1) The document provides an overview of personal finance topics including saving, spending, debt, investing, insurance, and retirement. It discusses strategies for managing finances in each area.

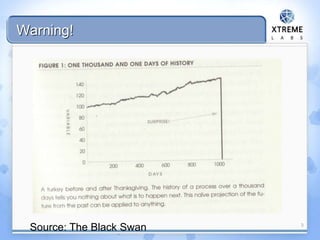

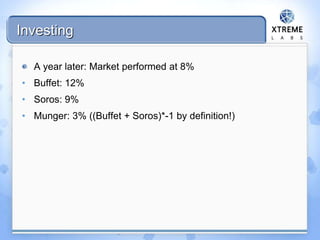

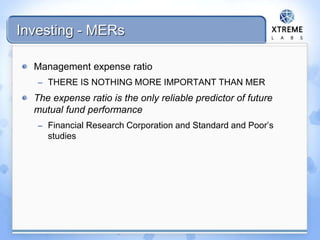

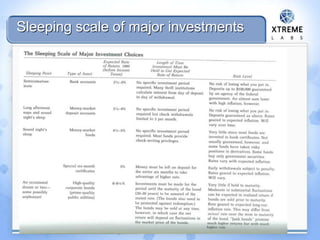

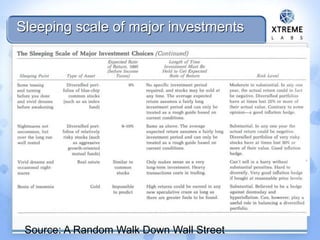

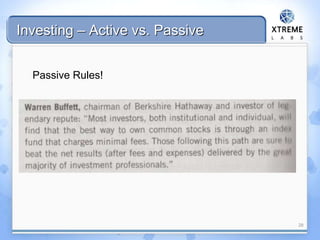

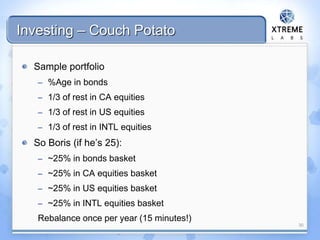

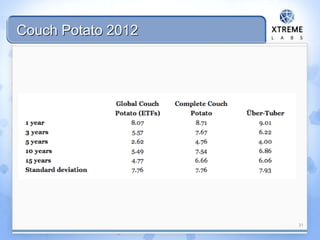

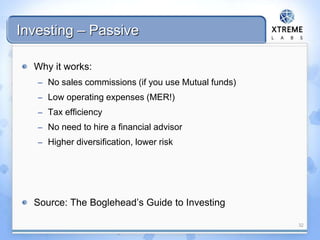

2) When it comes to investing, the document emphasizes low-cost, passive investing in index funds as the best approach for most people. It notes that actively-picking stocks or trying to beat the market is difficult to do successfully.

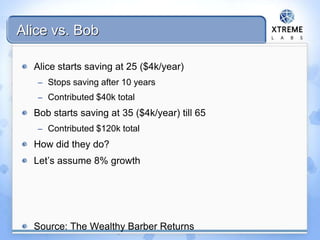

3) The document recommends automatically saving a portion of income, paying with cash when possible to avoid overspending, and prioritizing experiences over possessions for happiness. It also stresses the power of compound interest in building wealth over time.

![Spending

“It is preoccupation with possesions, more than anything

else, that prevents us from living freely and nobly” –

Bertrand Russell

“I can resist everything but temptation” – Oscar Wilde

– Stop going

Experiences vs. stuff: [NYTimes] Will it make you happy? -

http://bit.ly/cQu4ui](https://image.slidesharecdn.com/finance101december2010-101207135154-phpapp01/85/Finance101-9-320.jpg)

![Investing – Passive

“The conclusions [supporting trying to beat the market] can

only be justified by assuming that the laws of arithmetic

have been suspended for the convenience of those who

choose to pursue careers as active managers”

– William F. Sharpe (Nobel Laureate in Economic Sciences”

33](https://image.slidesharecdn.com/finance101december2010-101207135154-phpapp01/85/Finance101-33-320.jpg)