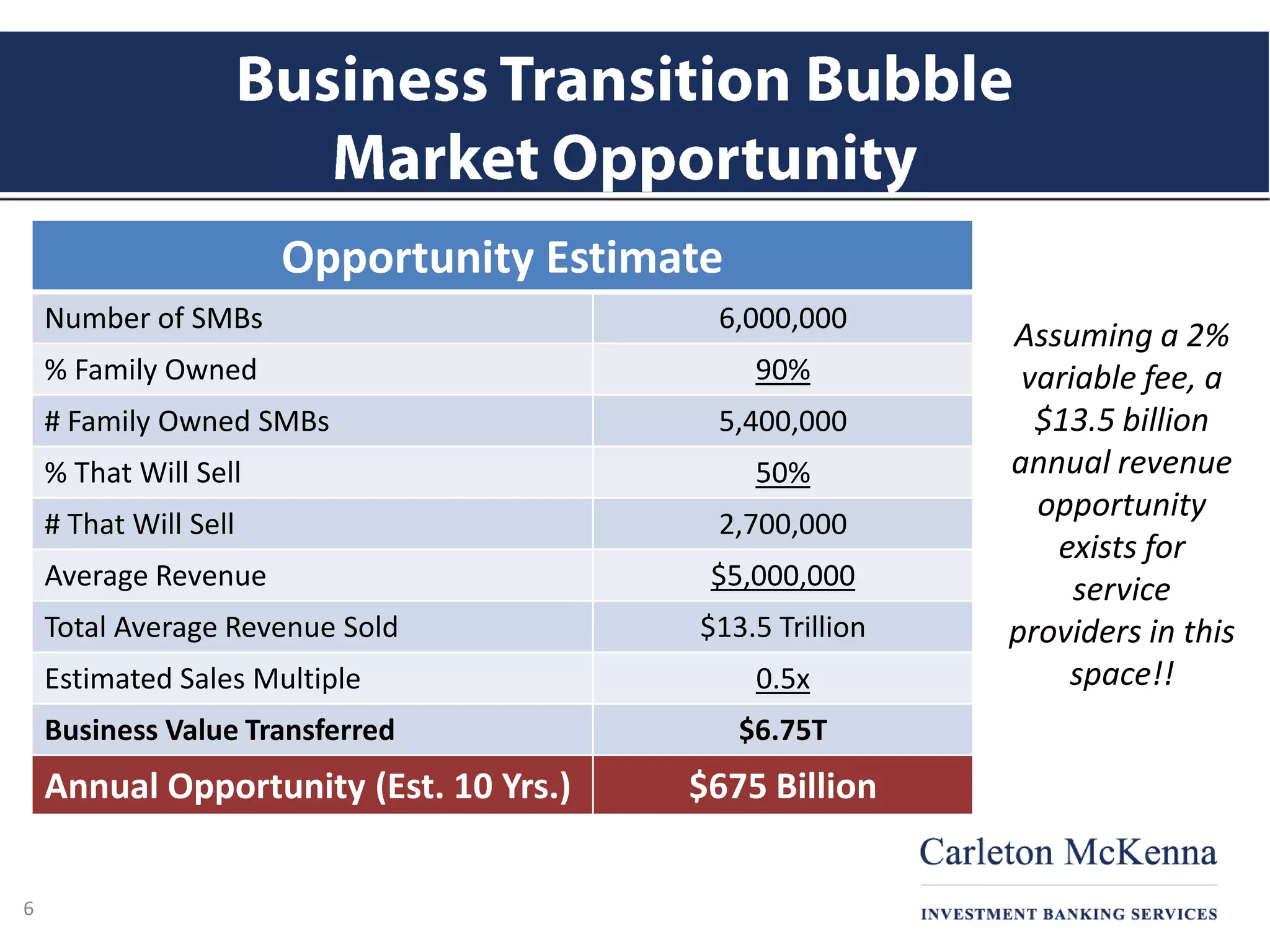

