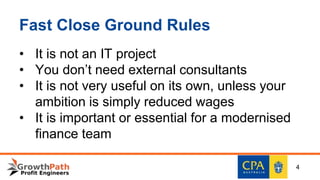

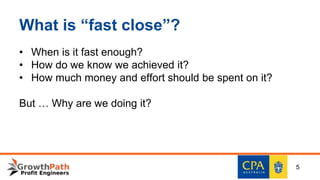

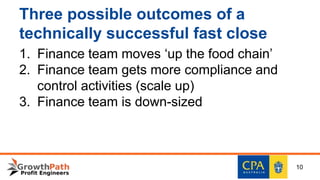

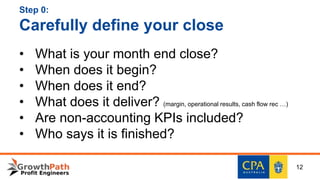

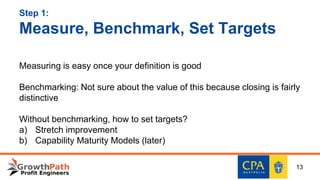

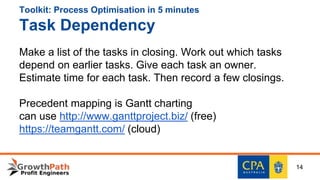

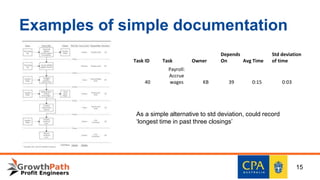

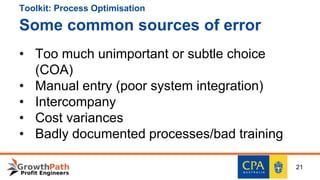

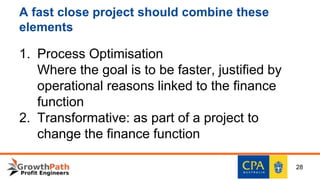

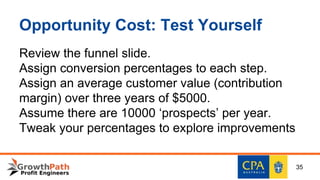

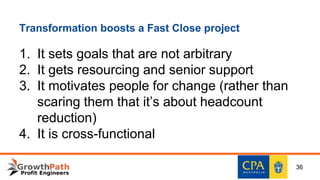

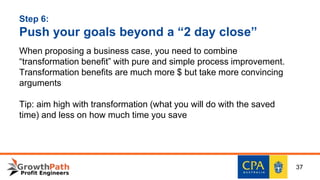

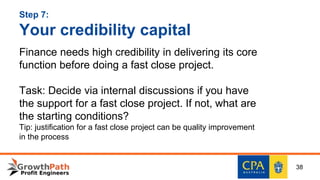

The document discusses the concept of 'fast close' in finance, outlining its importance for modern finance teams and emphasizing the need for process optimization, effective project management, and the reduction of inefficiencies. It details various steps to achieve a fast close, including defining the closing process, measuring performance, and recognizing the potential transformative benefits for finance teams. The presentation also addresses common challenges and encourages continuous improvement in financial processes.