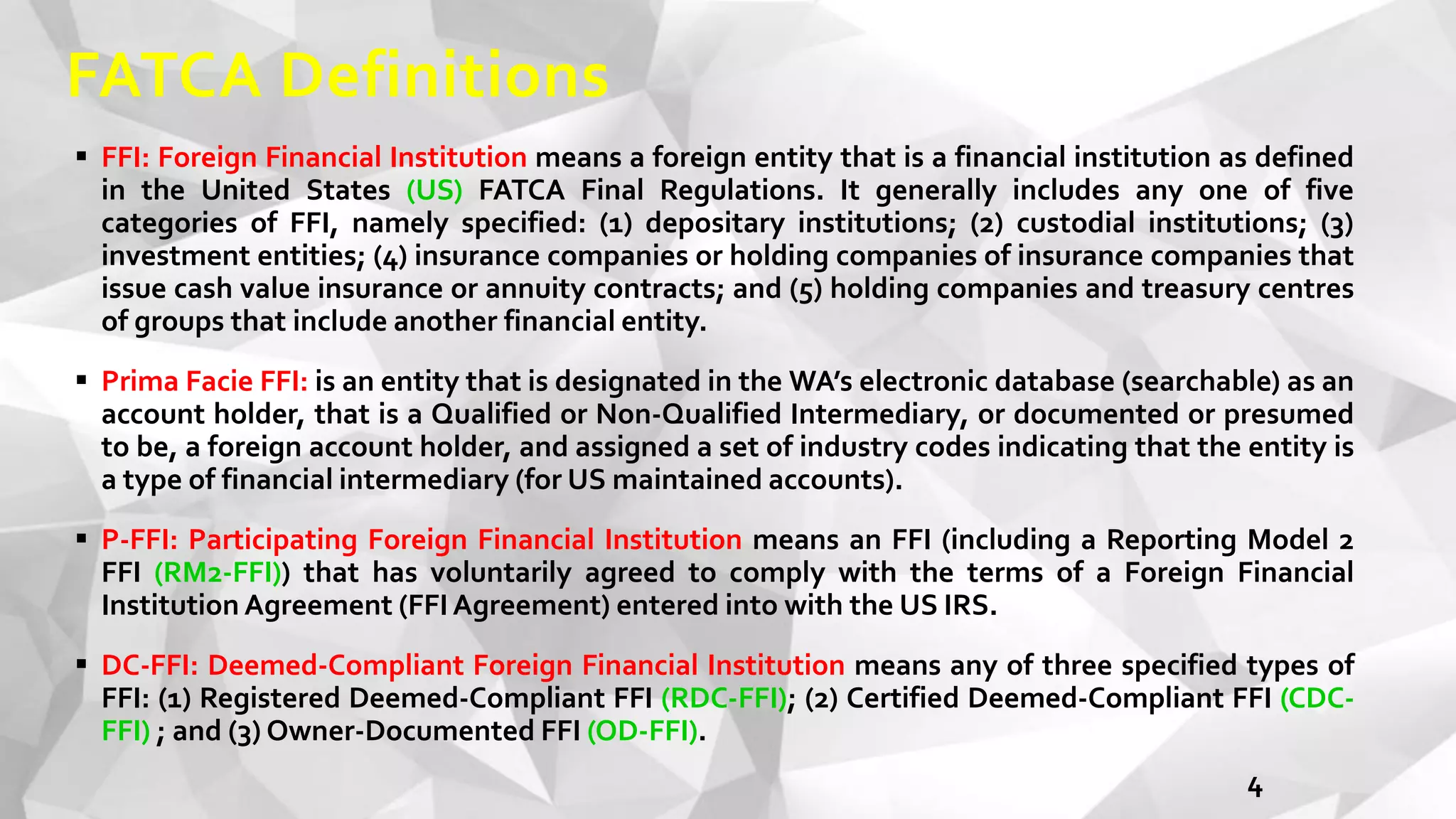

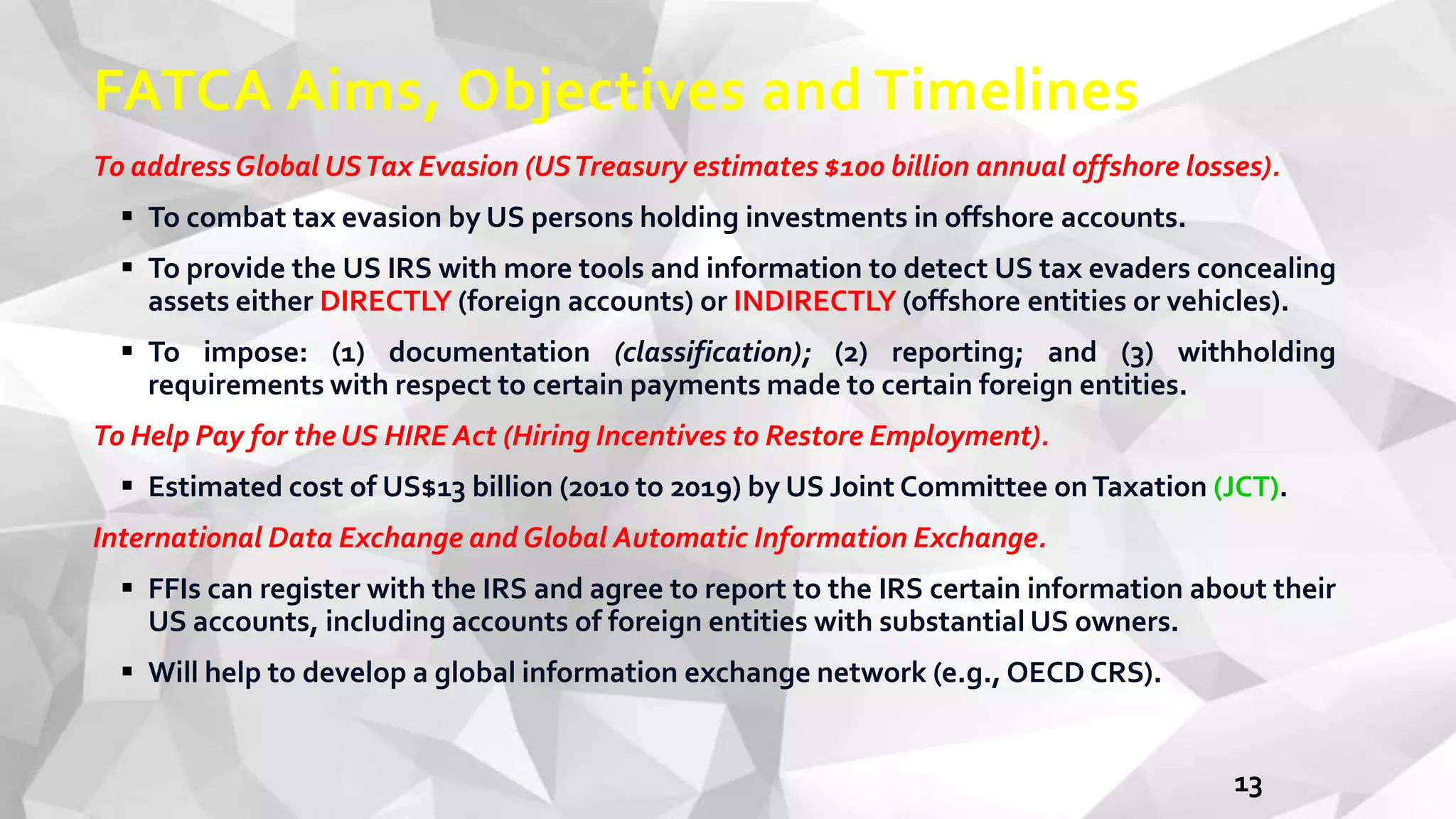

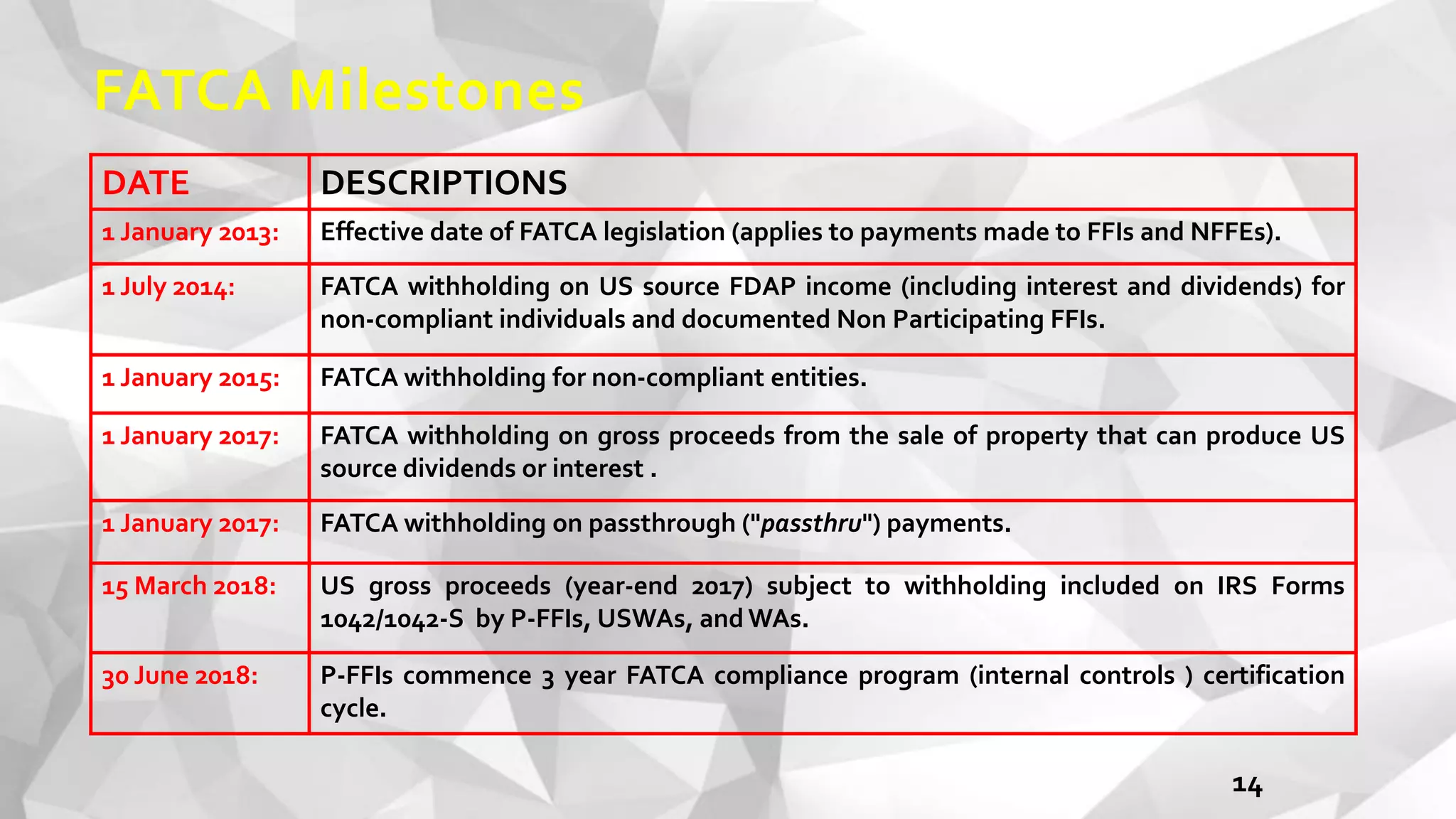

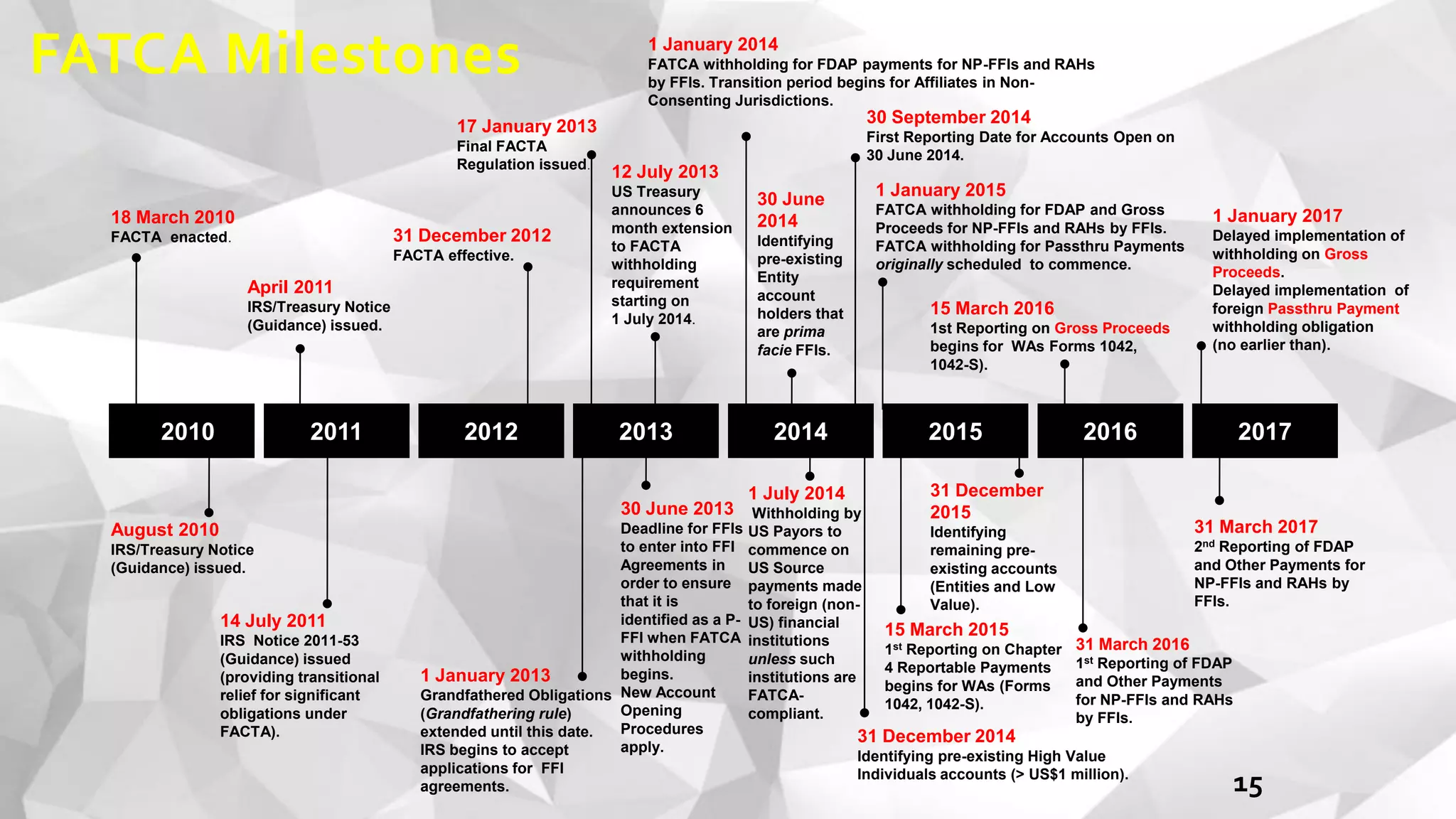