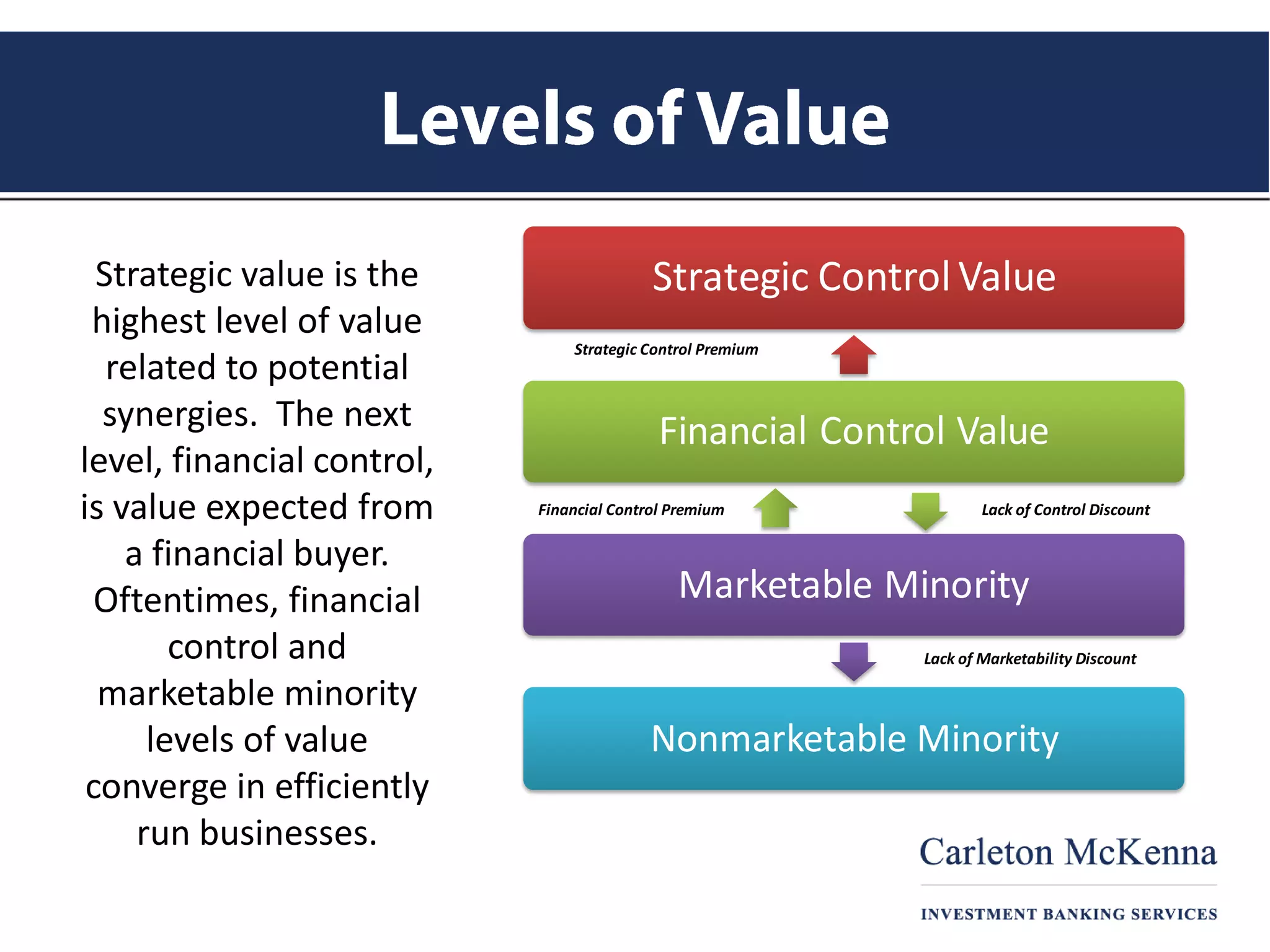

