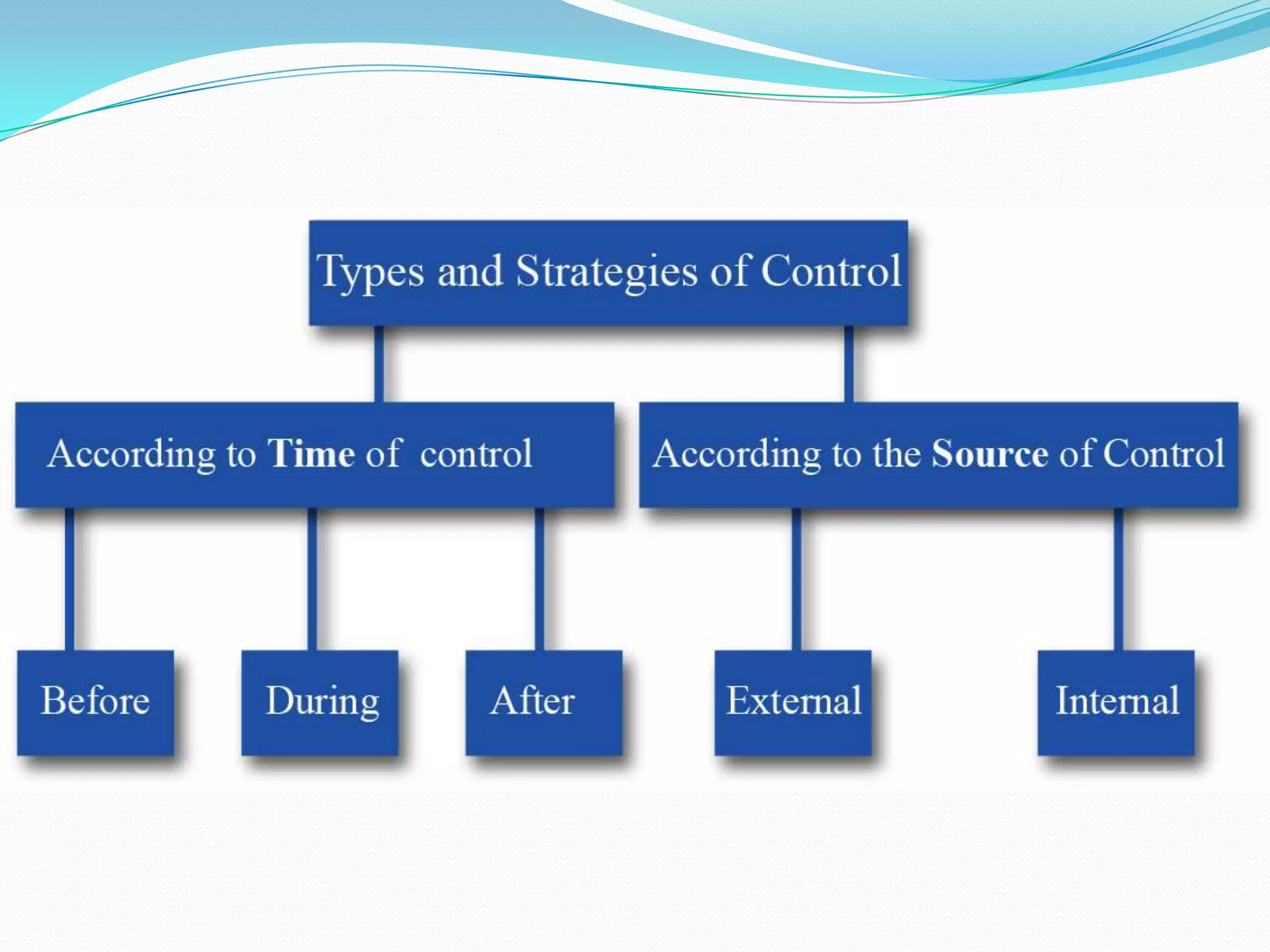

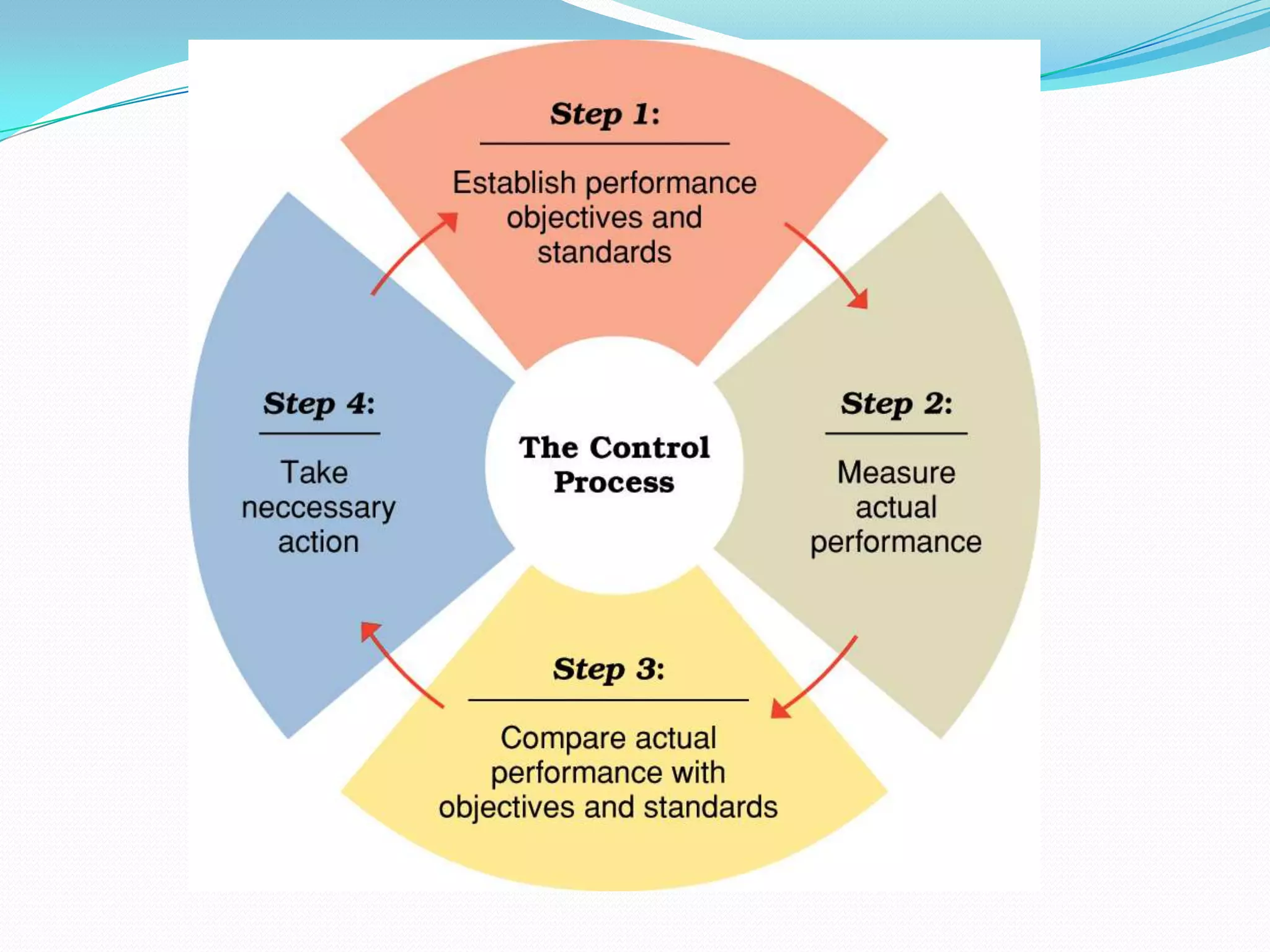

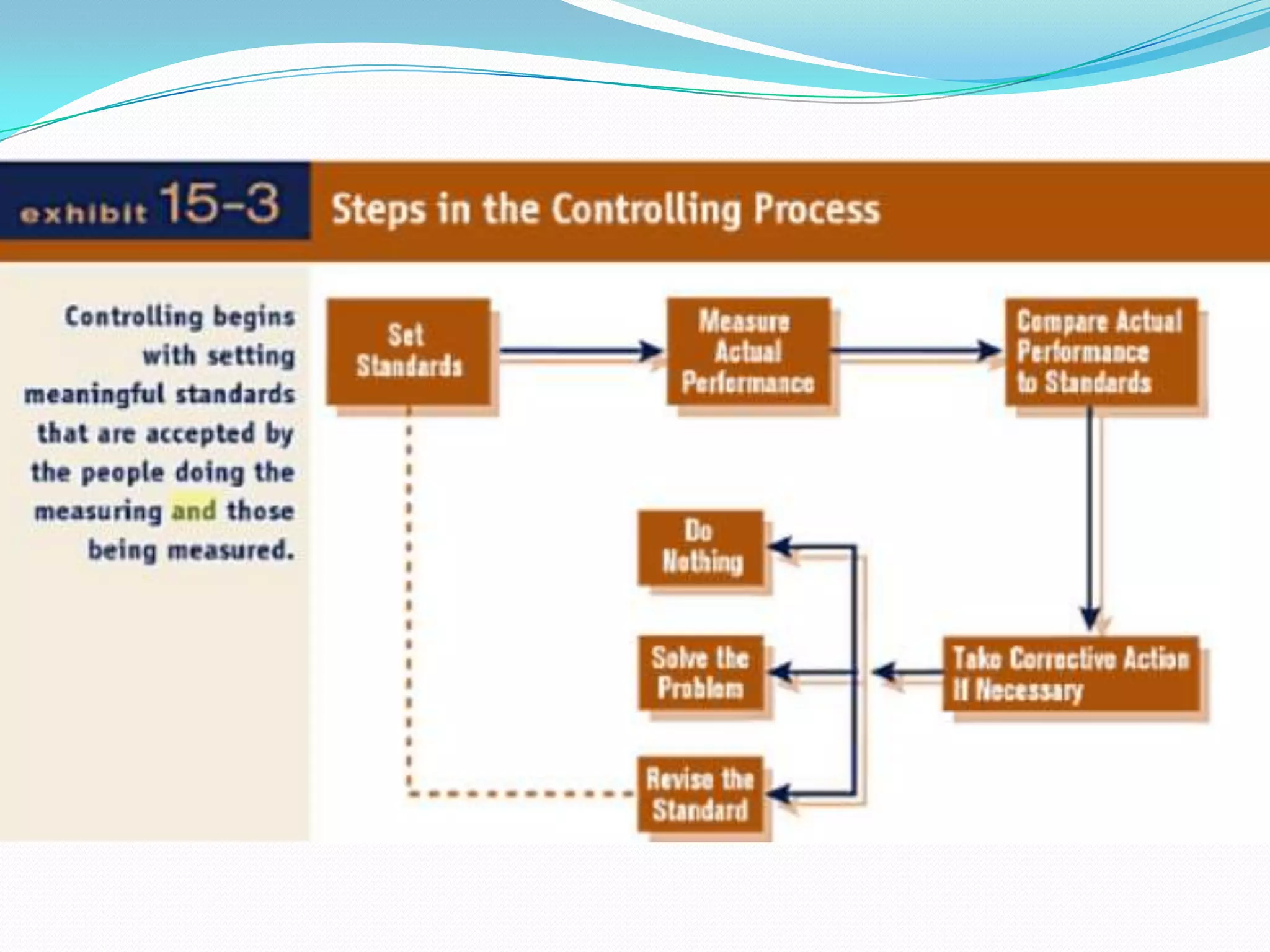