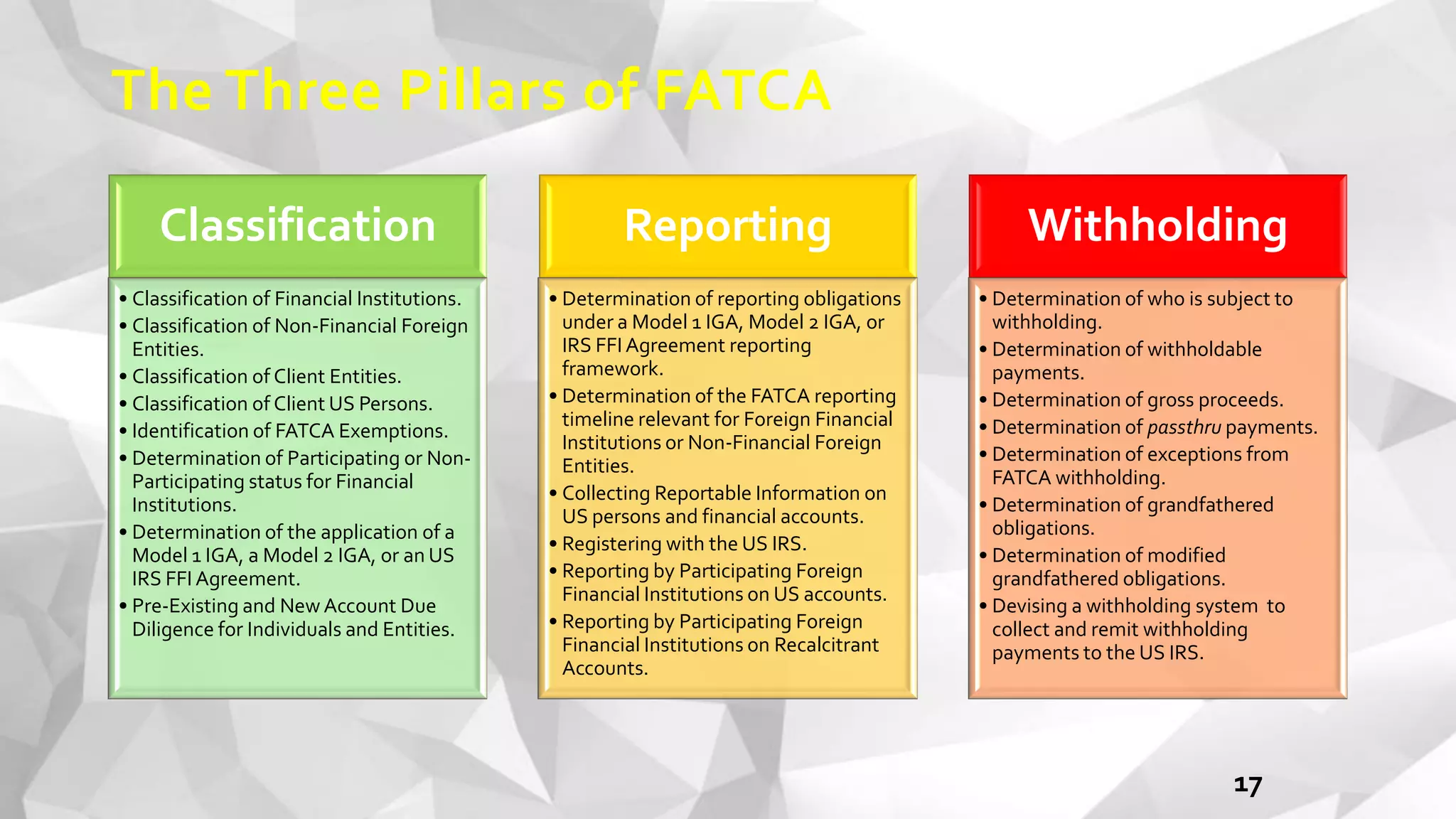

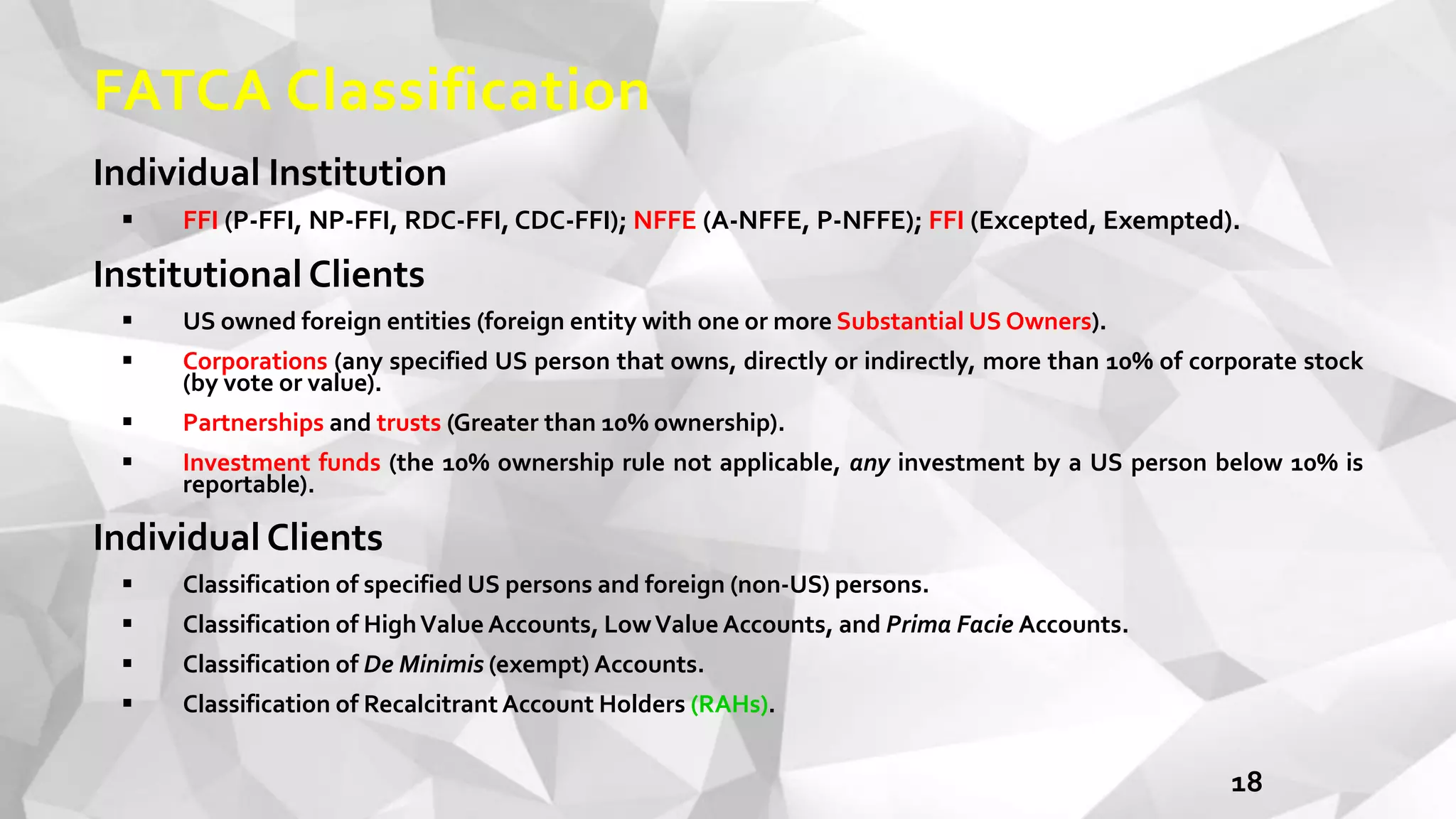

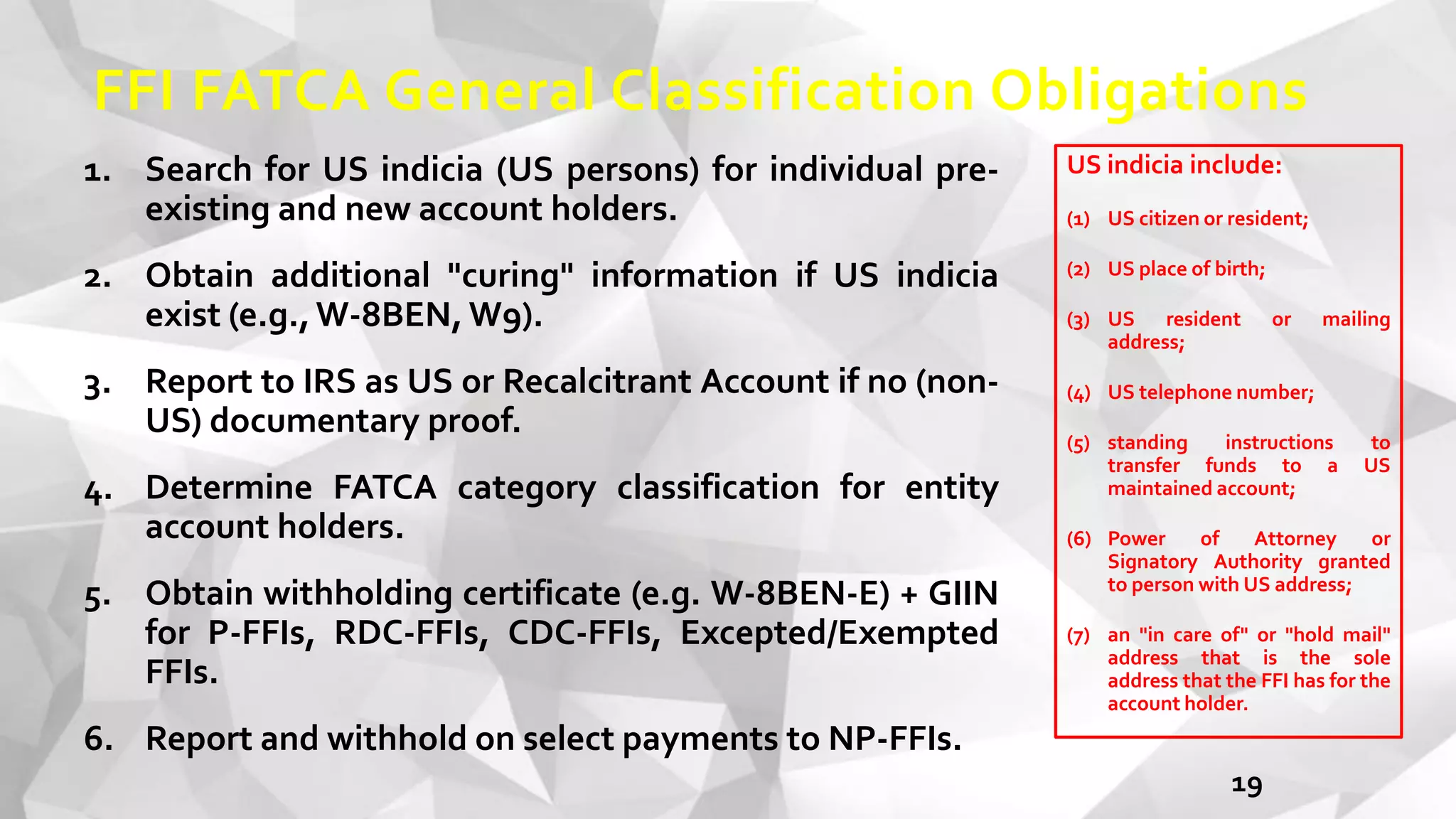

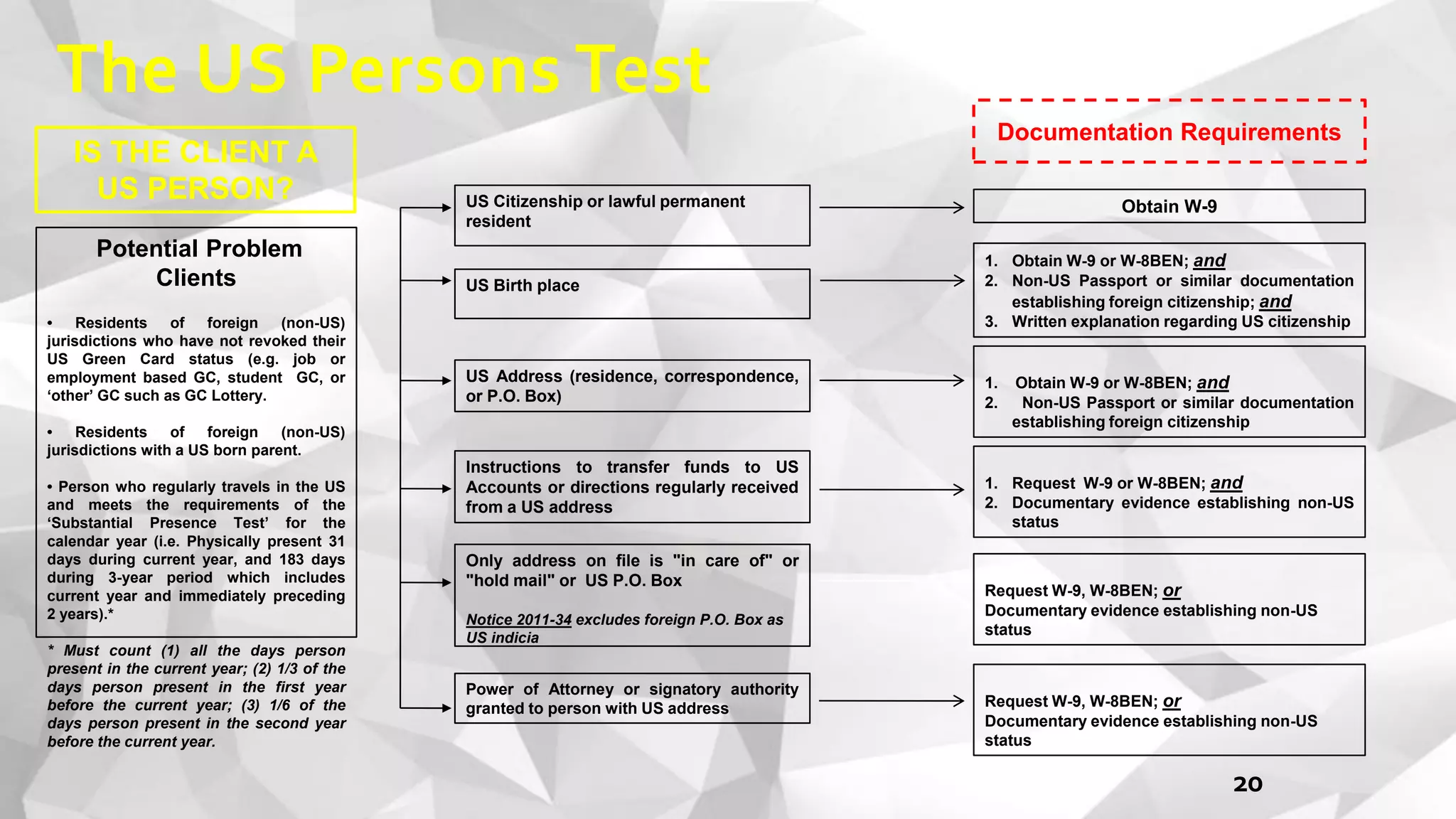

