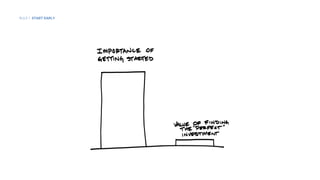

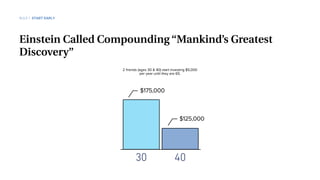

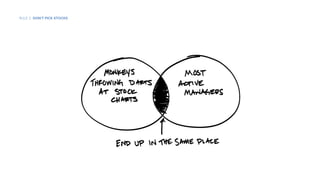

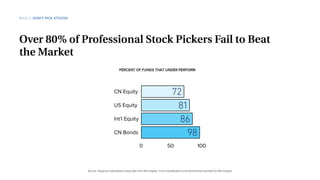

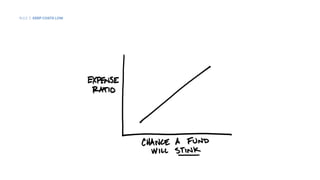

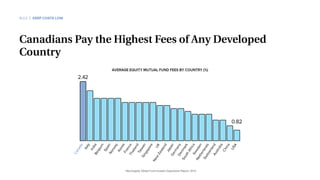

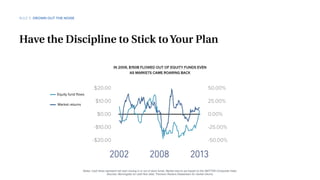

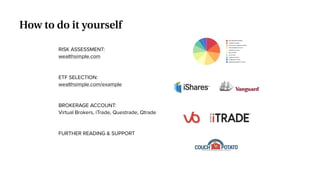

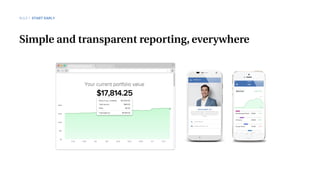

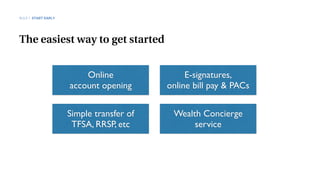

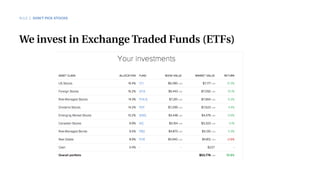

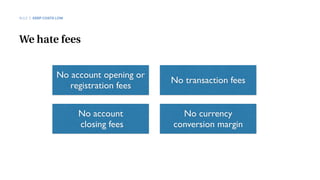

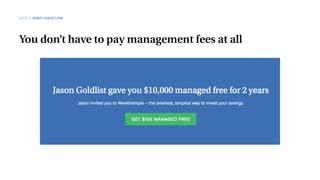

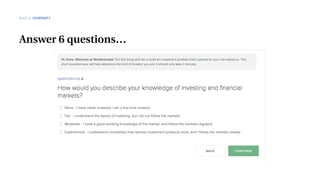

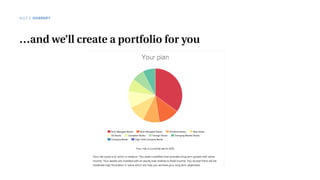

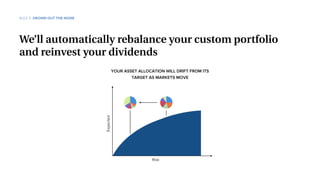

The document outlines Wealthsimple's five simple rules of smart investing: start early, don't pick stocks, keep costs low, diversify, and drown out the noise. It emphasizes the importance of starting investments early, the risks of stock picking, the impact of high fees on wealth, the advantages of diversification, and maintaining discipline amidst market volatility. Wealthsimple offers a straightforward investment platform focused on ETFs, low costs, and personalized support.