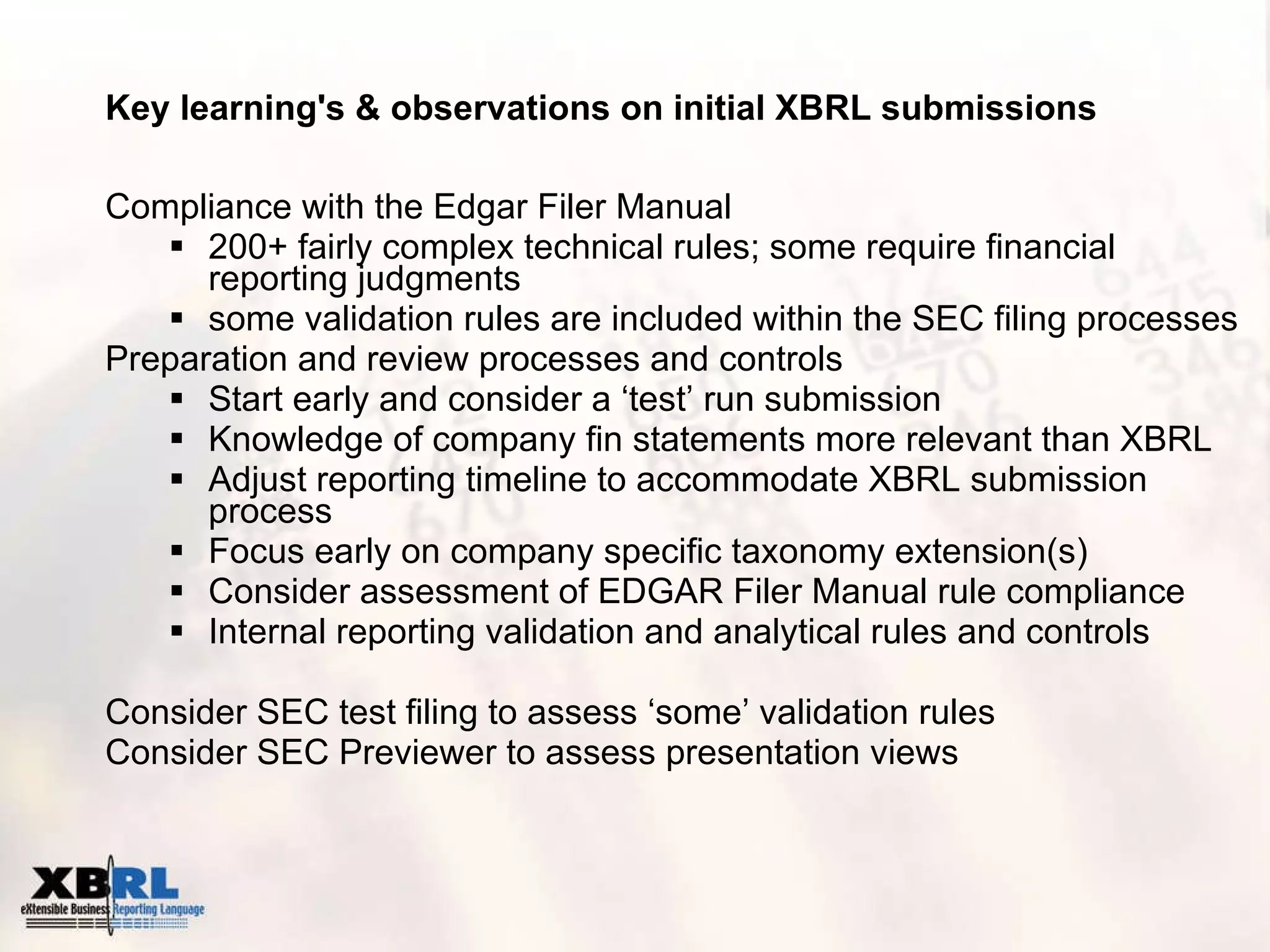

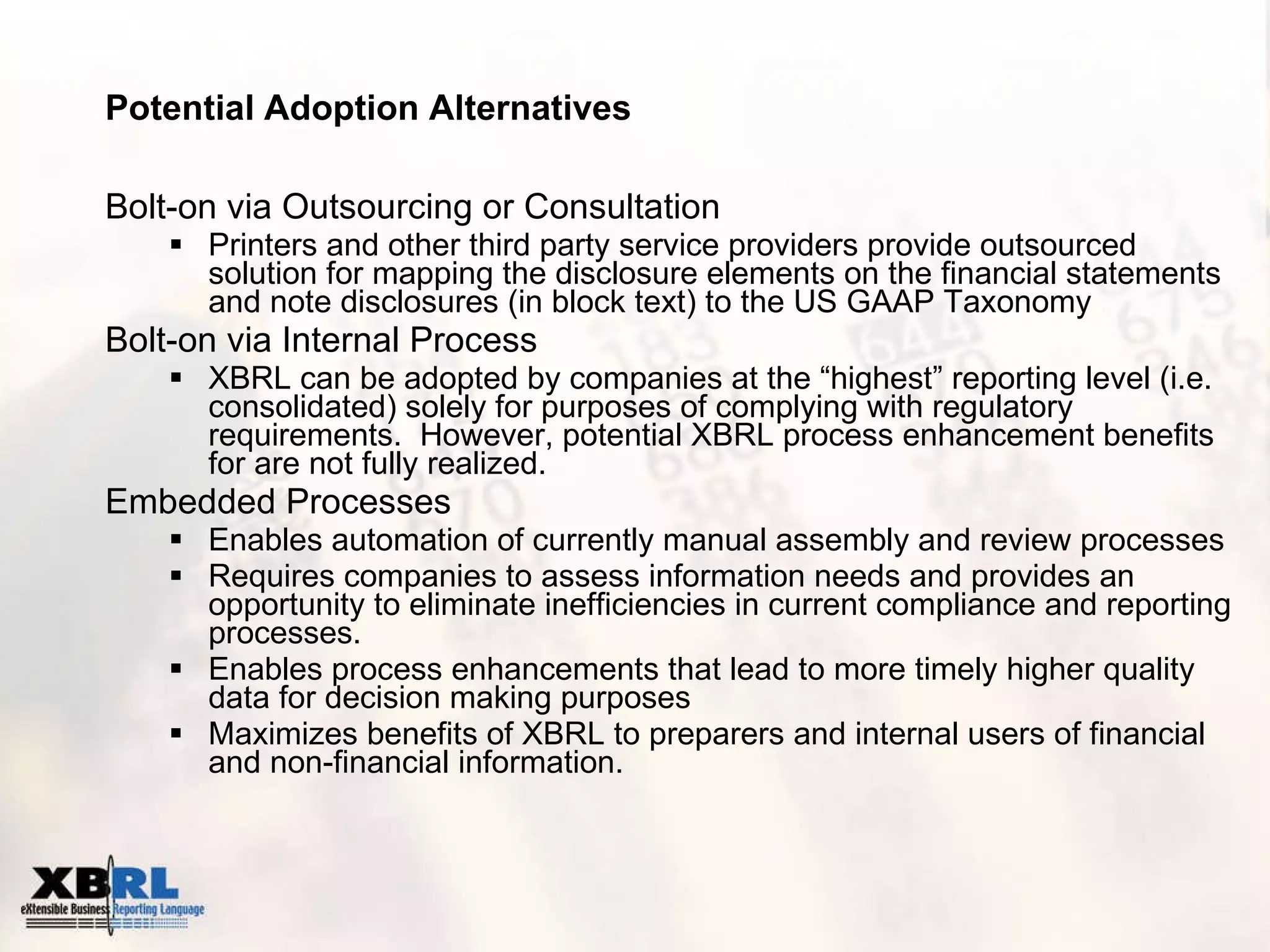

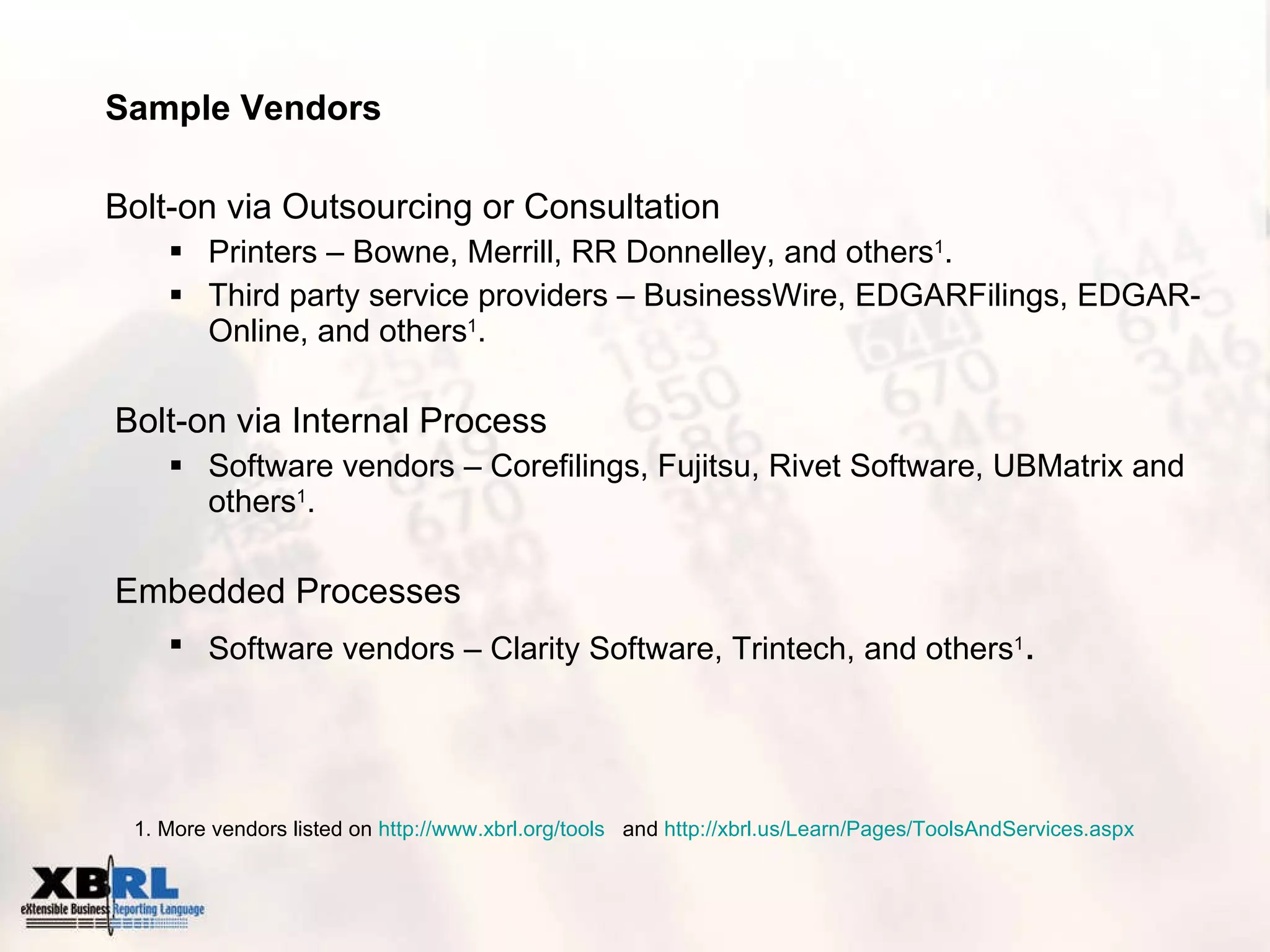

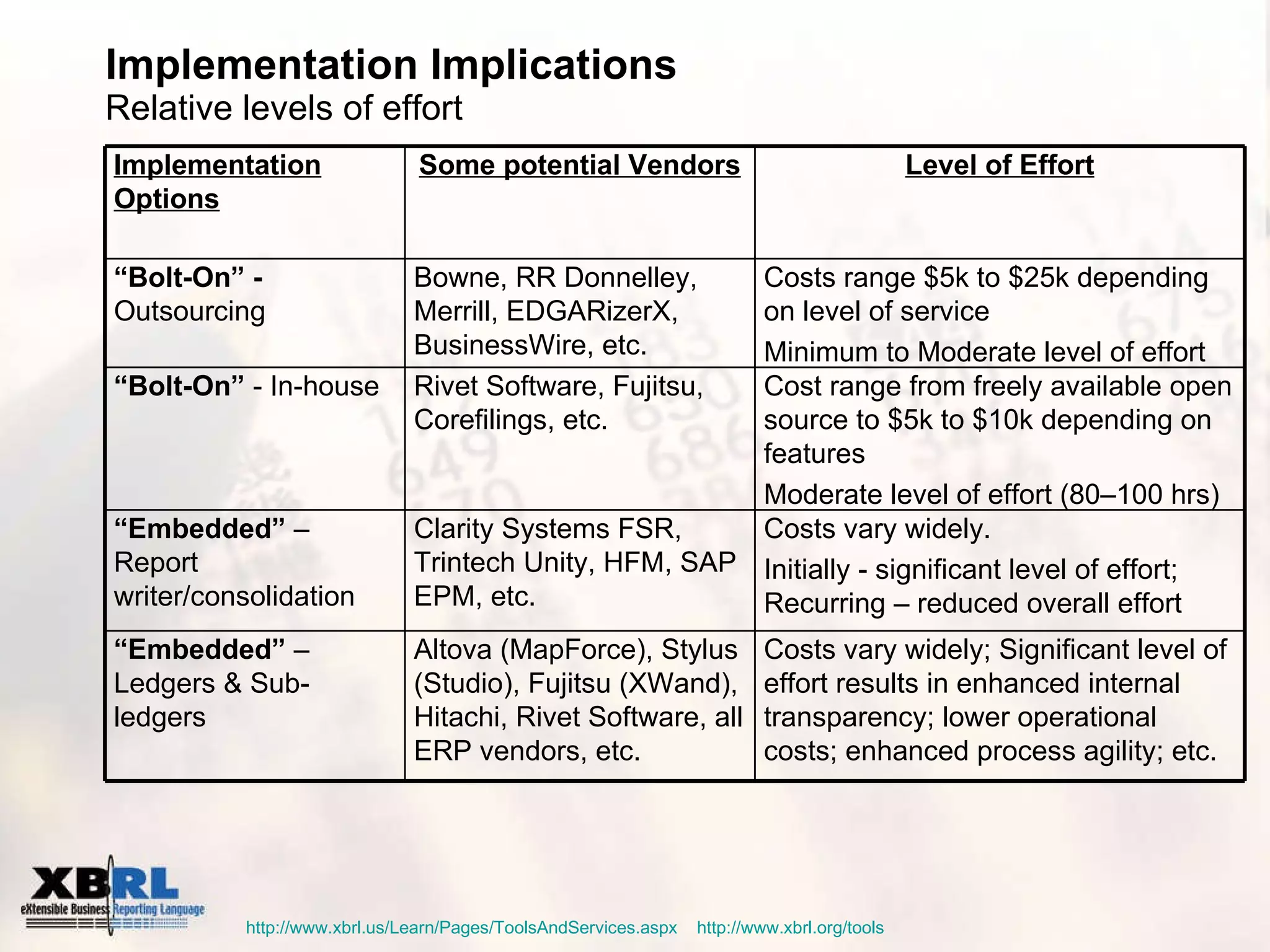

