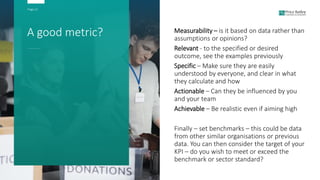

The document discusses how to improve financial reporting for charities, focusing on enhancing the pace of financial close downs, linking key performance indicators (KPIs) to strategic objectives, and emphasizing effective management reporting. It covers best practices for planning, communication, and responsibilities to ensure accuracy and timely financial insights, which support decision-making. The document also highlights the significance of selecting relevant metrics that align with a charity's strategic goals and the importance of having effective commentary to guide stakeholders.