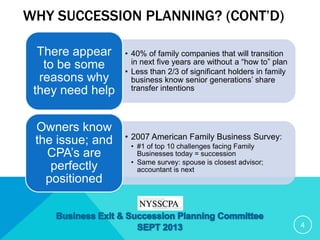

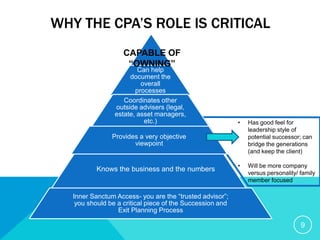

This document discusses succession planning, estate planning, and exit planning for business owners. It outlines the key differences between these processes. Succession planning focuses on transferring leadership from current to future management to ensure the ongoing viability of the company. Estate planning aims to transfer ownership from current to future shareholders. Exit planning involves determining the owner's plan to leave the business, usually transferring both ownership and management responsibilities. The document emphasizes that succession and exit planning are critical given statistics on family business survival rates and the fact that many owners lack formal plans. It provides overviews of the key steps in succession and exit planning processes to help owners successfully transfer their companies. The role of CPAs is highlighted as they are well-positioned to coordinate the