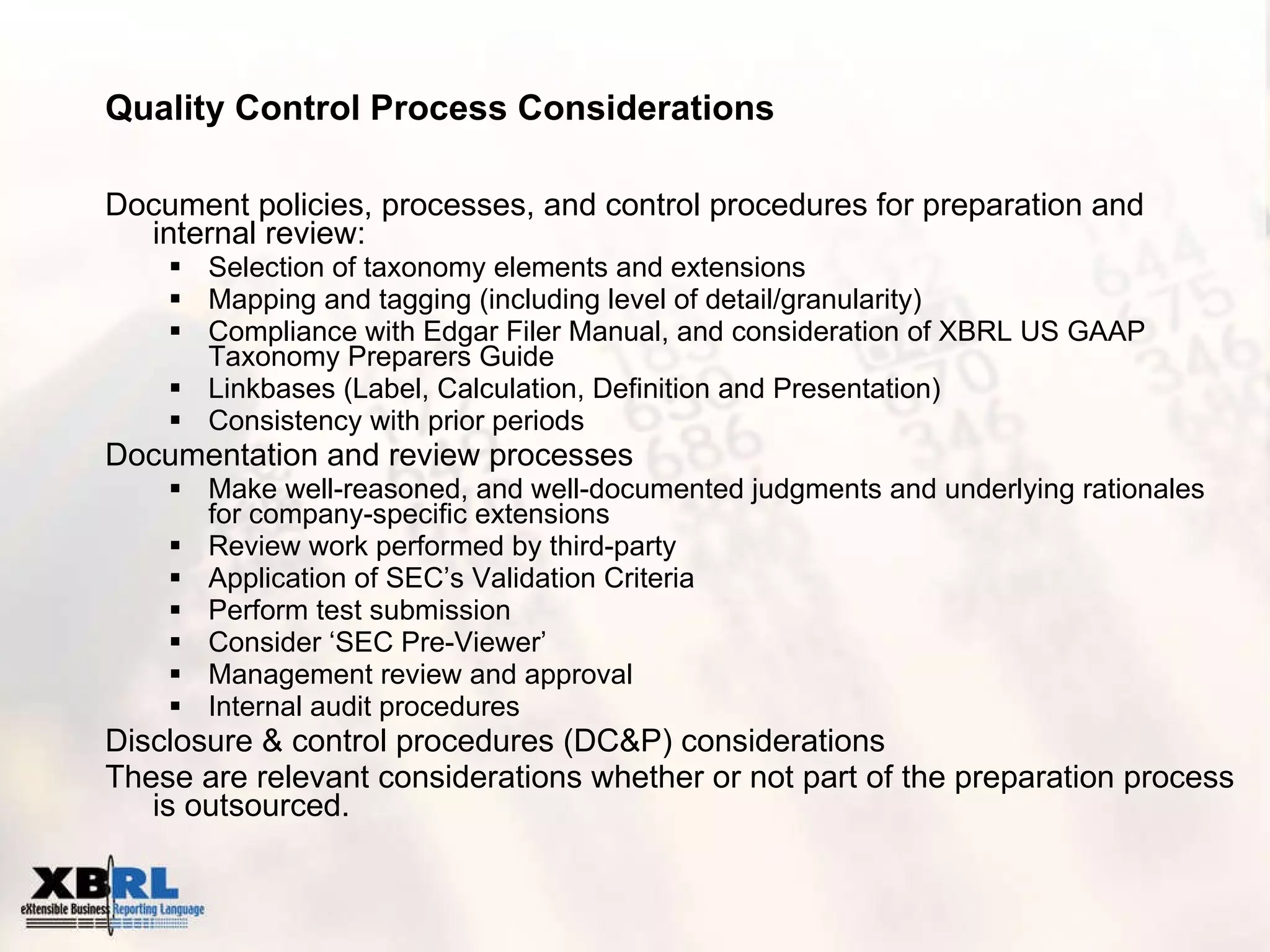

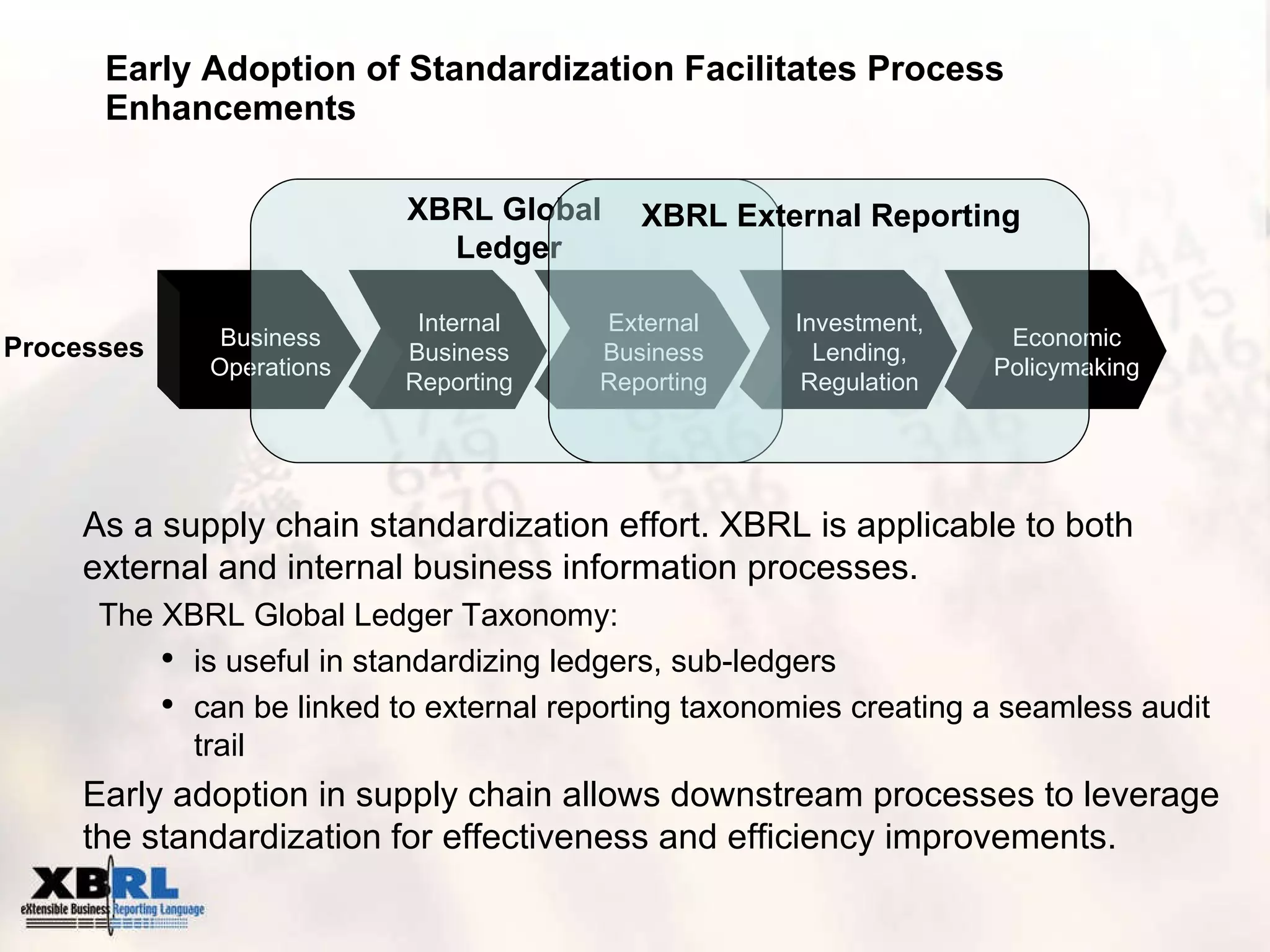

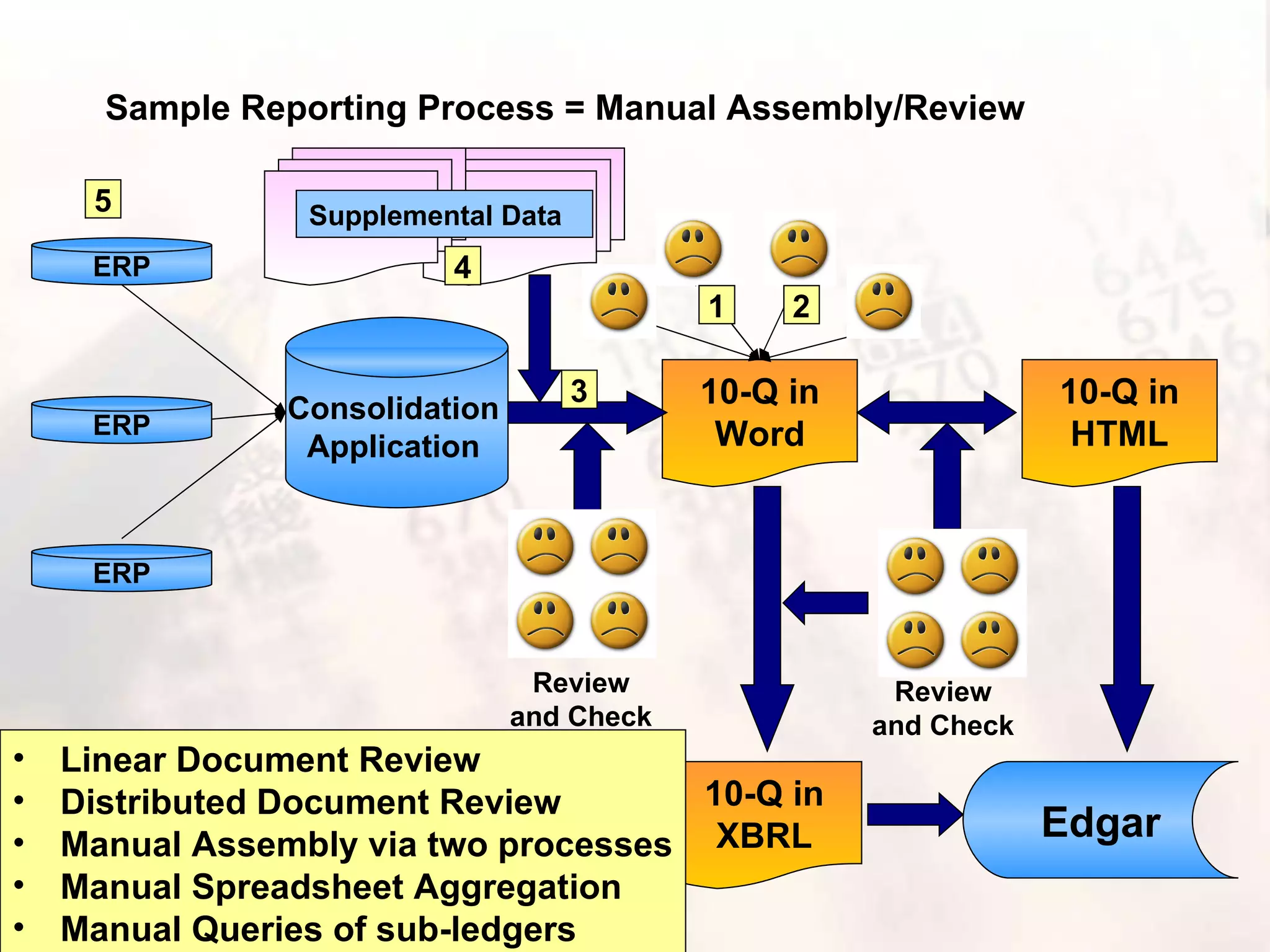

