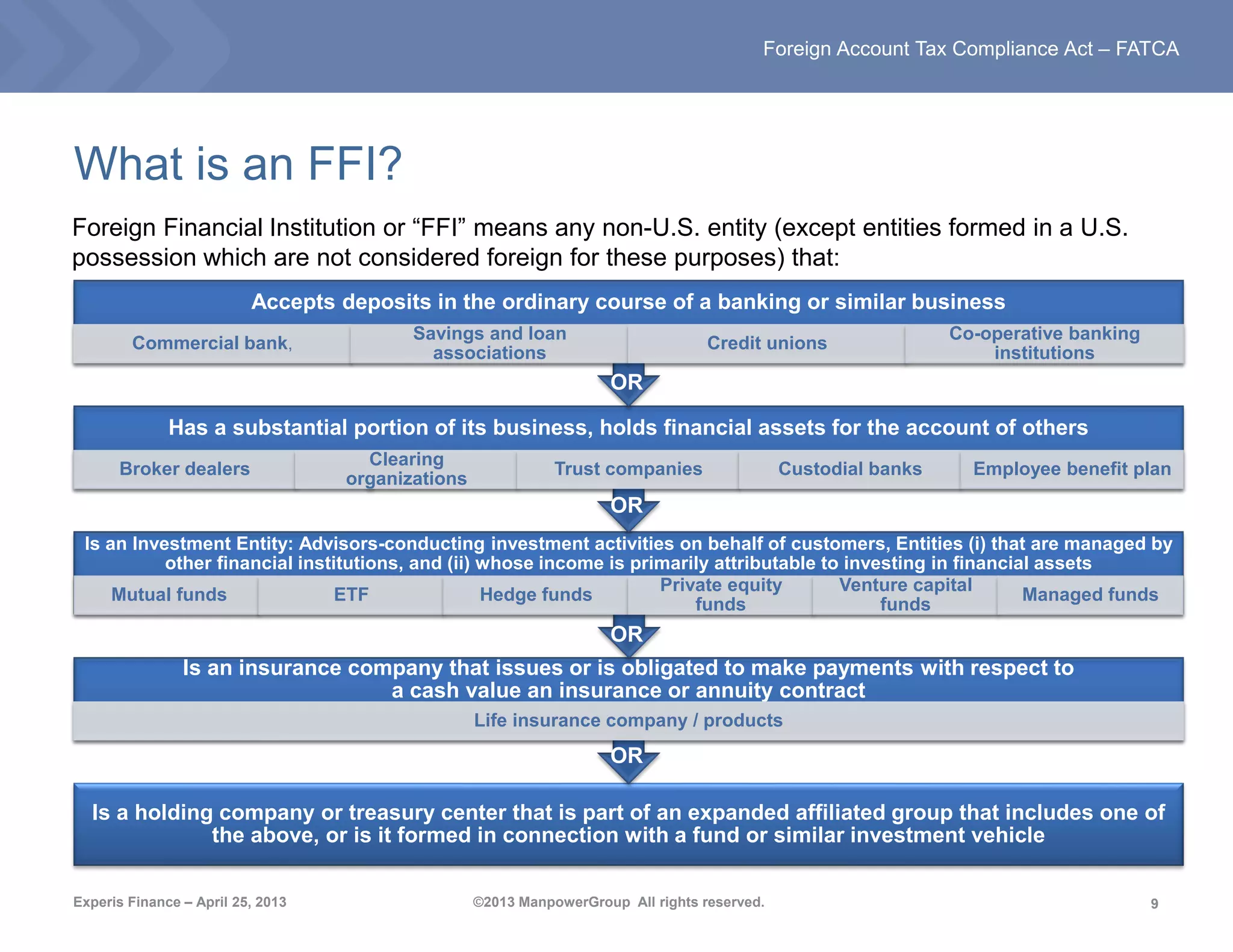

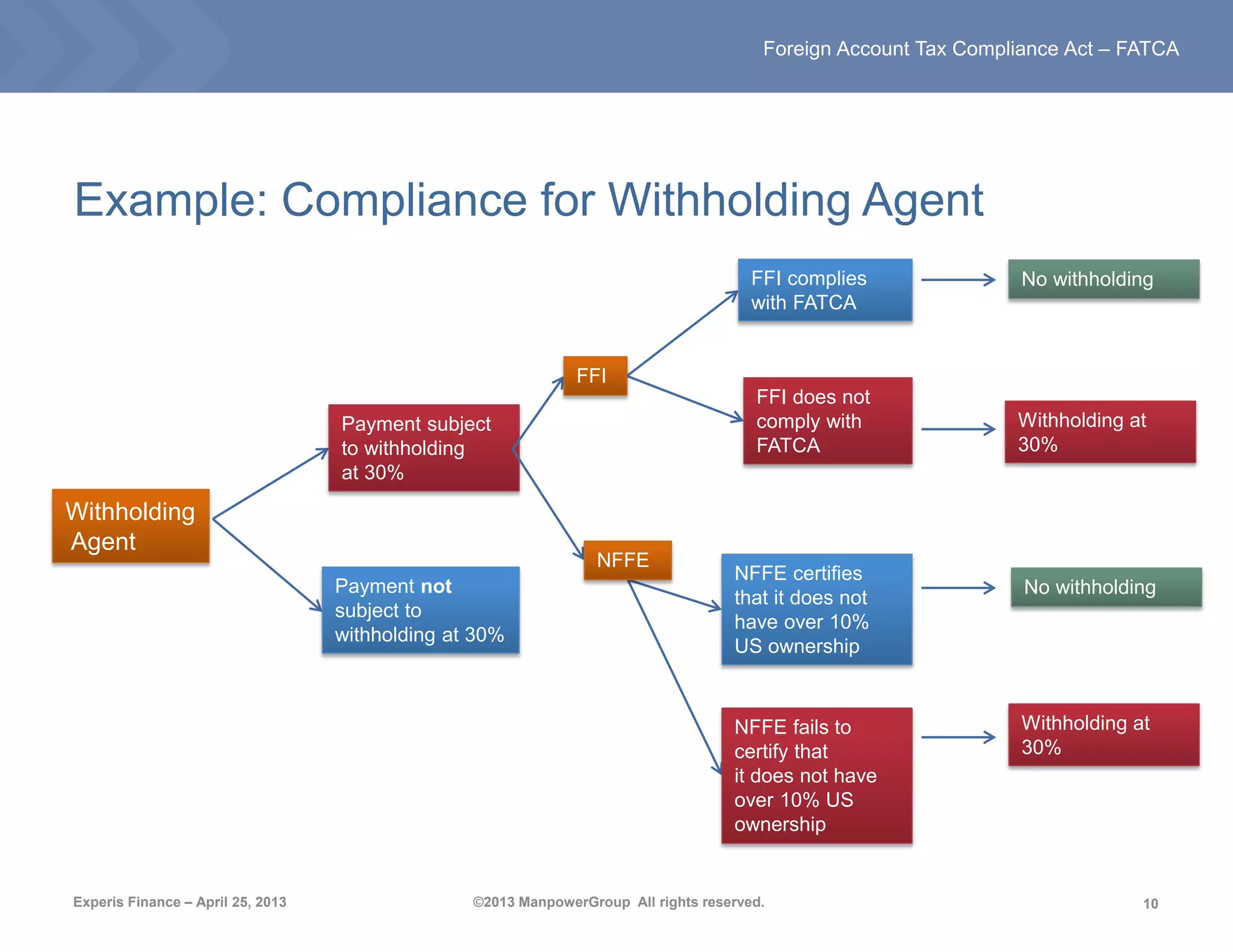

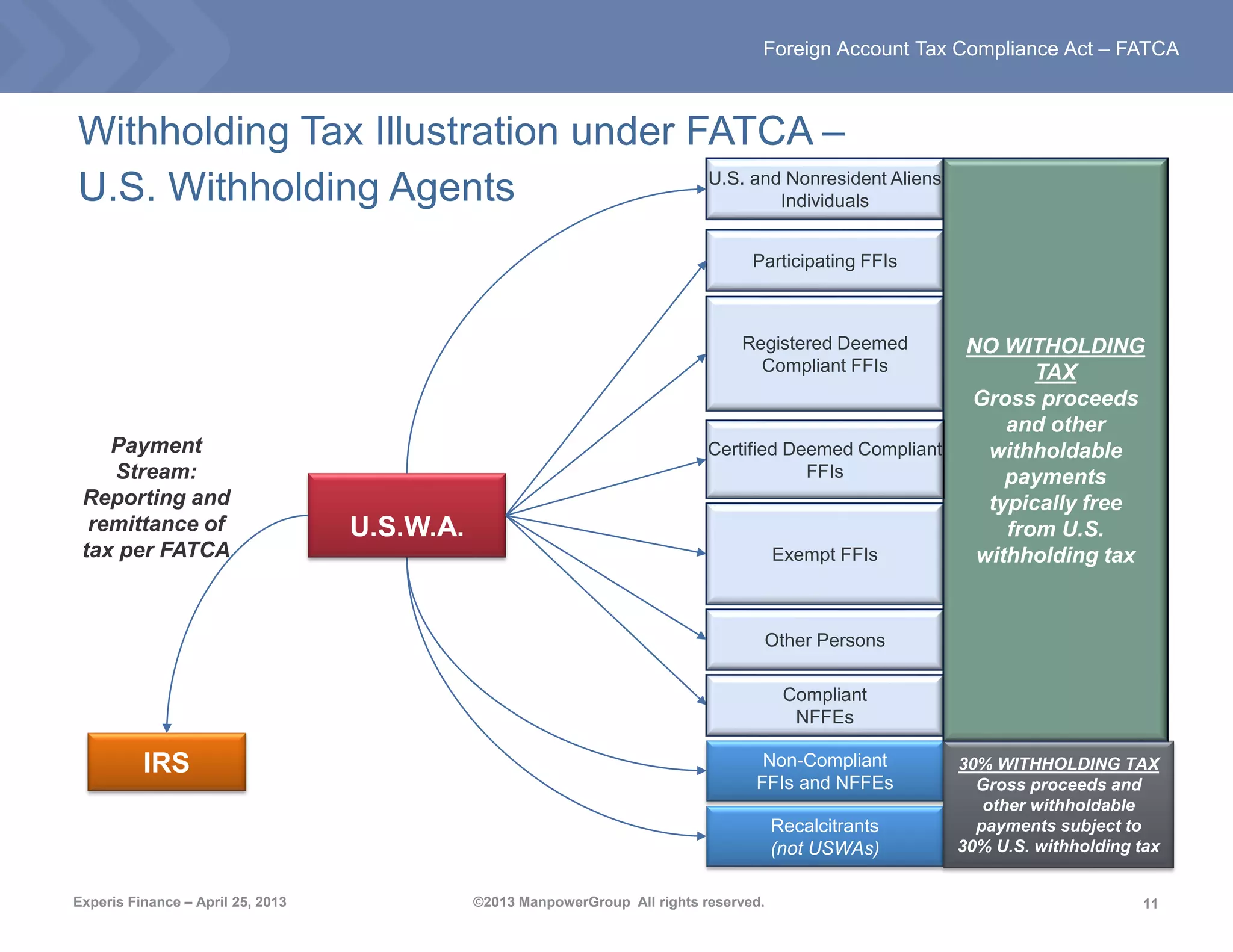

