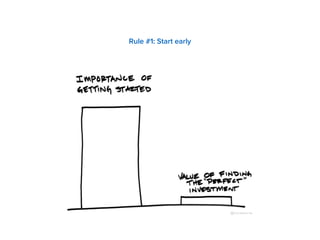

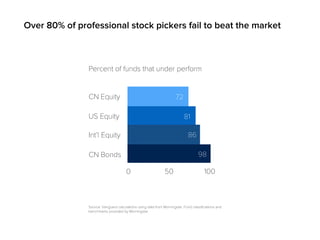

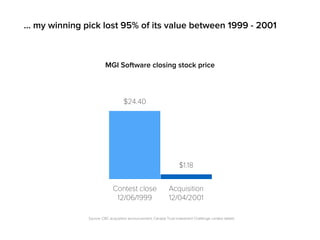

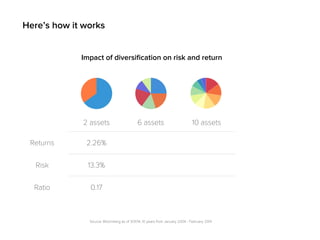

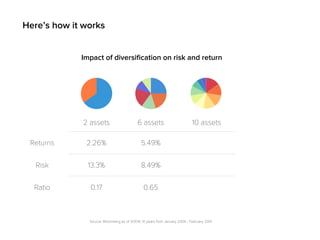

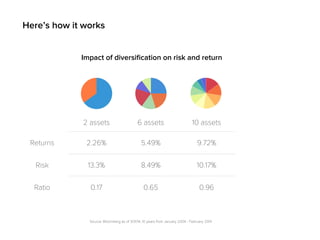

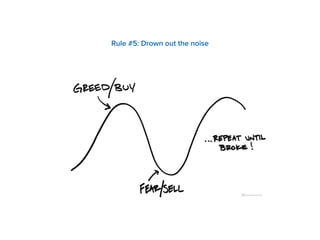

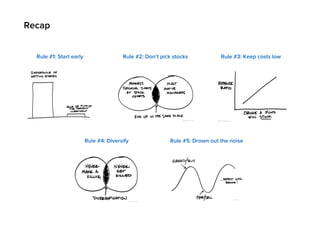

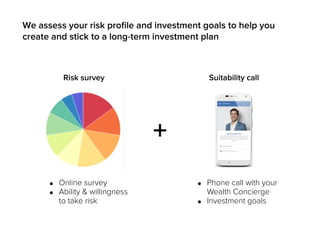

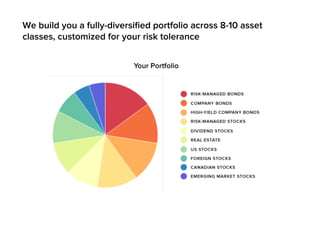

- The document outlines 5 simple rules of smart investing: start early, don't pick stocks, keep costs low, diversify your portfolio, and drown out noise by sticking to your long-term investment plan.

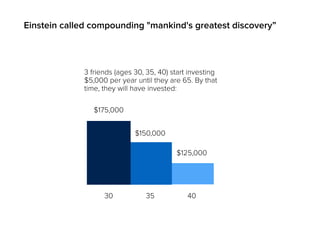

- It emphasizes the power of compound returns over time, showing how starting to invest just 10 years earlier can result in hundreds of thousands more by retirement.

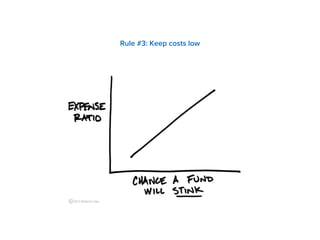

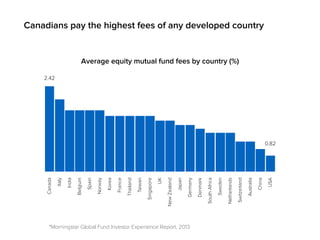

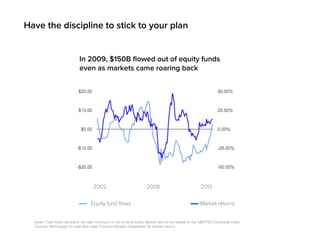

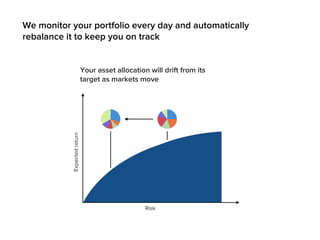

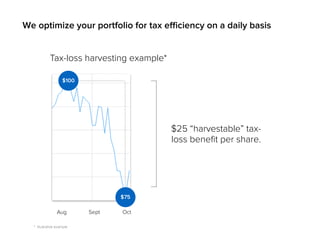

- Minimizing fees, diversifying across asset classes, and ignoring short-term market fluctuations are presented as keys to long-term investment success.