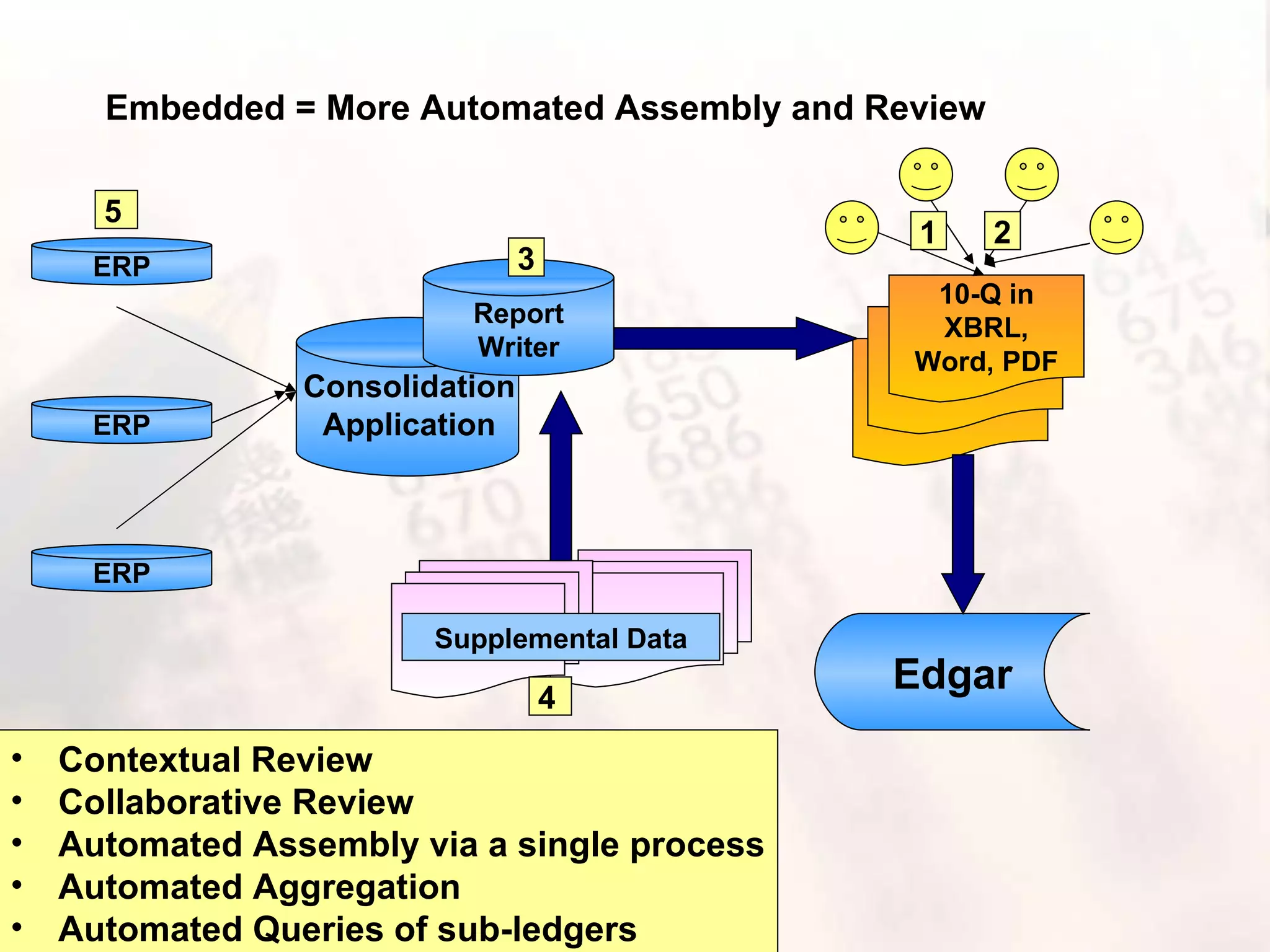

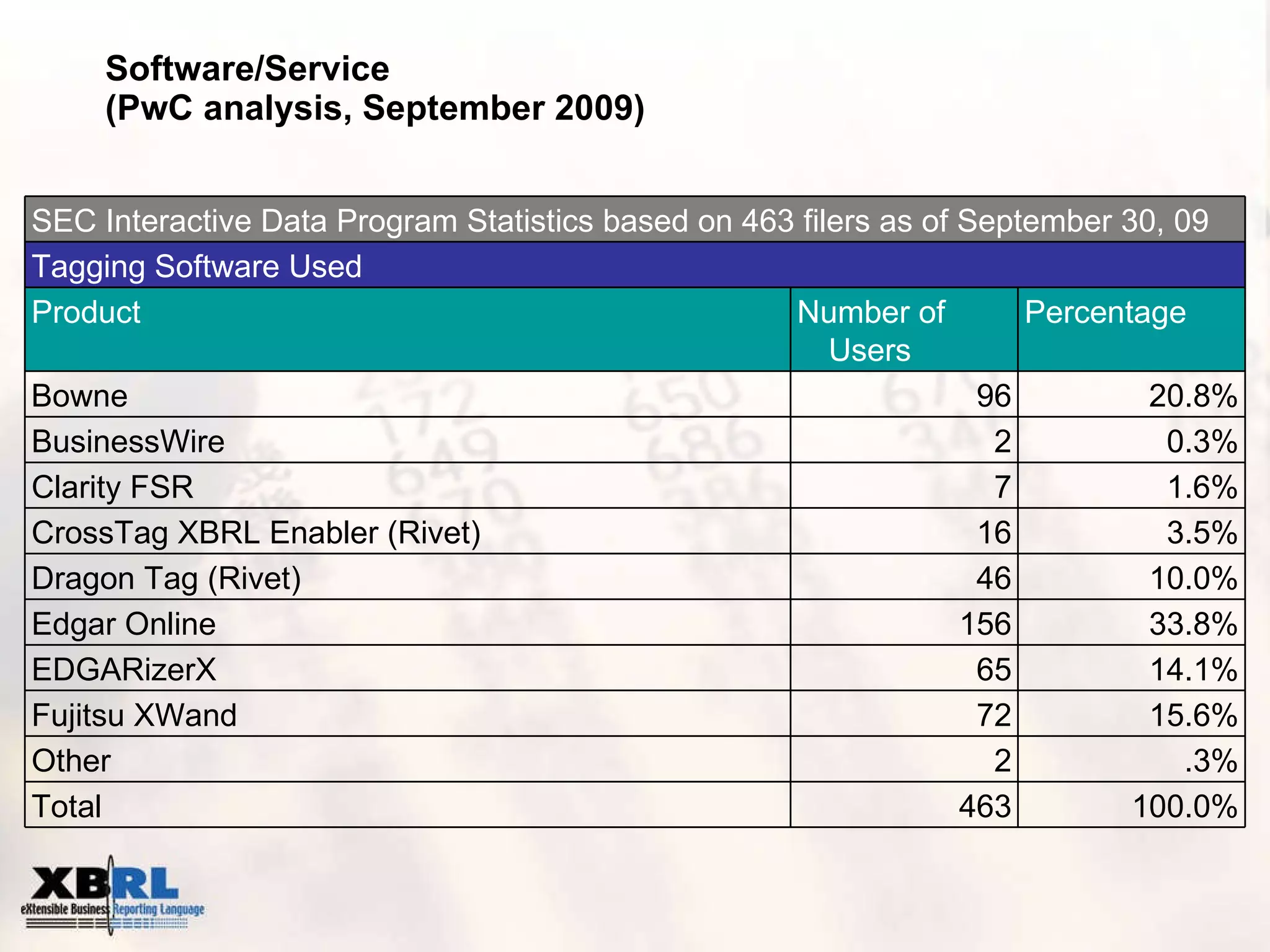

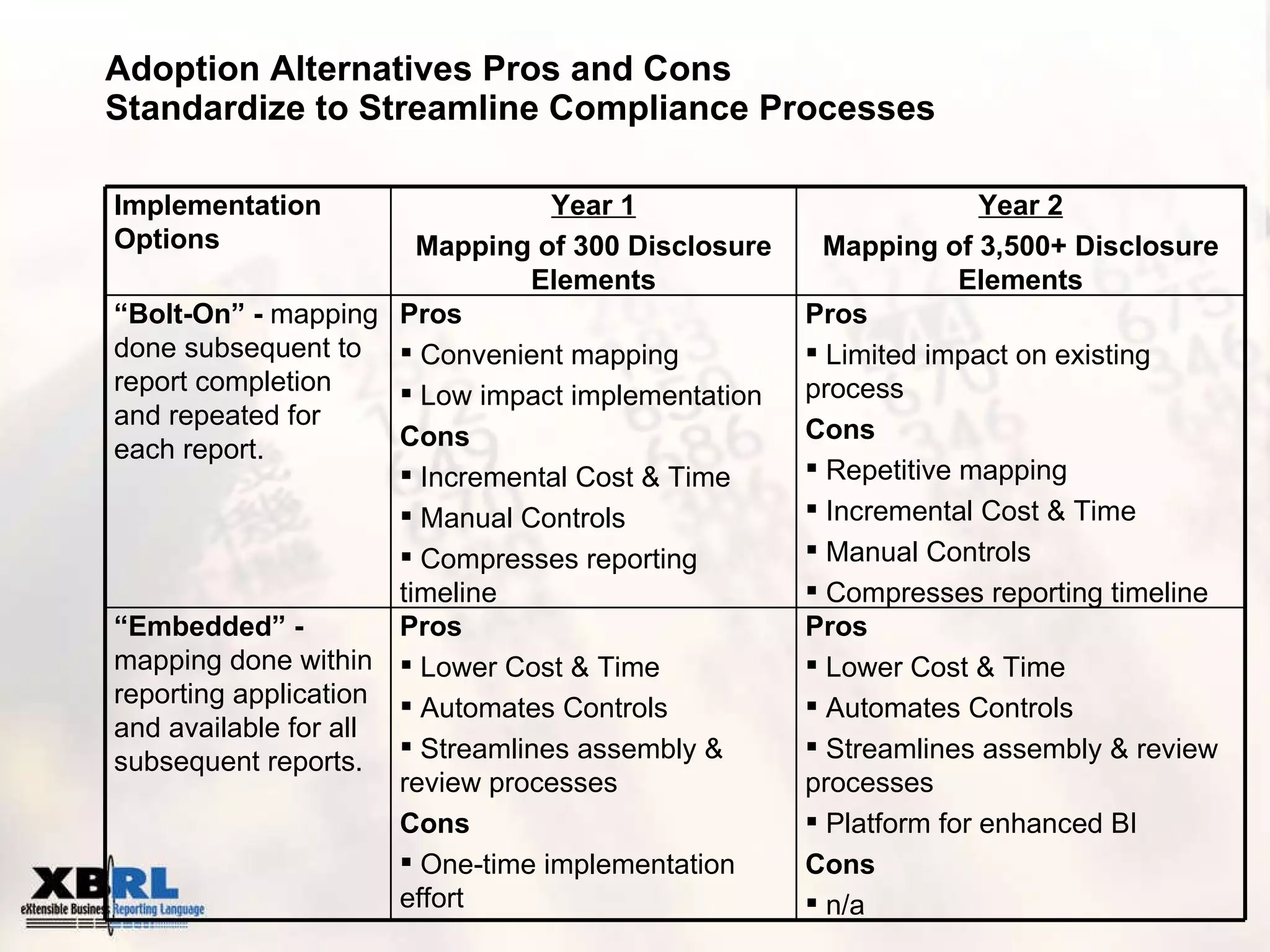

The document outlines the SEC mandate for the submission of XBRL-formatted financial statements, including timelines and requirements for various filers based on their size and reporting standards. It discusses key implementation considerations, compliance with the Edgar Filer Manual, and the importance of internal controls and quality assurance in the tagging process for financial statements. Additionally, the document highlights potential outsourcing solutions and necessary training for companies to adapt to XBRL reporting standards.

![US Filing 21 October 2009 Mike Willis, Chair, XBRL International Partner, PricewaterhouseCoopers [email_address] 001 813 340 0932](https://image.slidesharecdn.com/xbrlusfilingupdate10212209-091021091045-phpapp01/75/XBRL-US-Filing-Update-10212209-1-2048.jpg)