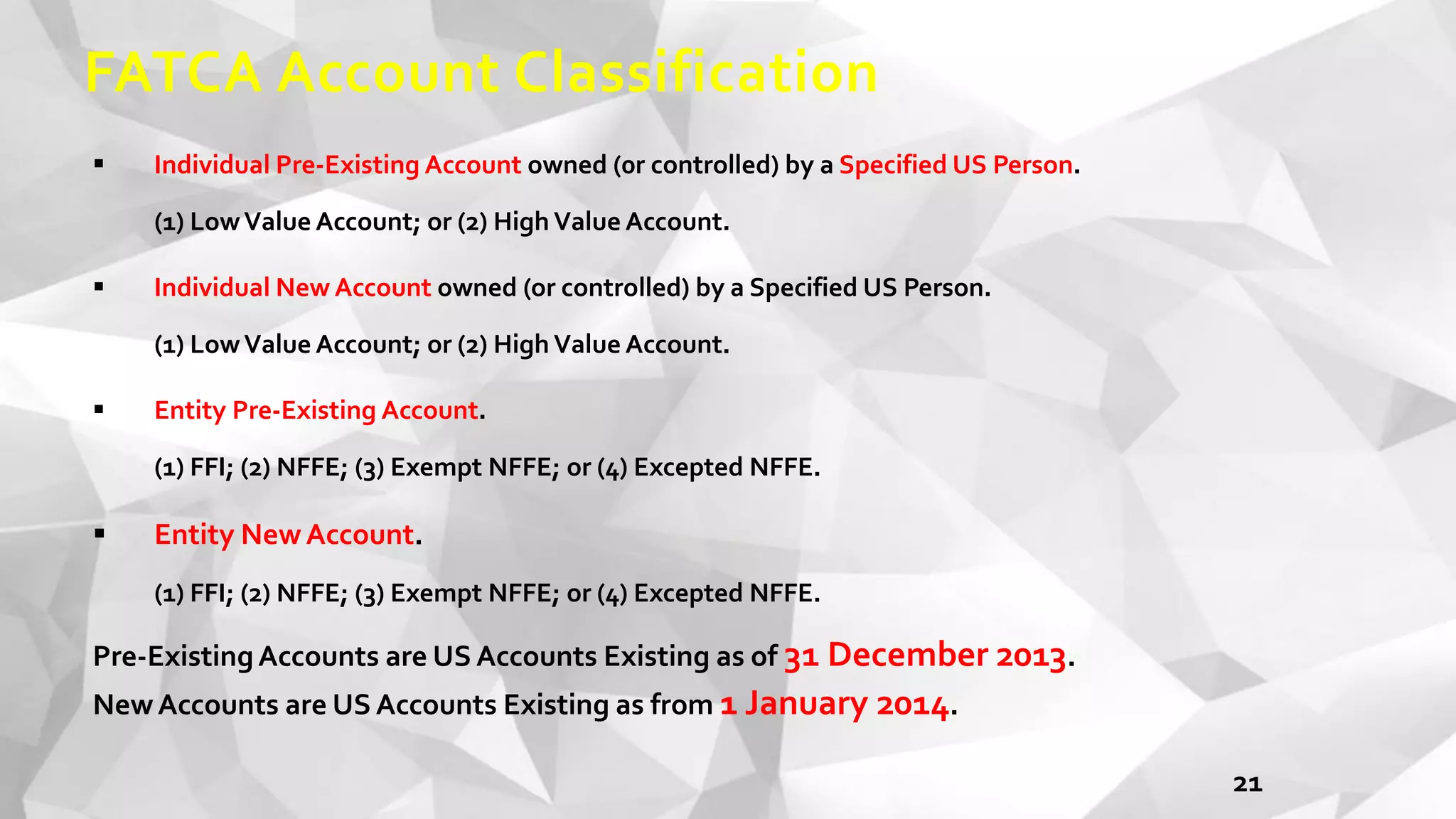

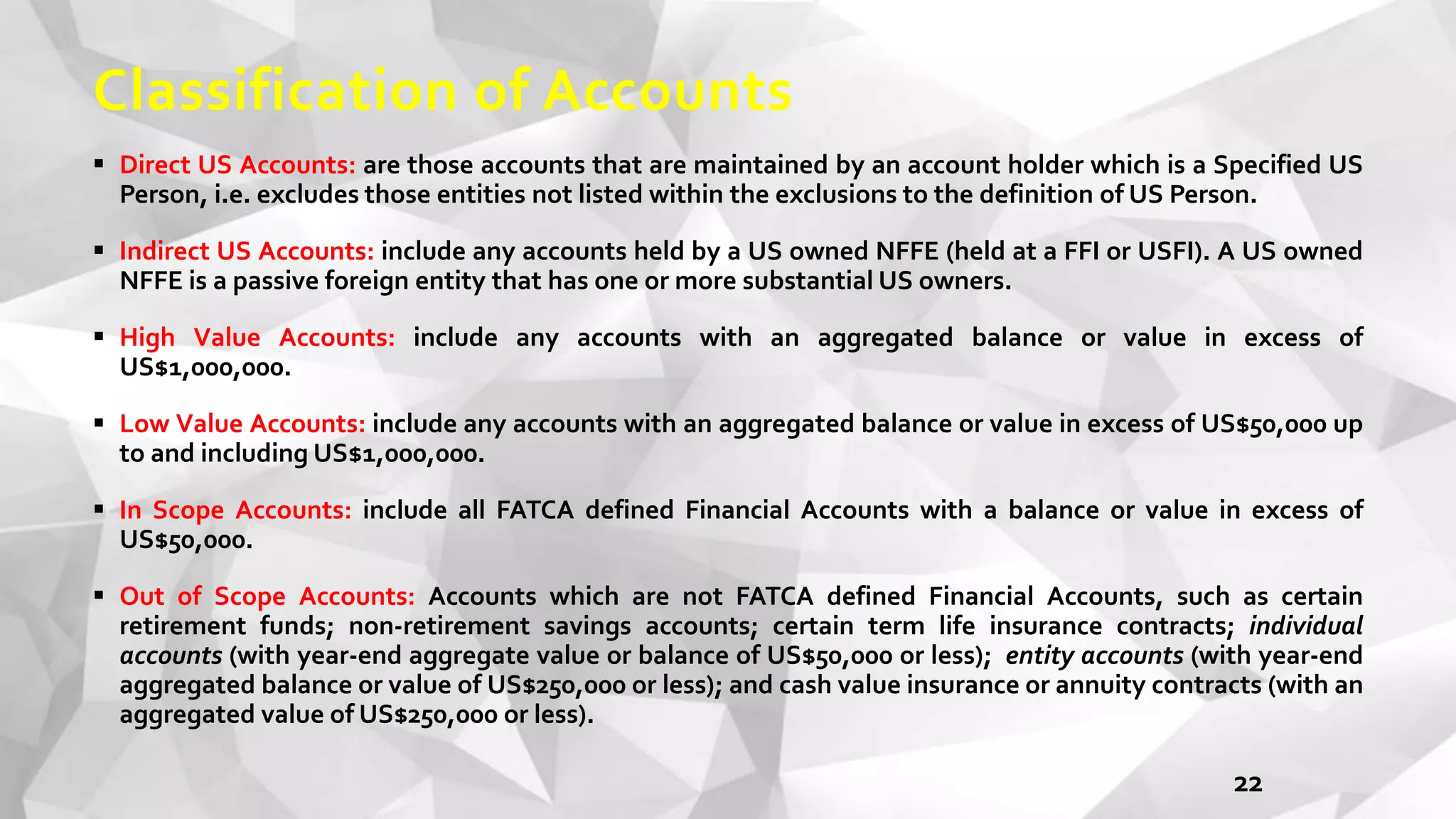

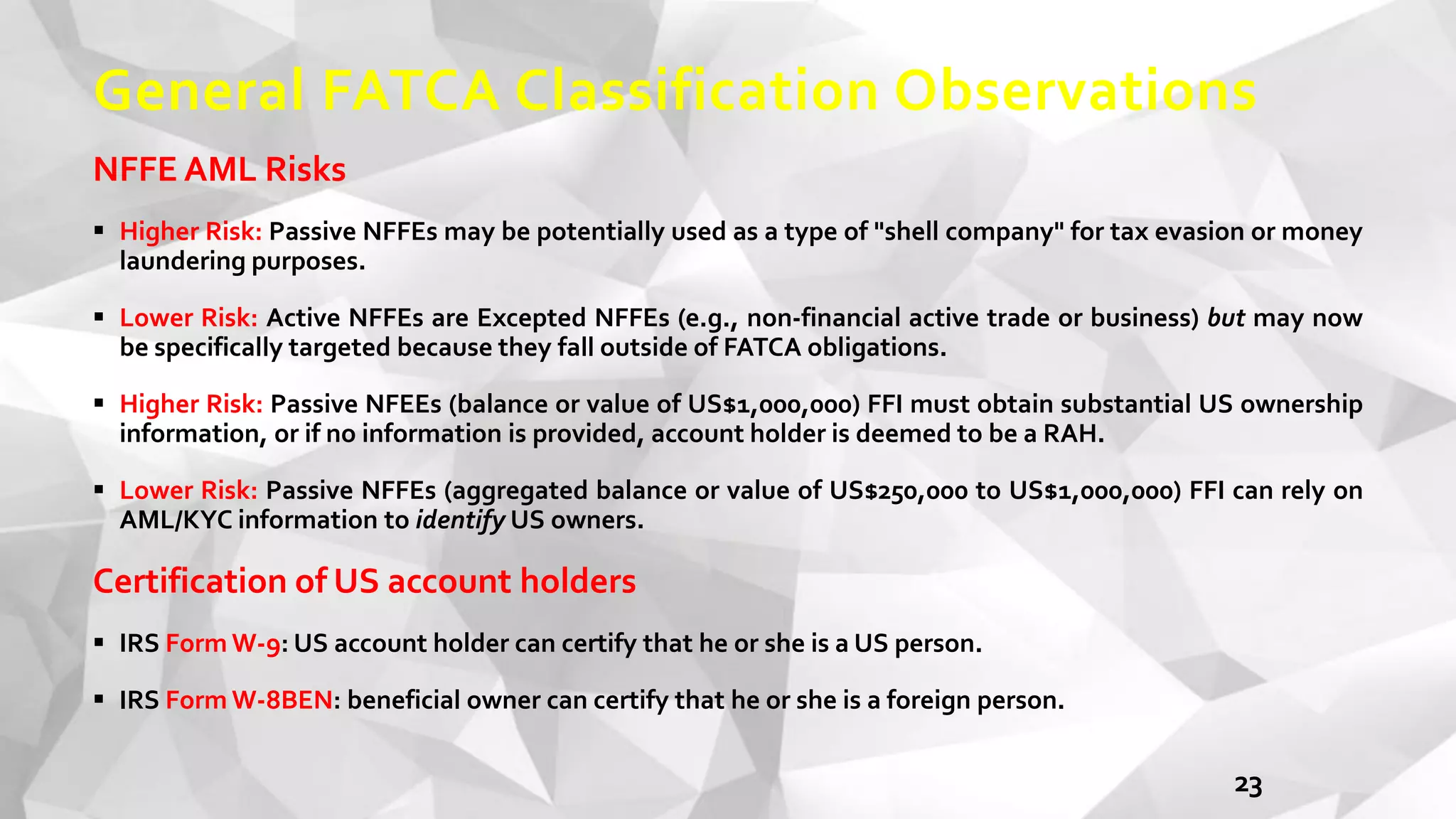

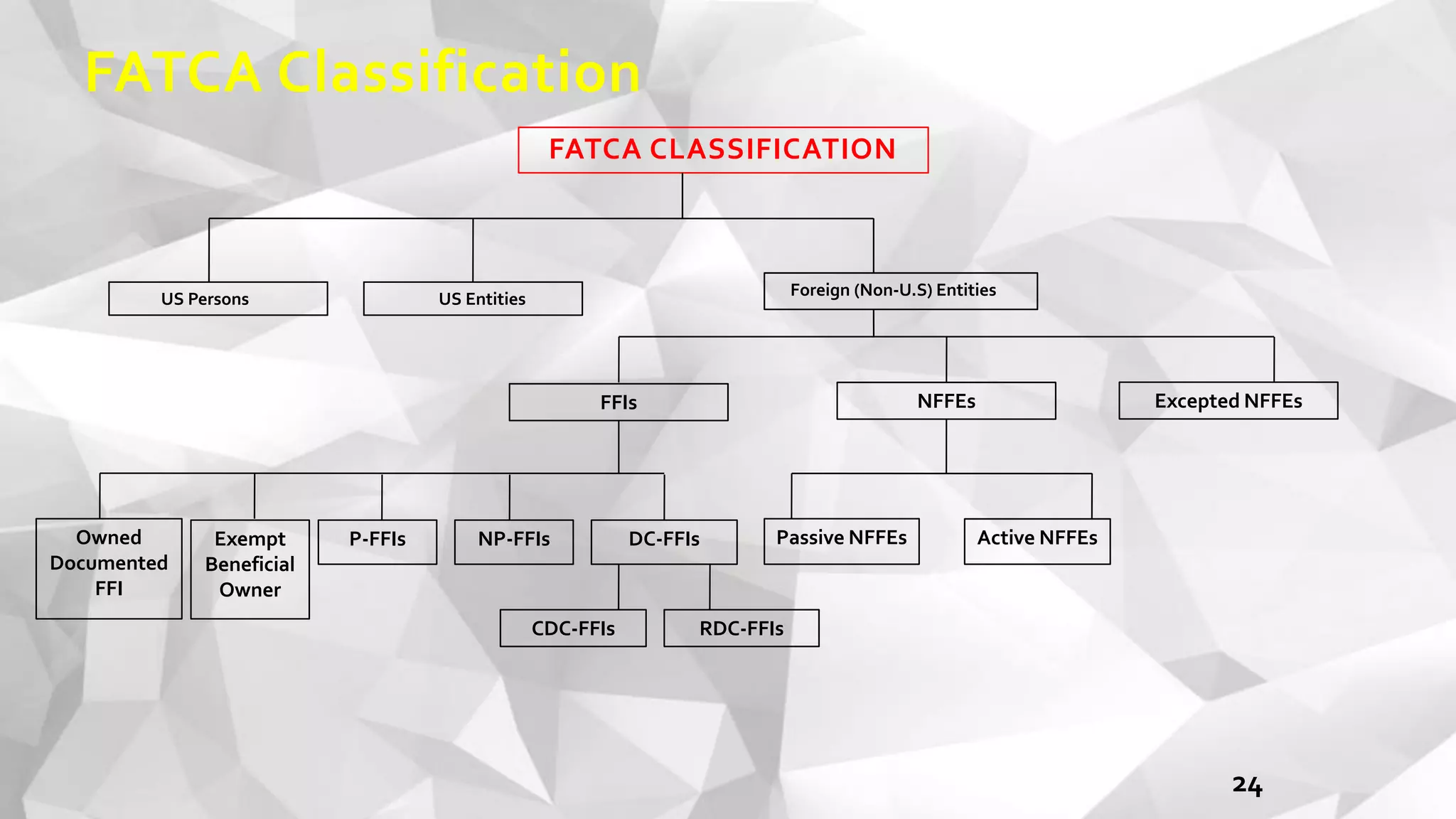

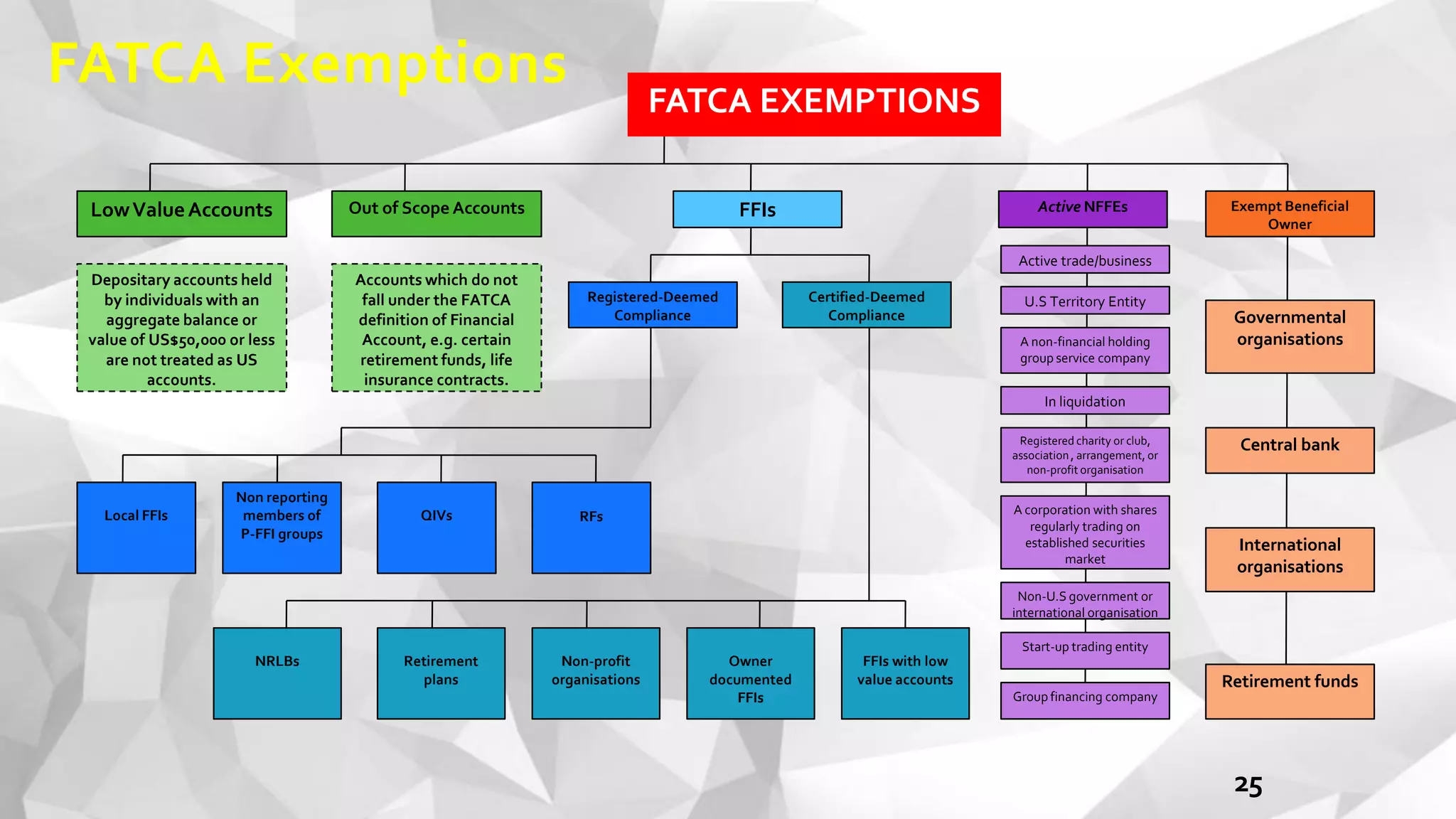