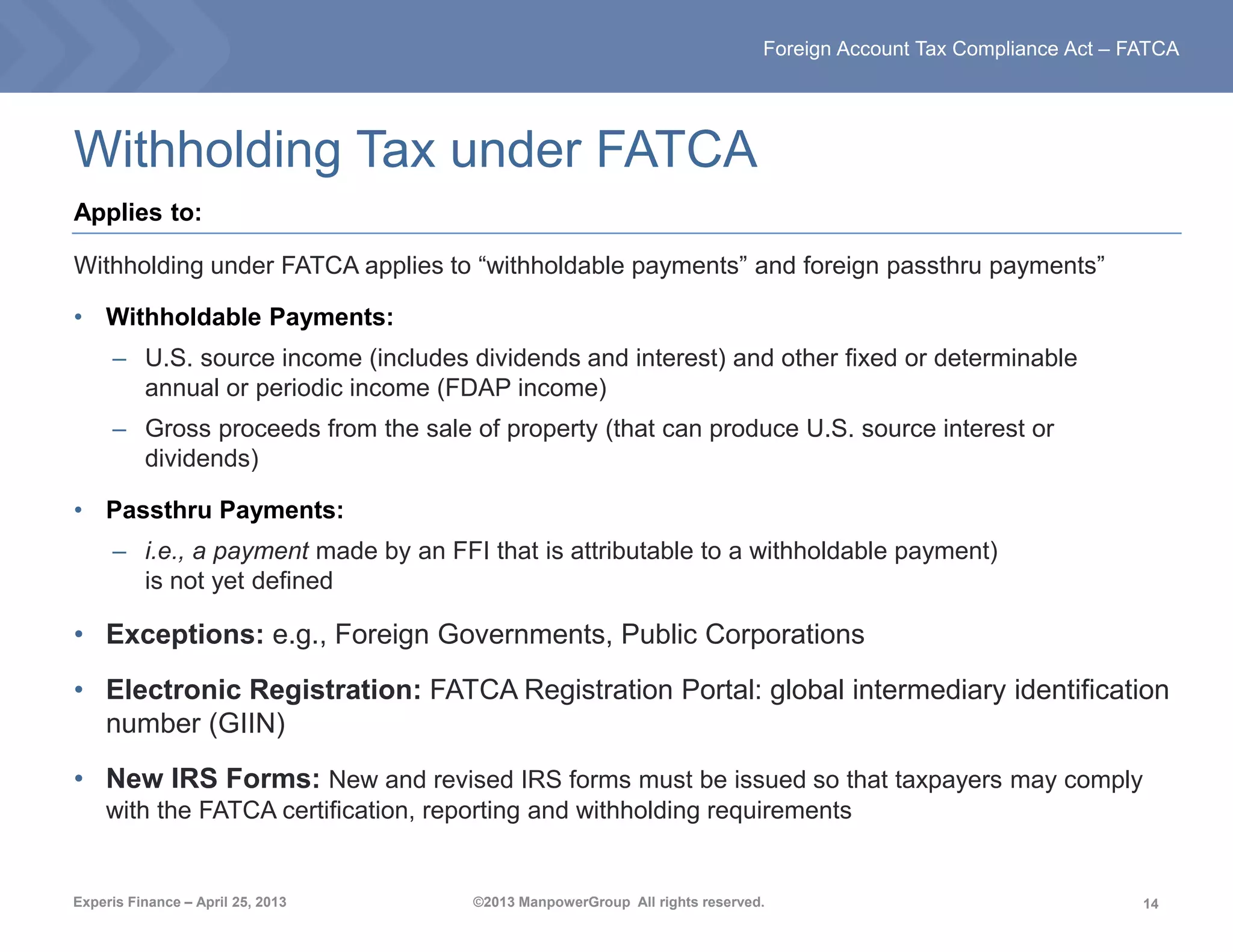

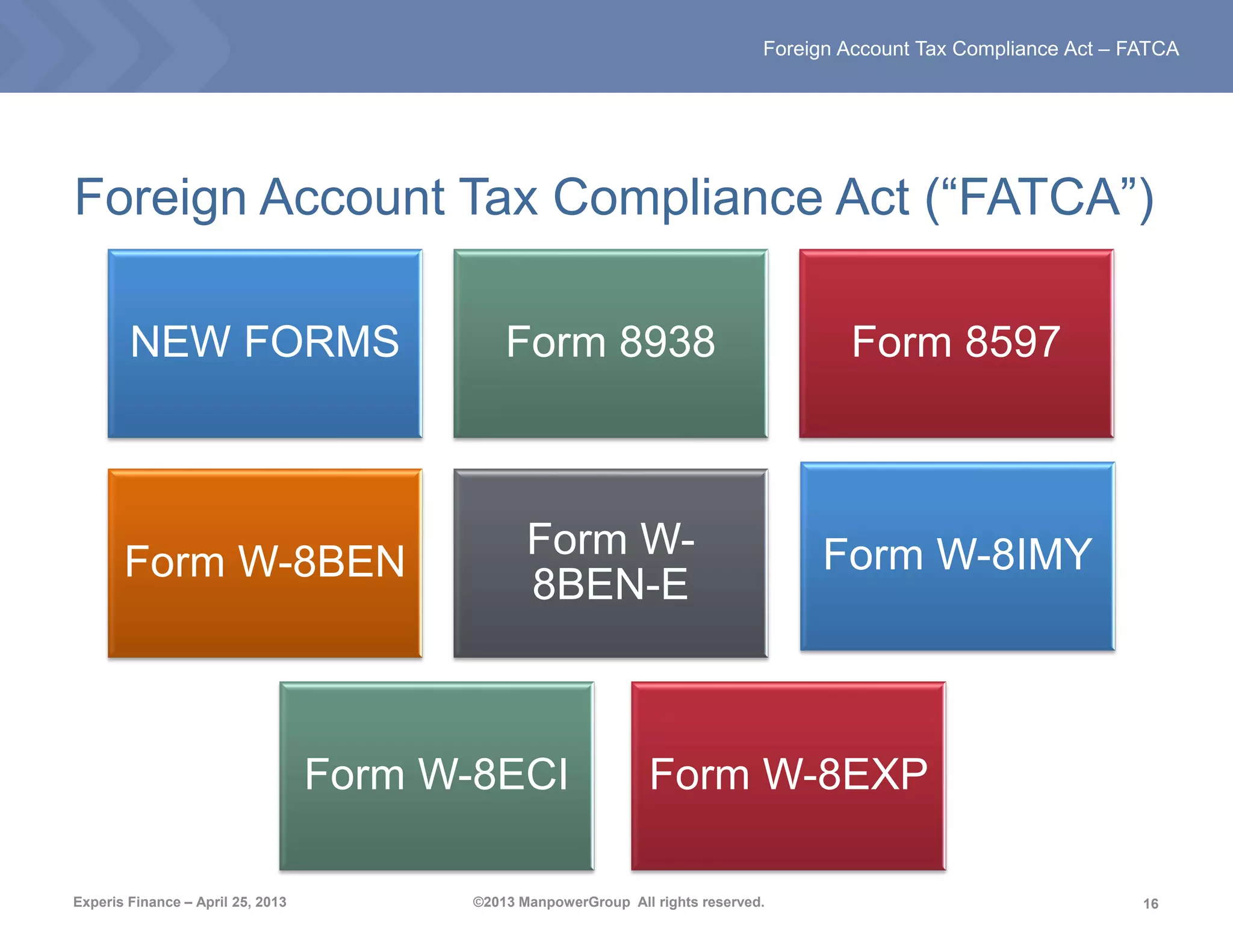

