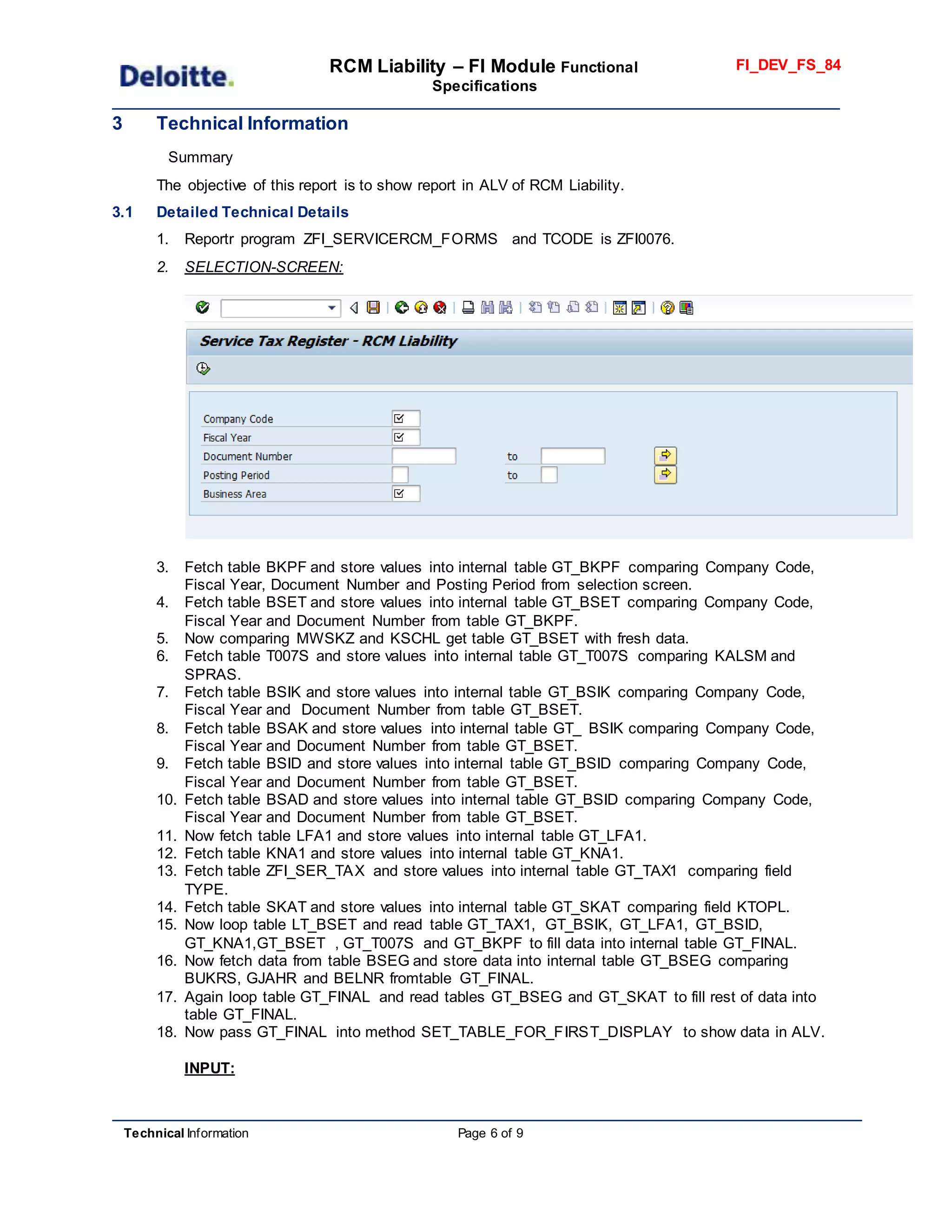

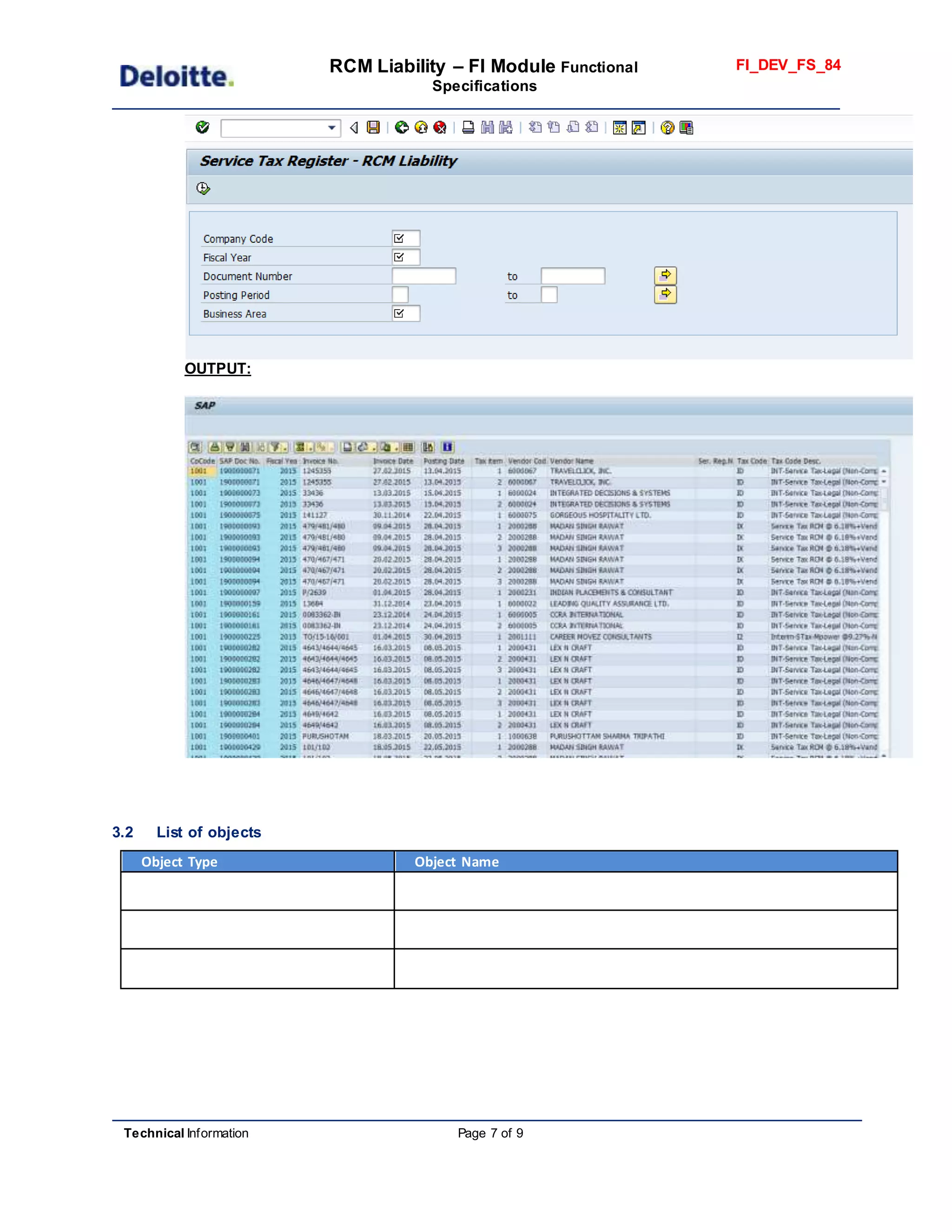

This document provides specifications for developing a report on RCM Liability in the FI (Finance) module of the Oberoi@One ERP system. The report will display details of vendor invoices where RCM (Reverse Charge Mechanism) service tax was applied, including vendor information, tax codes, amounts, and liability totals. It describes the technical implementation including database tables to fetch data from, fields to extract, and use of ALV grids to display the report. Testing will validate that the report generates correctly for a given date range.