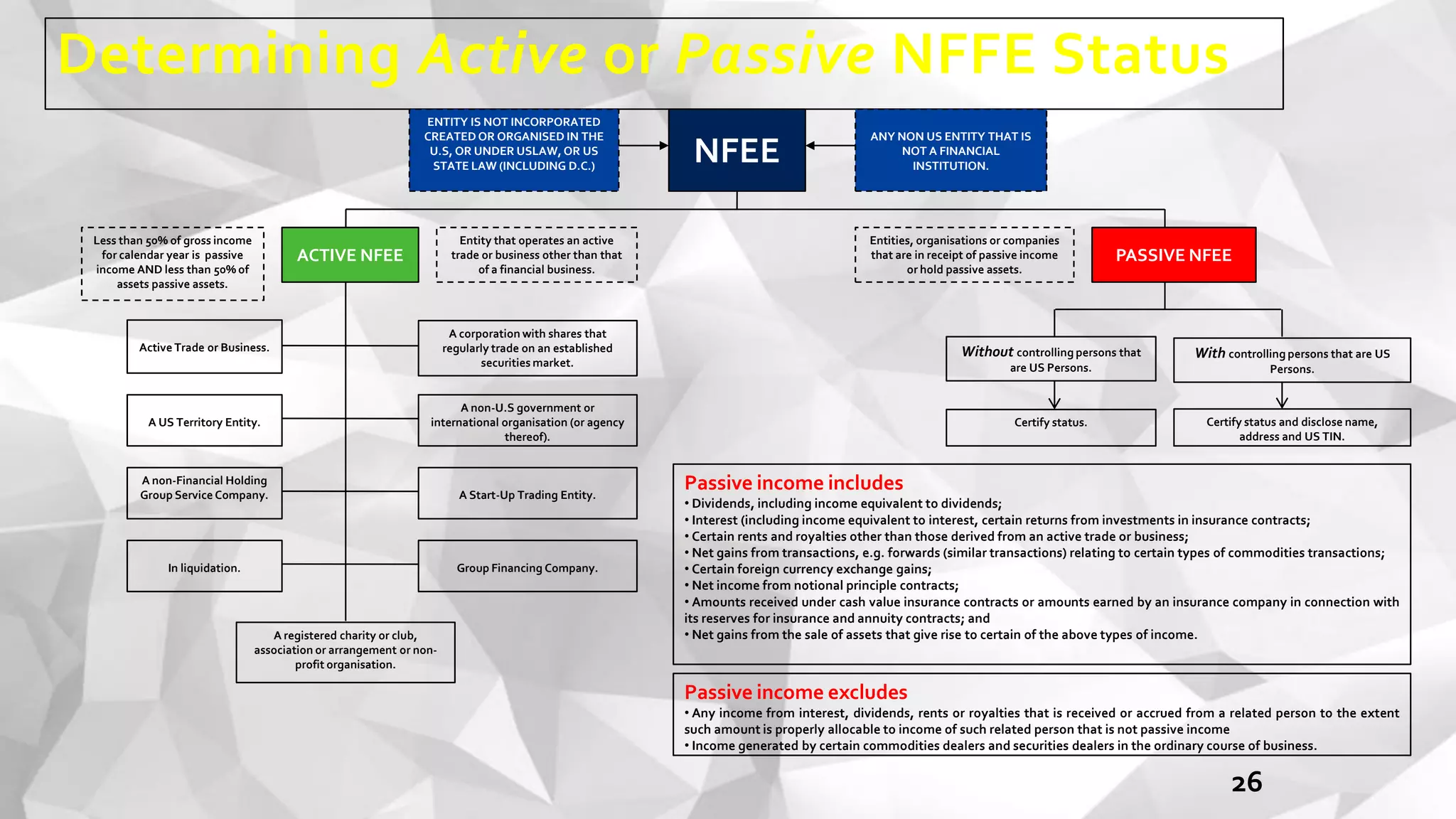

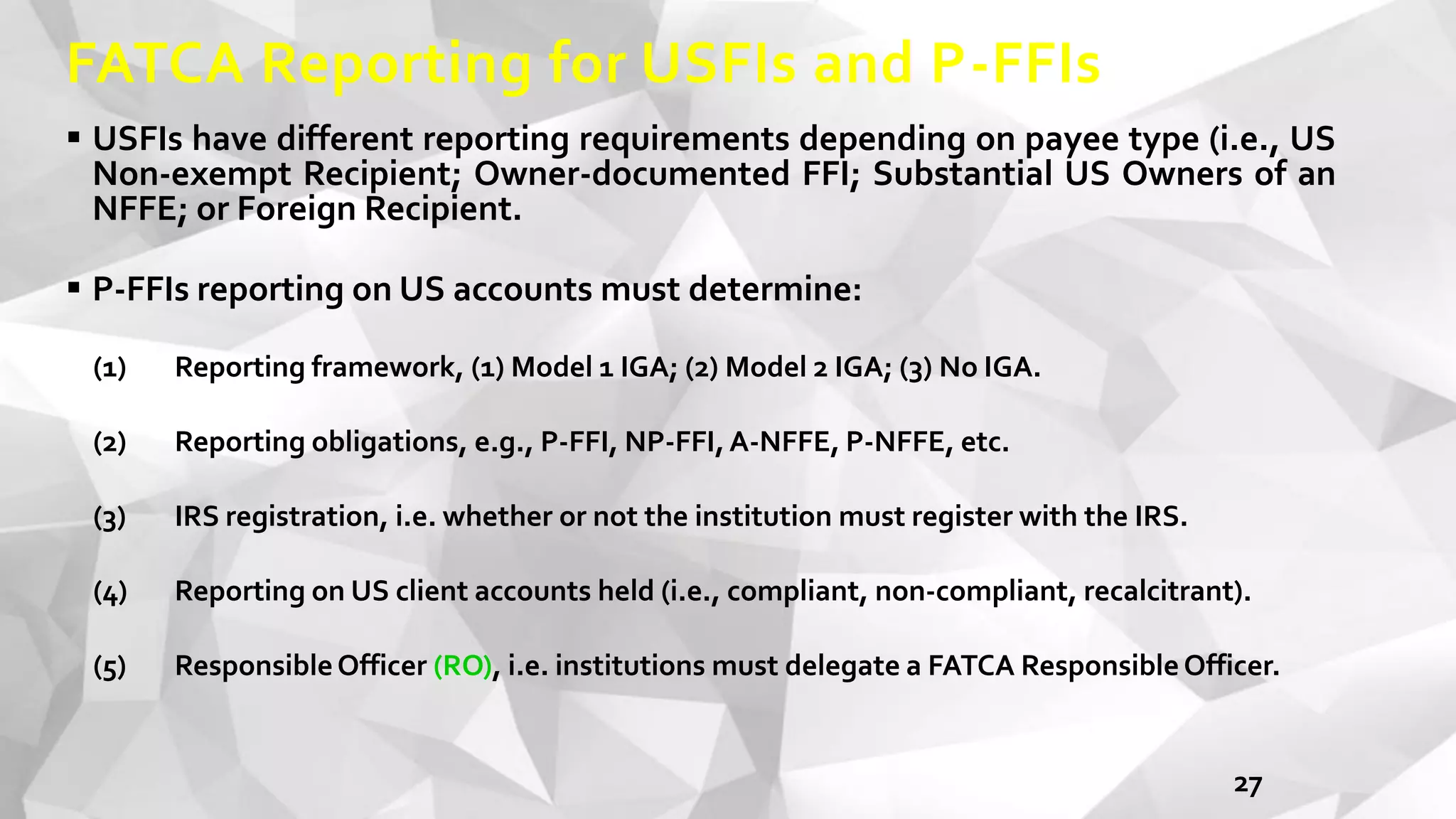

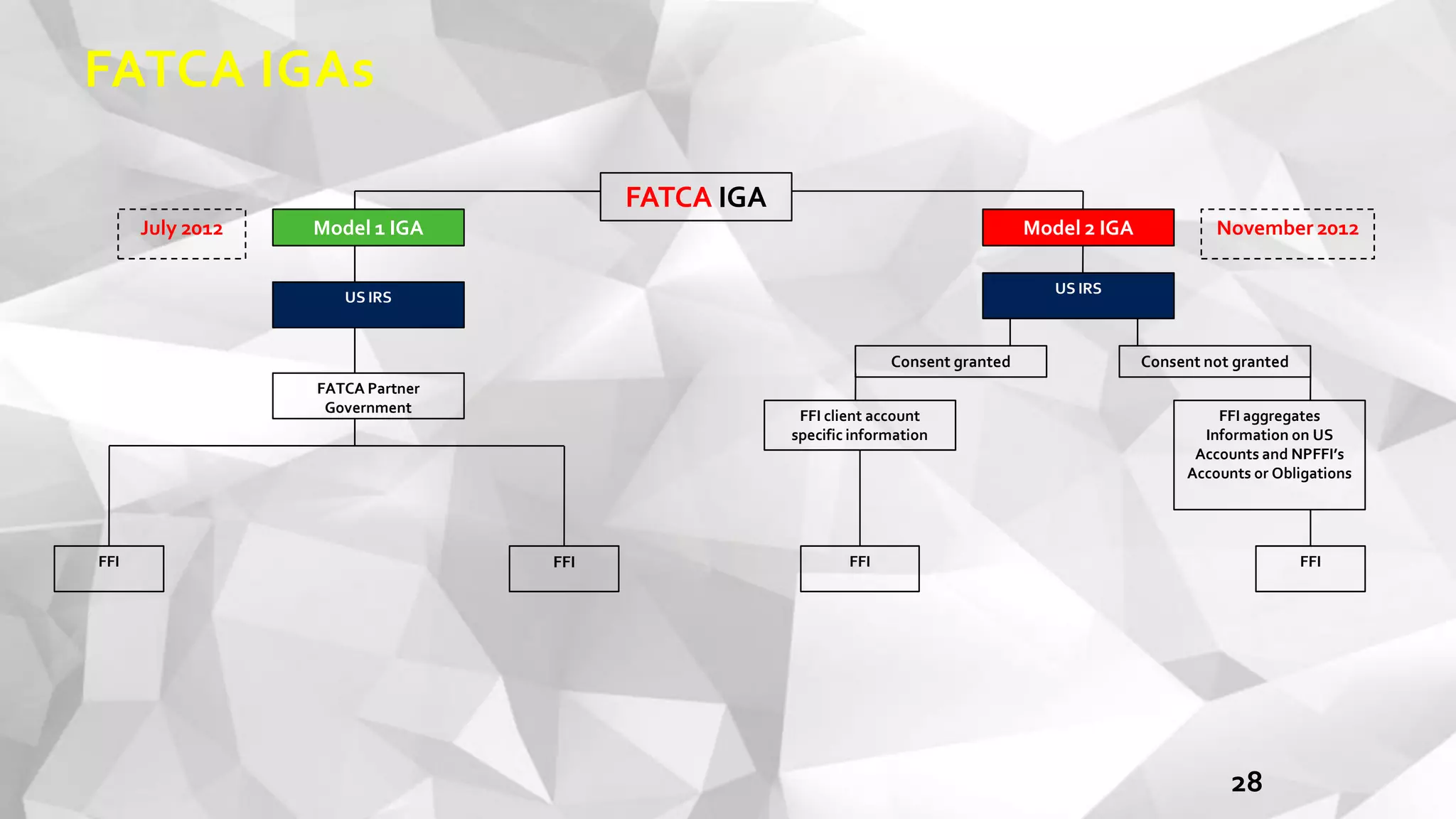

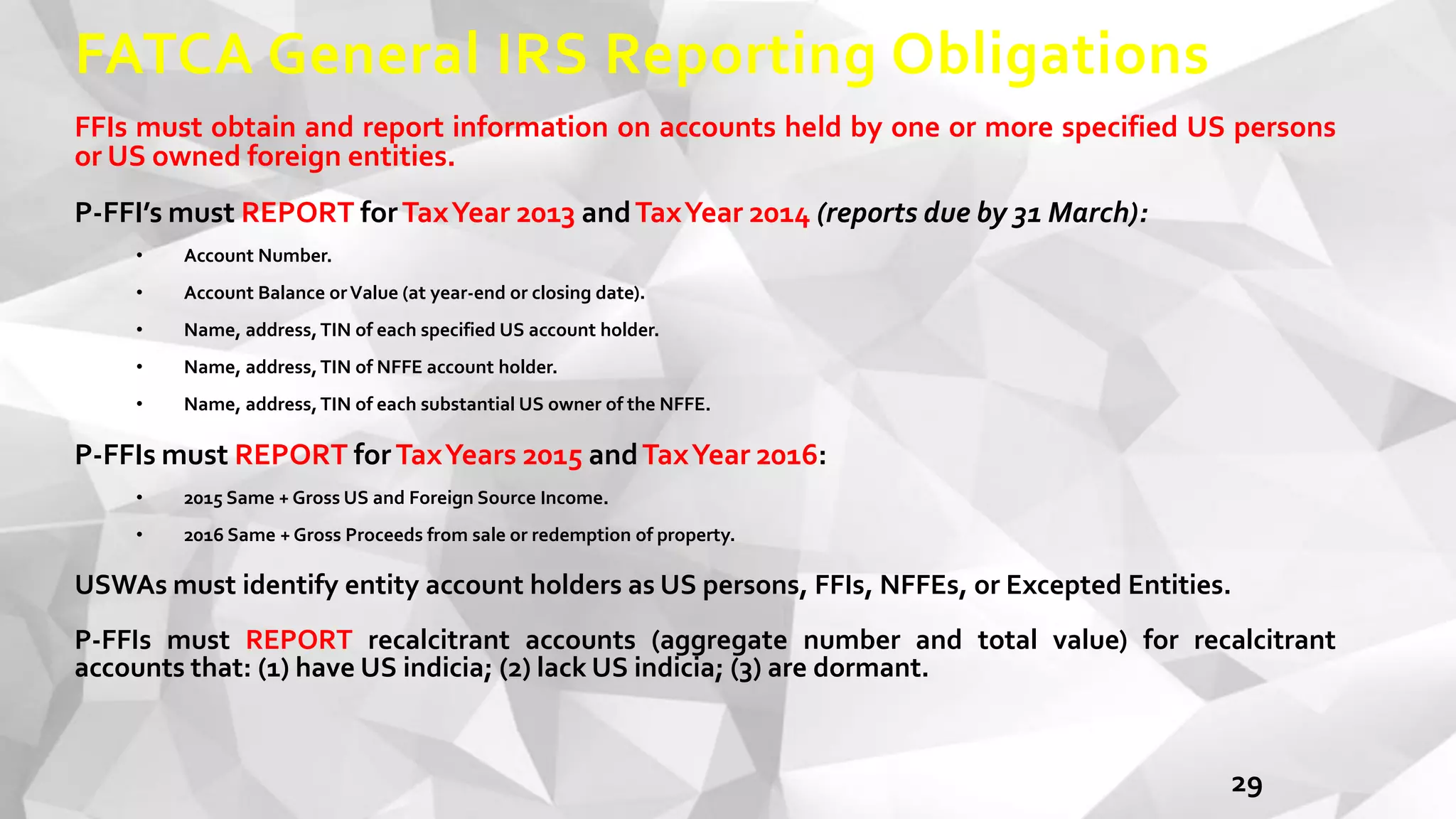