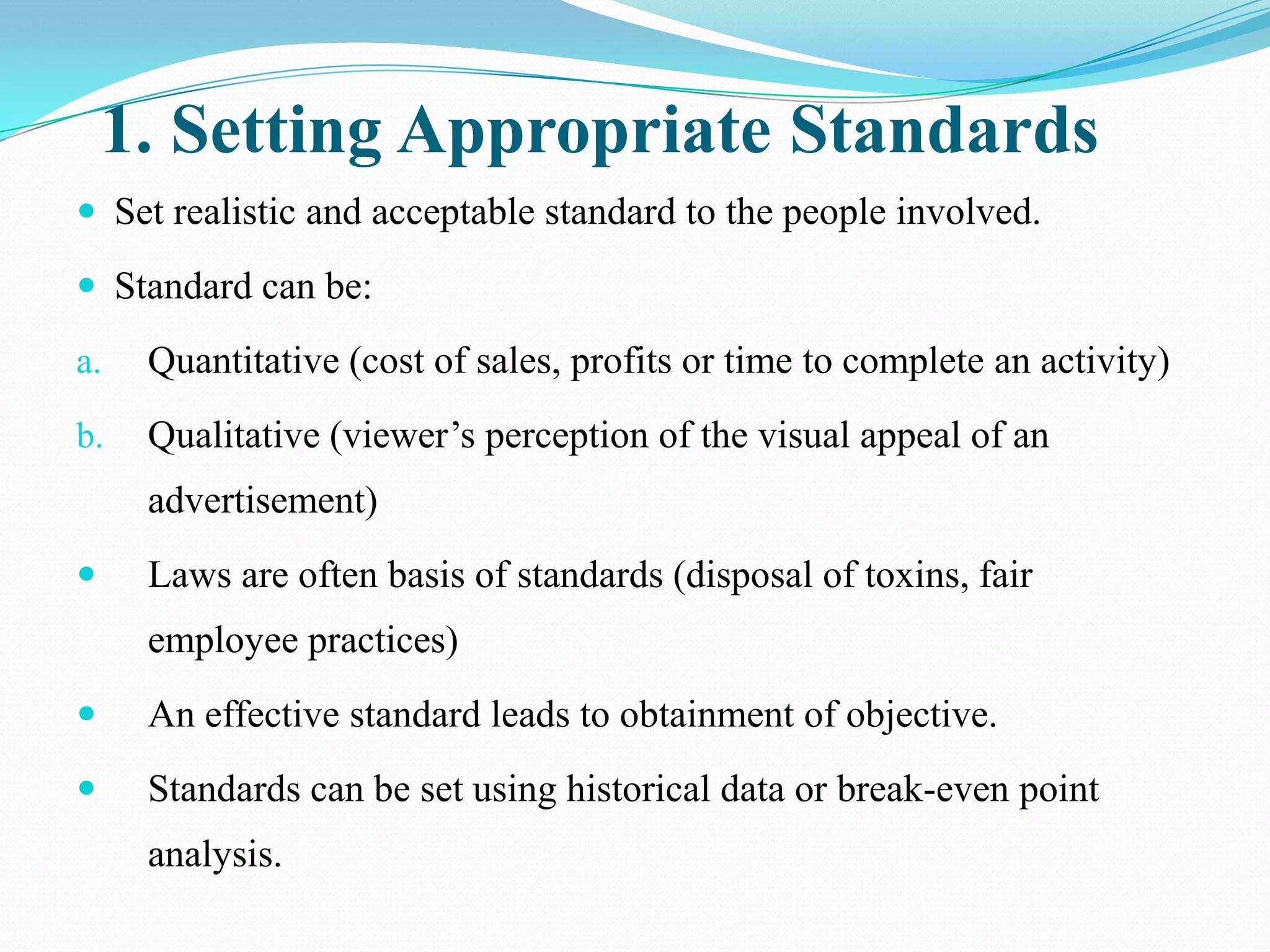

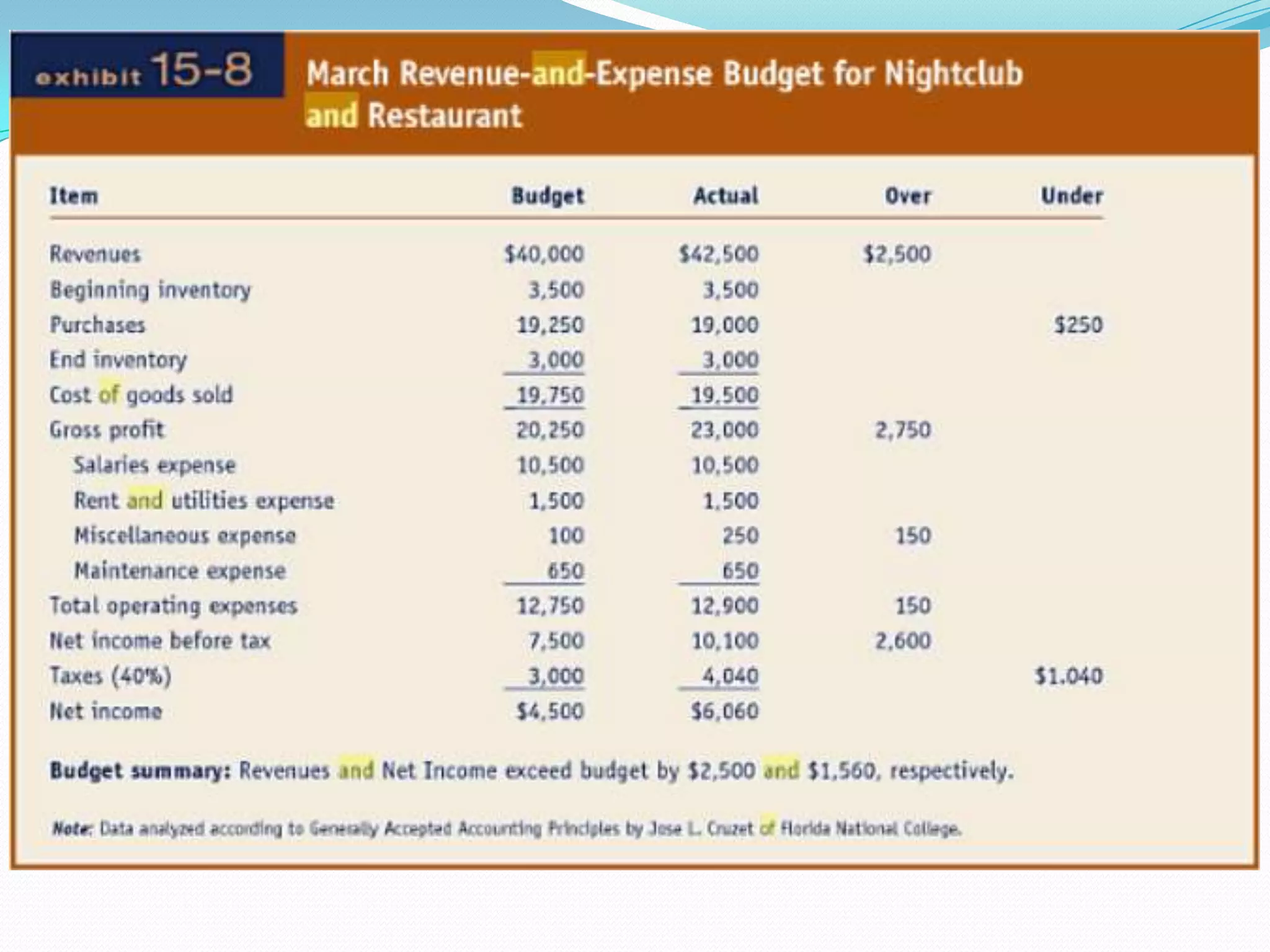

The document provides an overview of controlling as the terminal management function, describing its pervasive and dynamic nature. It then discusses types of control according to time (preventive, concurrent, feedback) and source (internal, external). Finally, it outlines the control process and various qualitative and quantitative control techniques, including budgets and financial ratios.