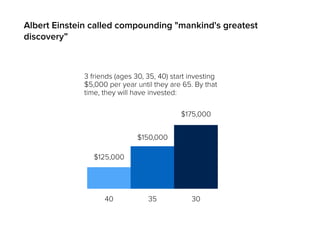

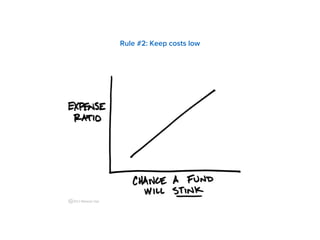

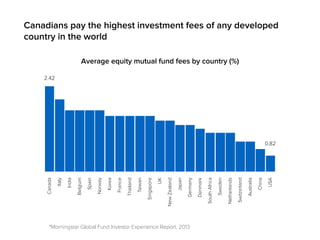

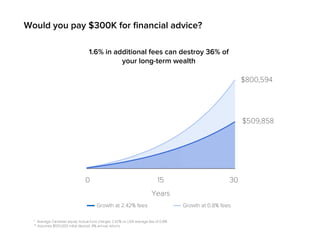

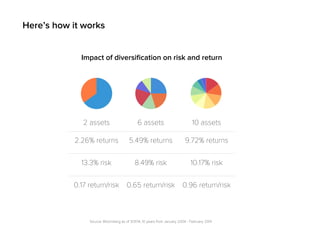

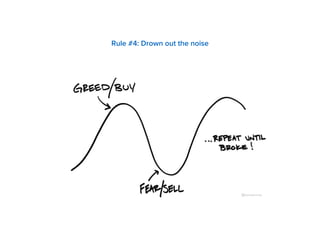

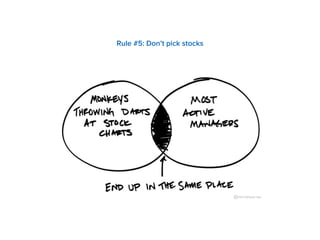

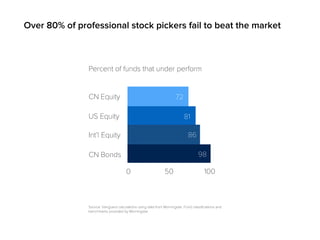

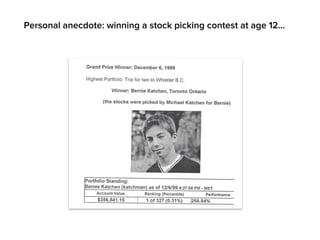

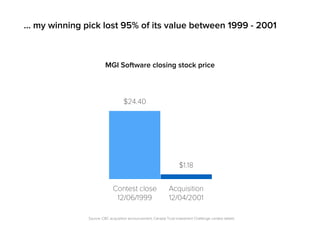

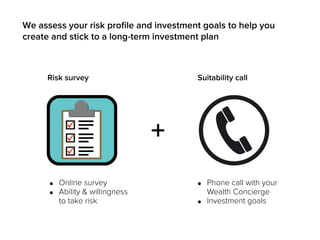

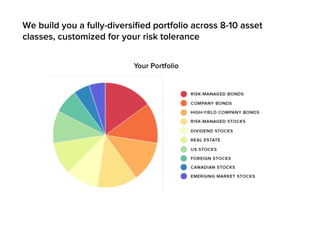

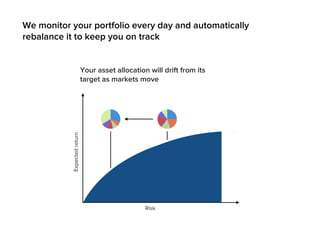

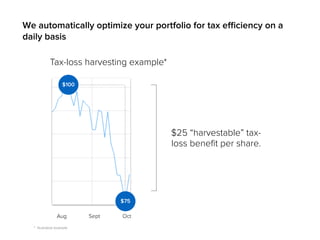

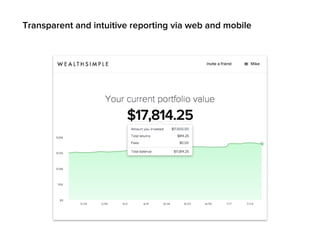

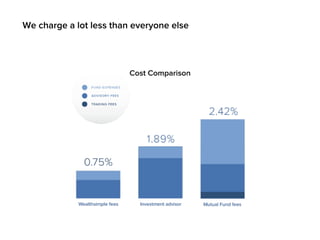

This document outlines 5 simple rules of smart investing according to Wealthsimple, an online investment manager. The rules are: 1) Start early to benefit from compounding returns. 2) Keep costs low as high fees can significantly reduce long-term returns. 3) Diversify across multiple asset classes to reduce risk. 4) Ignore short-term market noise and stick to a long-term plan. 5) Do not try to pick individual stocks yourself as most professional stock pickers do not beat the market. Wealthsimple aims to help investors follow these rules by building low-cost, diversified portfolios and rebalancing automatically.