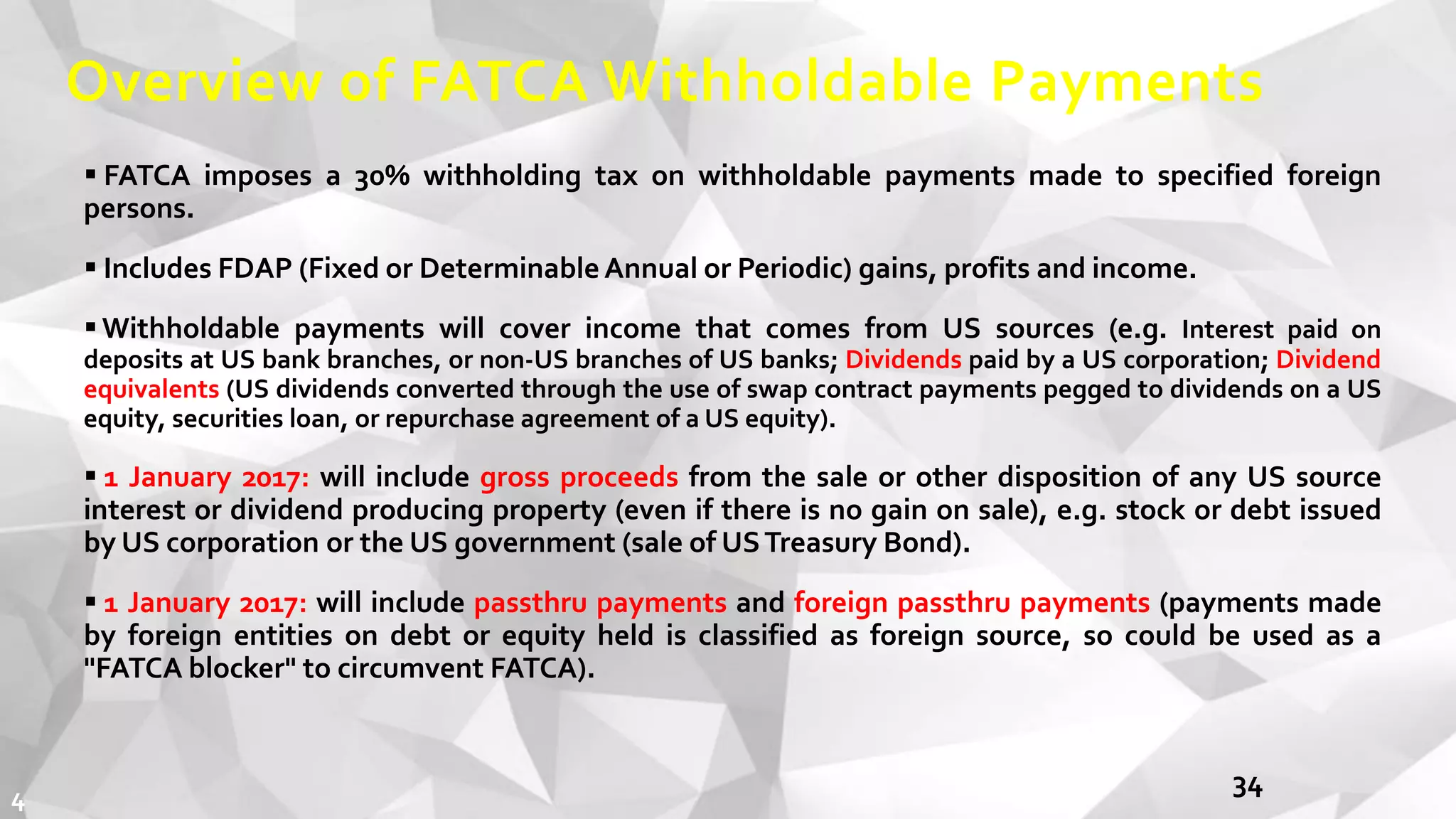

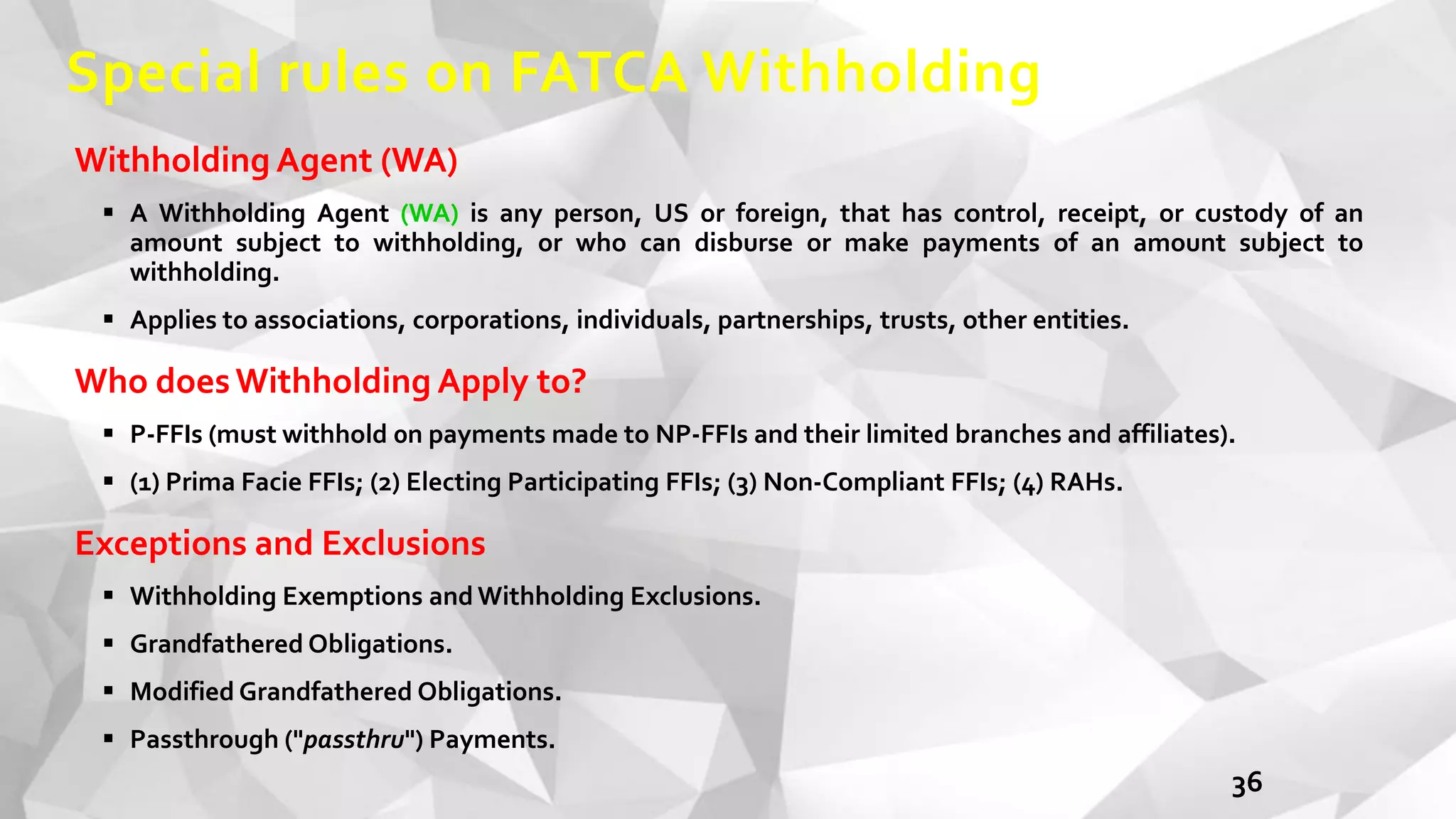

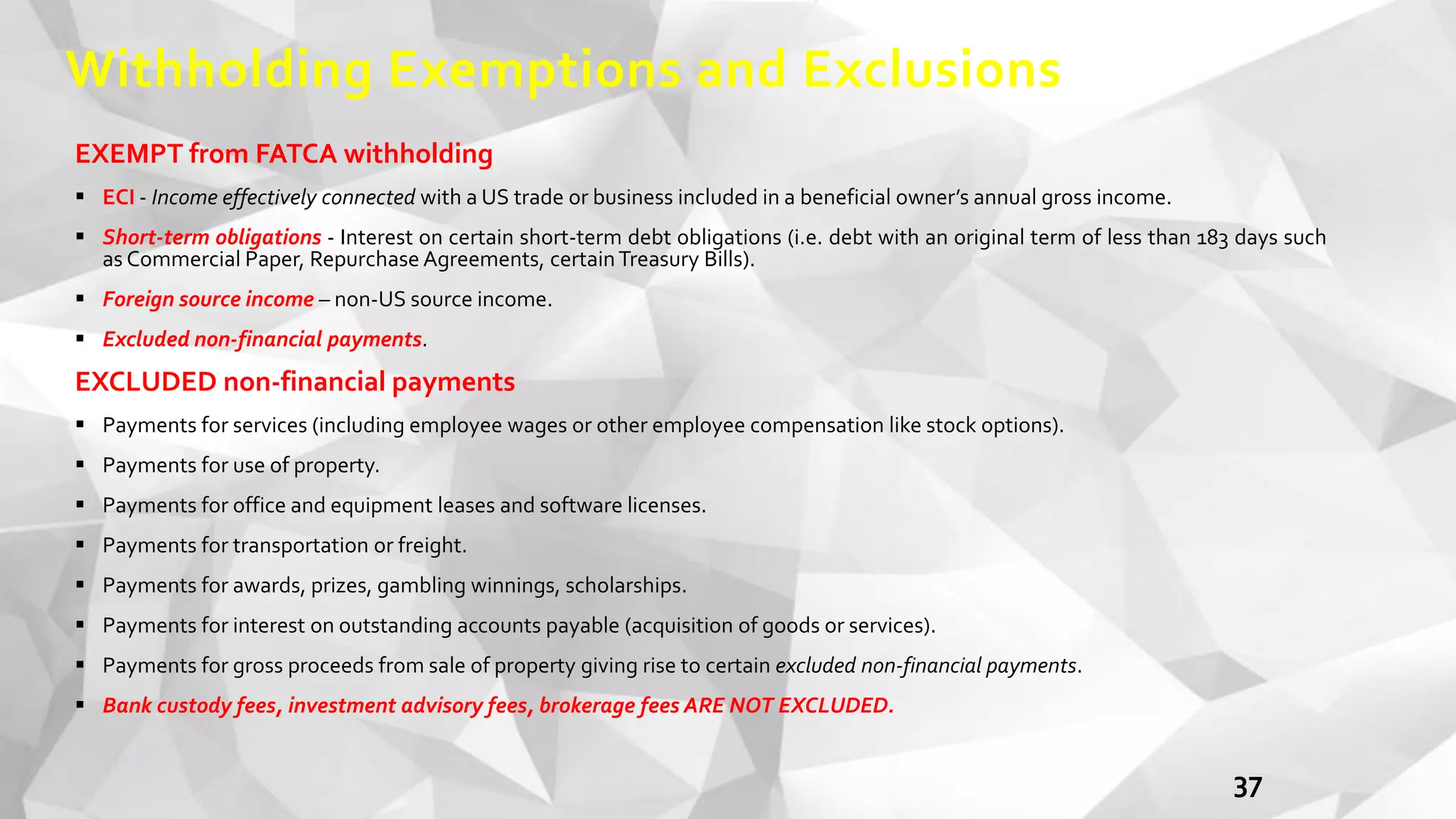

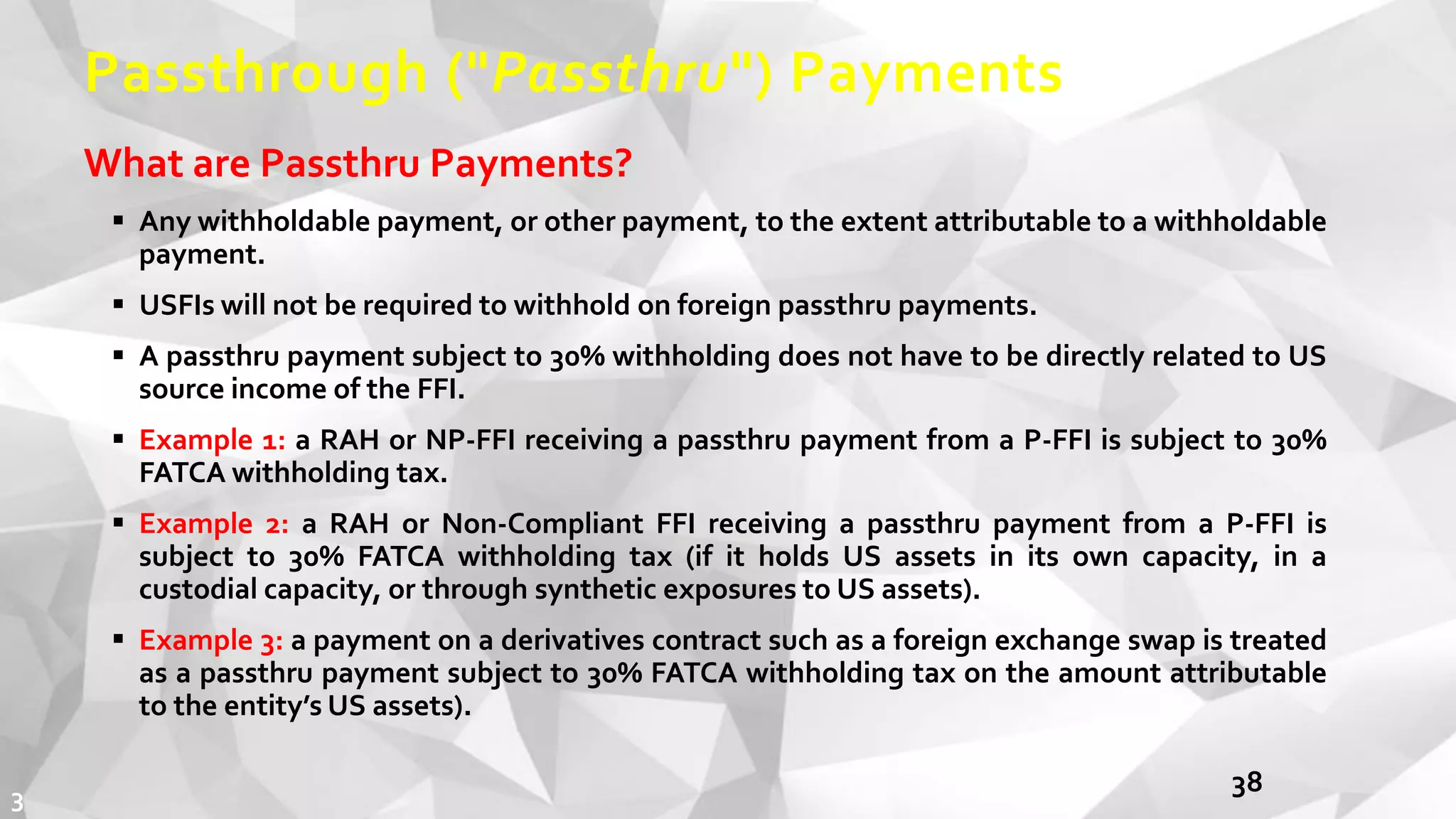

