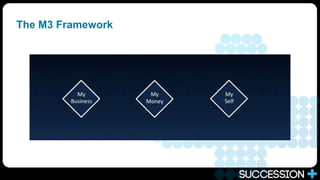

This document summarizes a succession masterclass presented by Craig West in February 2018. It provides biographies of Craig West and other presenters, Michael Vincent and Donald Poole. It then lists accredited advisers across Australia that work with Succession Plus. The document discusses trends in business succession planning and the psychology of succession. It introduces the M3 framework for succession, which considers the business, money, and self. It promotes Succession Plus' 21-step succession planning process and accredited adviser recruitment. The document concludes by listing upcoming adviser masterclass topics.