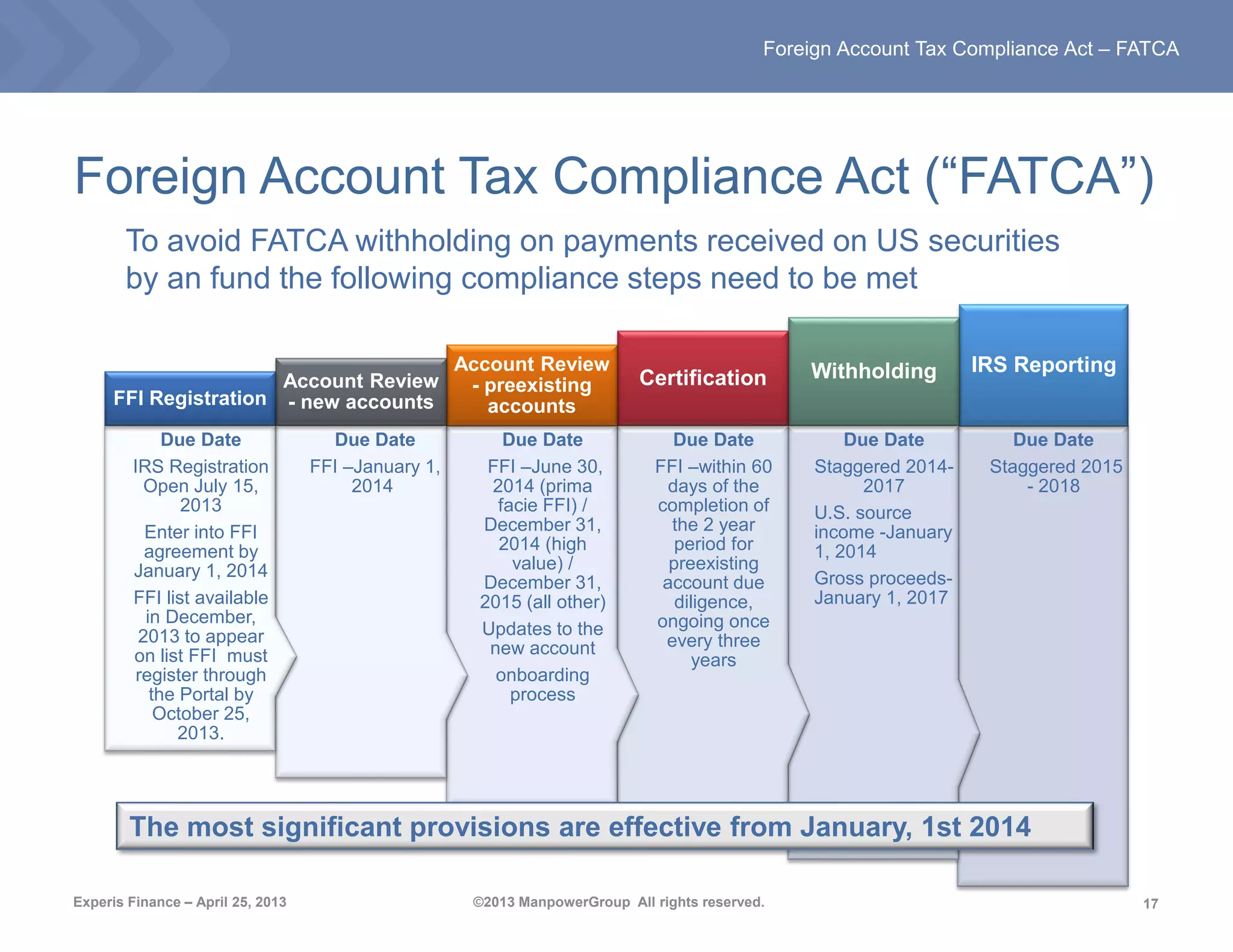

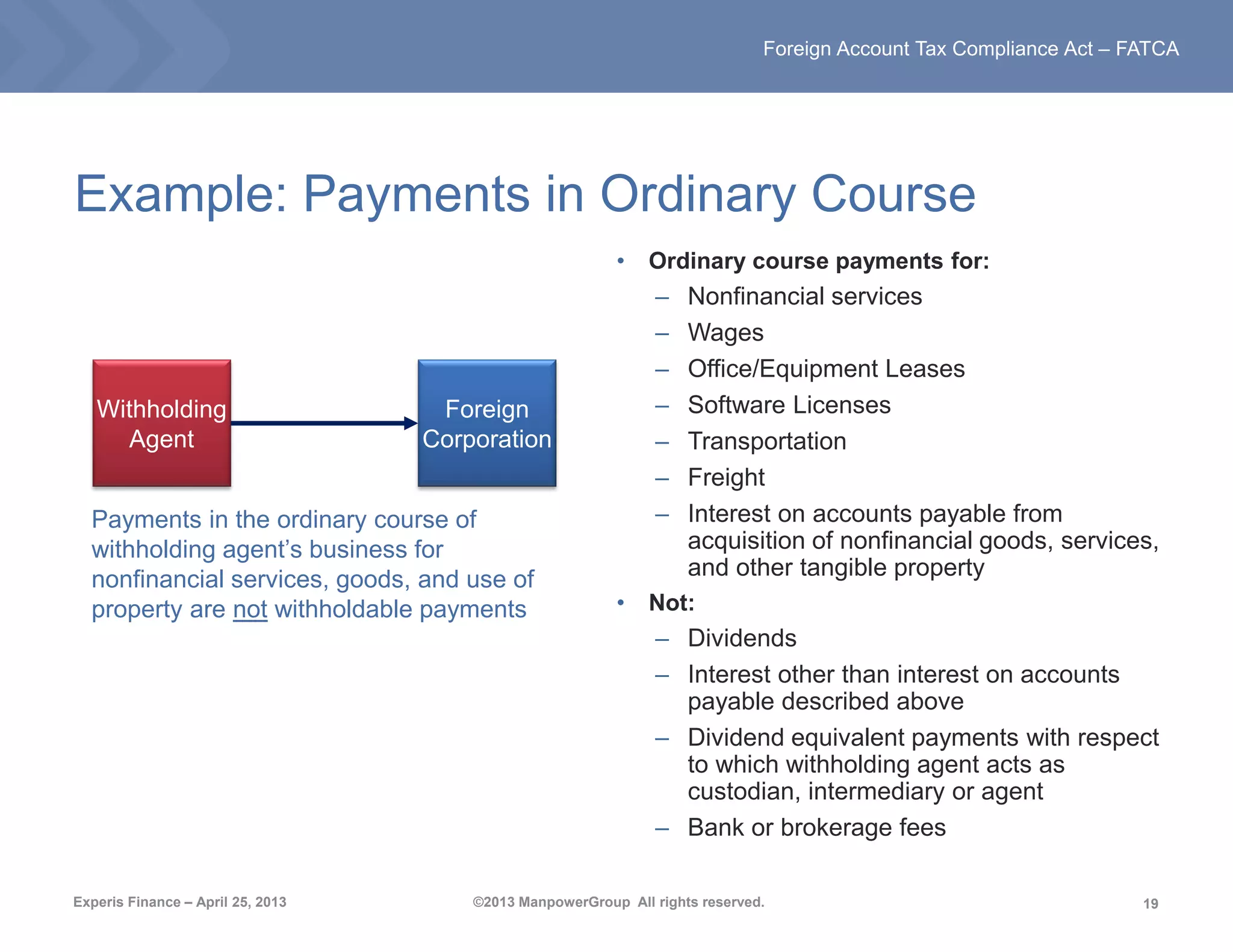

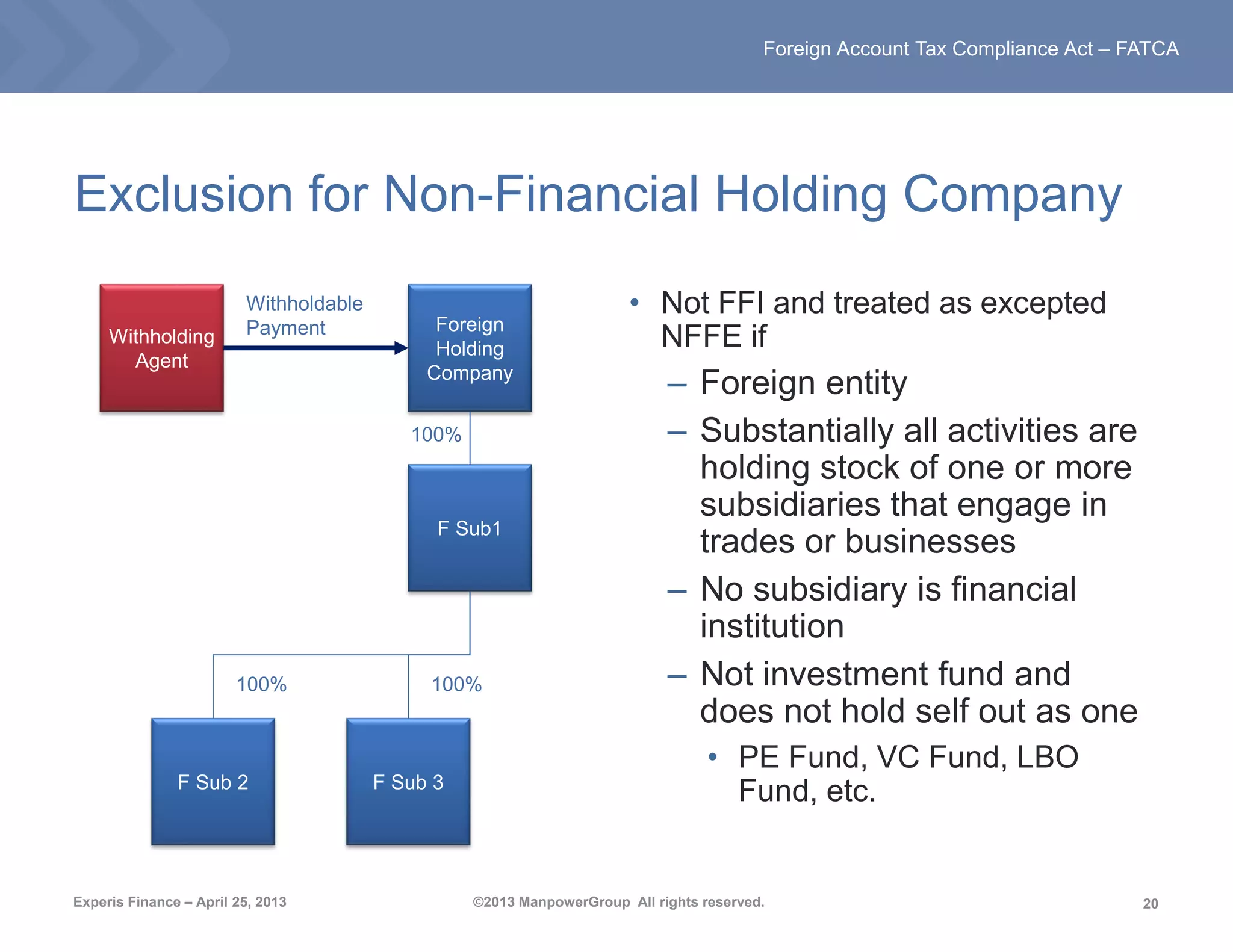