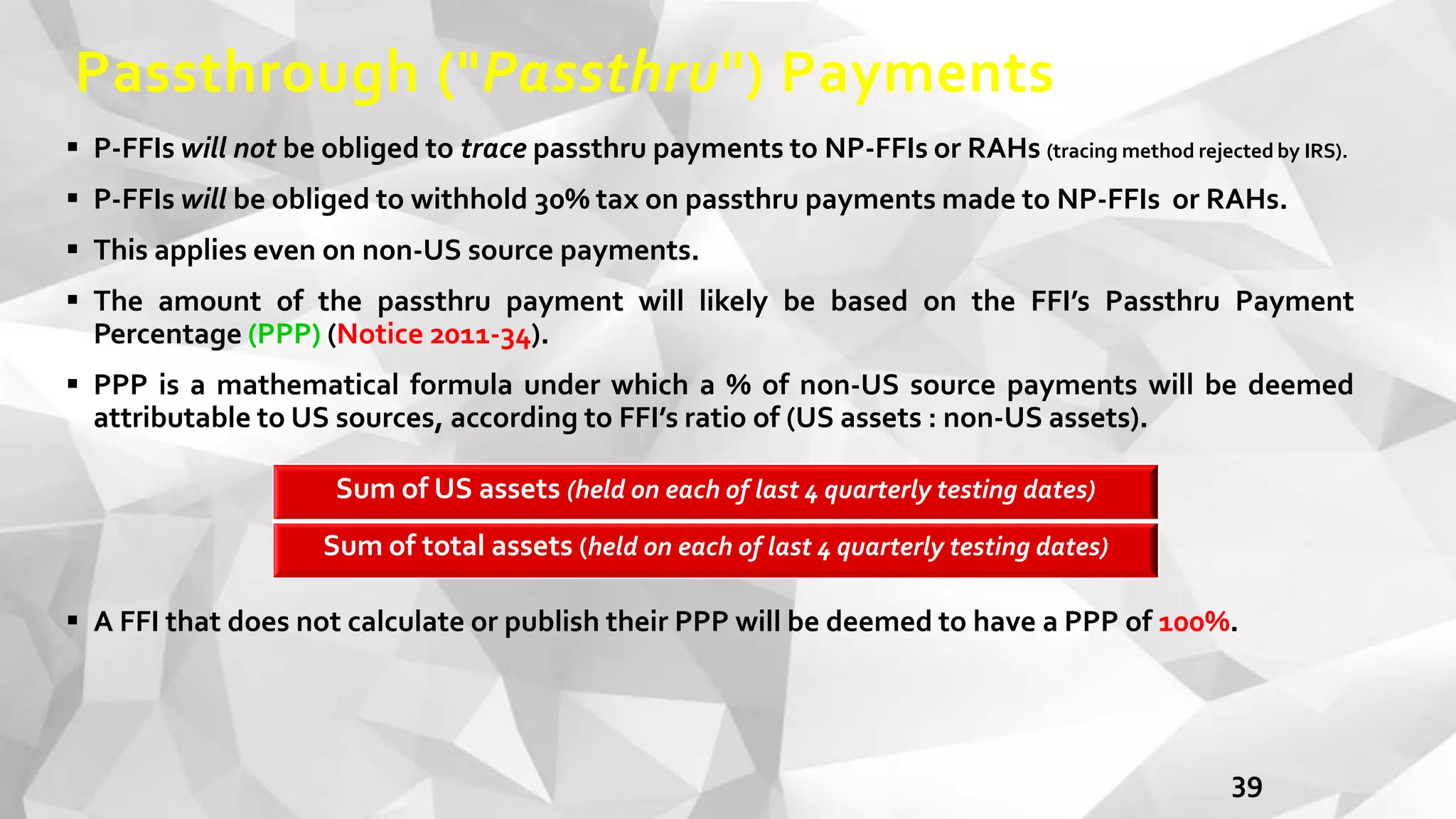

The document provides an overview of the Foreign Account Tax Compliance Act (FATCA) regulatory framework. It defines key FATCA terms and concepts. It also outlines the main aims and objectives of FATCA, which are to combat offshore tax evasion by US persons and help pay for the US Hiring Incentives to Restore Employment Act. The document discusses FATCA's three pillars of classification, reporting, and withholding requirements. It also provides timelines of FATCA implementation.