- FedEx was founded in 1971 by Fred Smith with $4 million in capital raised to provide transportation services. UPS was founded in 1907 and provides logistics services including transportation, distribution, and freight.

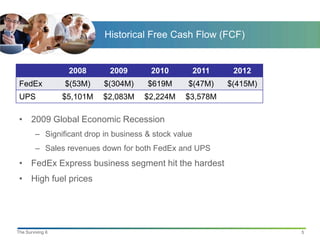

- Both companies have grown significantly over the years through acquisitions and international expansion. By 2009, FedEx reported $35 billion in revenues and UPS reported $45 billion in revenues.

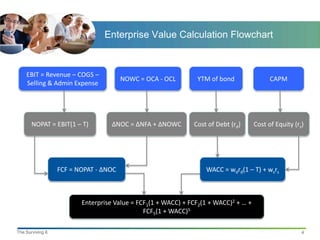

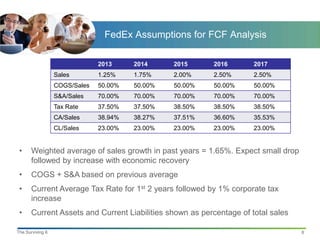

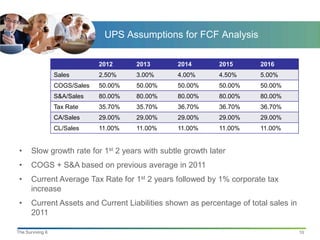

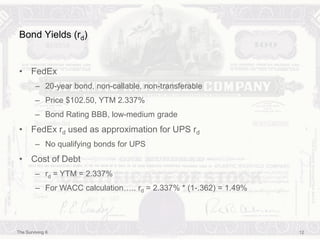

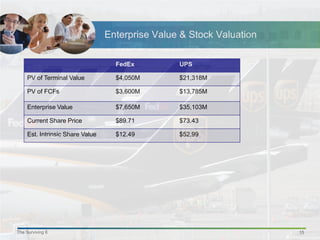

- Financial projections were made for FedEx and UPS from 2012-2017 based on assumptions about growth rates, costs, tax rates, and capital structure to calculate free cash flows and enterprise values for valuation. The estimated intrinsic share values were above current market prices.