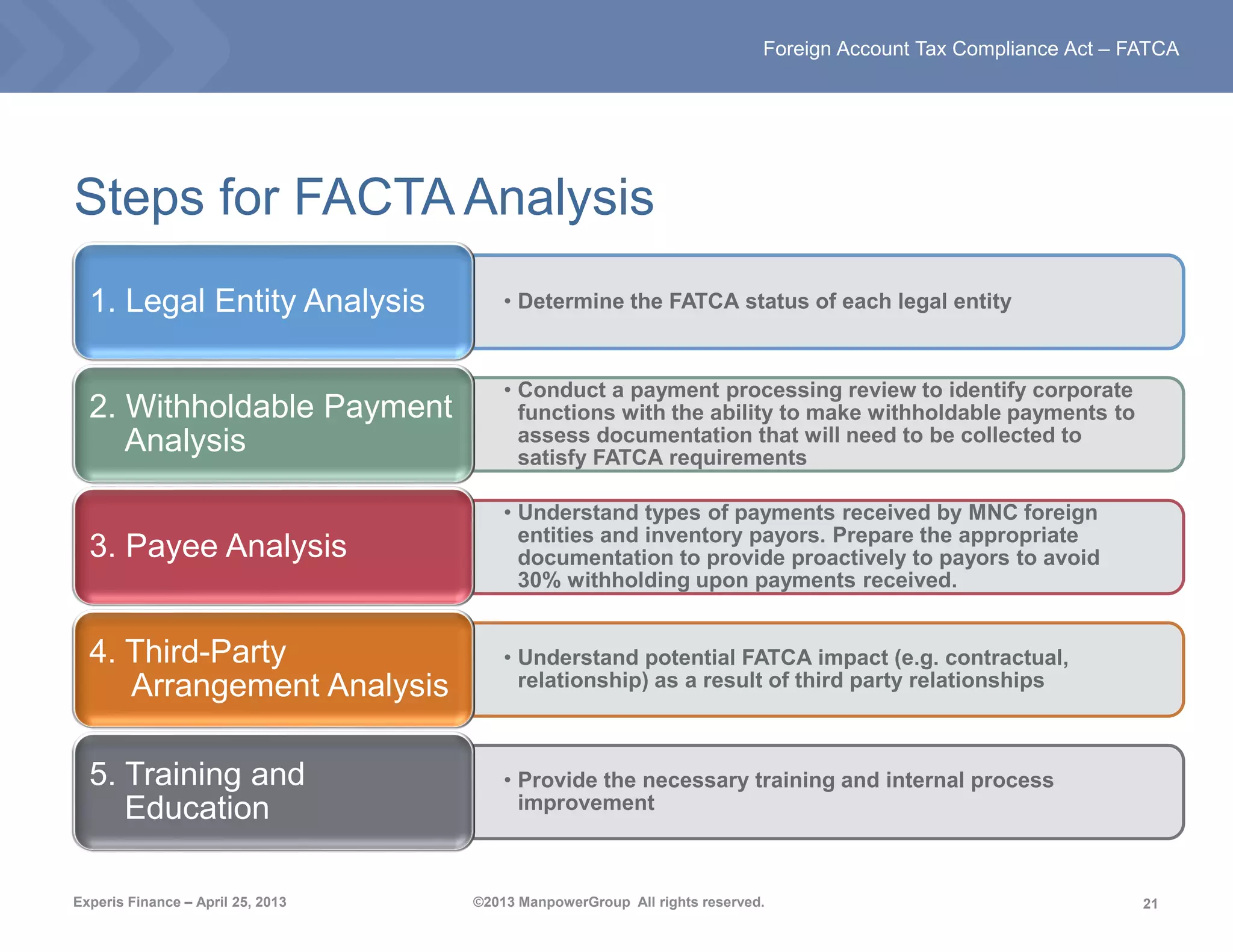

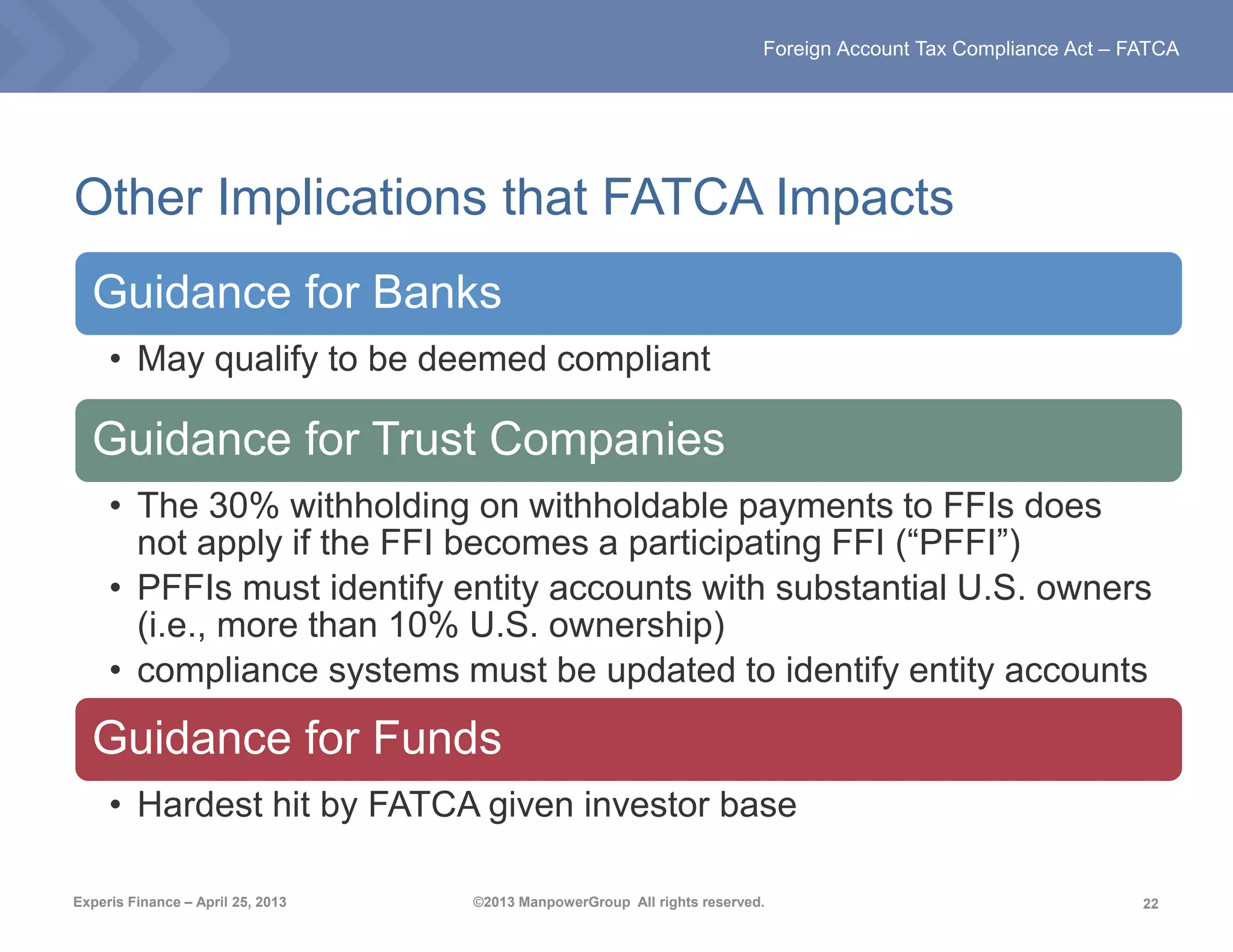

The Foreign Account Tax Compliance Act (FATCA) requires foreign financial institutions to collect and report information on U.S. account holders to prevent tax evasion. Enacted in 2010, it imposes a 30% withholding tax on certain payments unless compliance is achieved through agreements with the IRS. The act affects a wide range of entities, including multinational corporations, banks, and investment funds, requiring substantial changes to compliance processes by January 1, 2014.