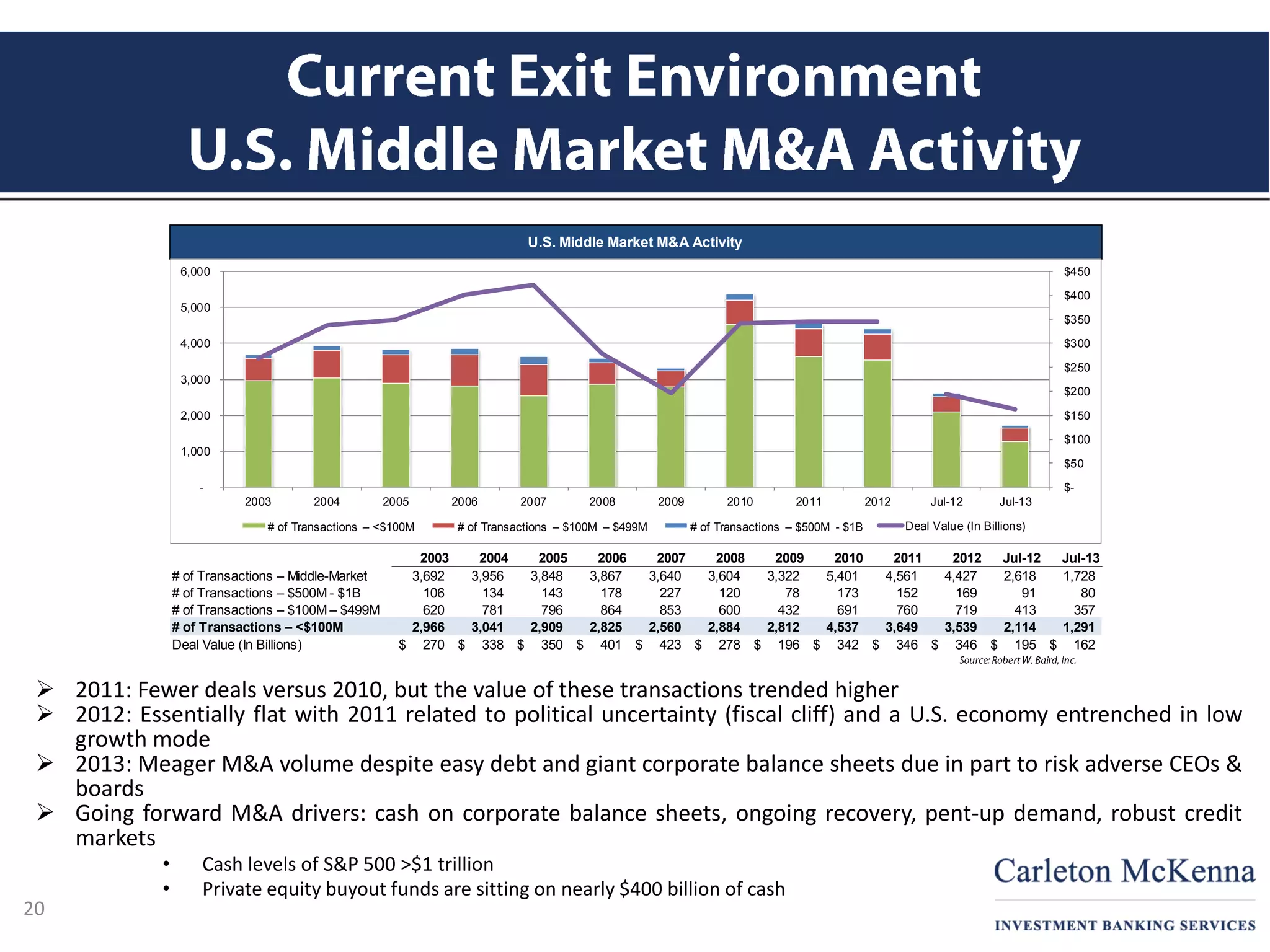

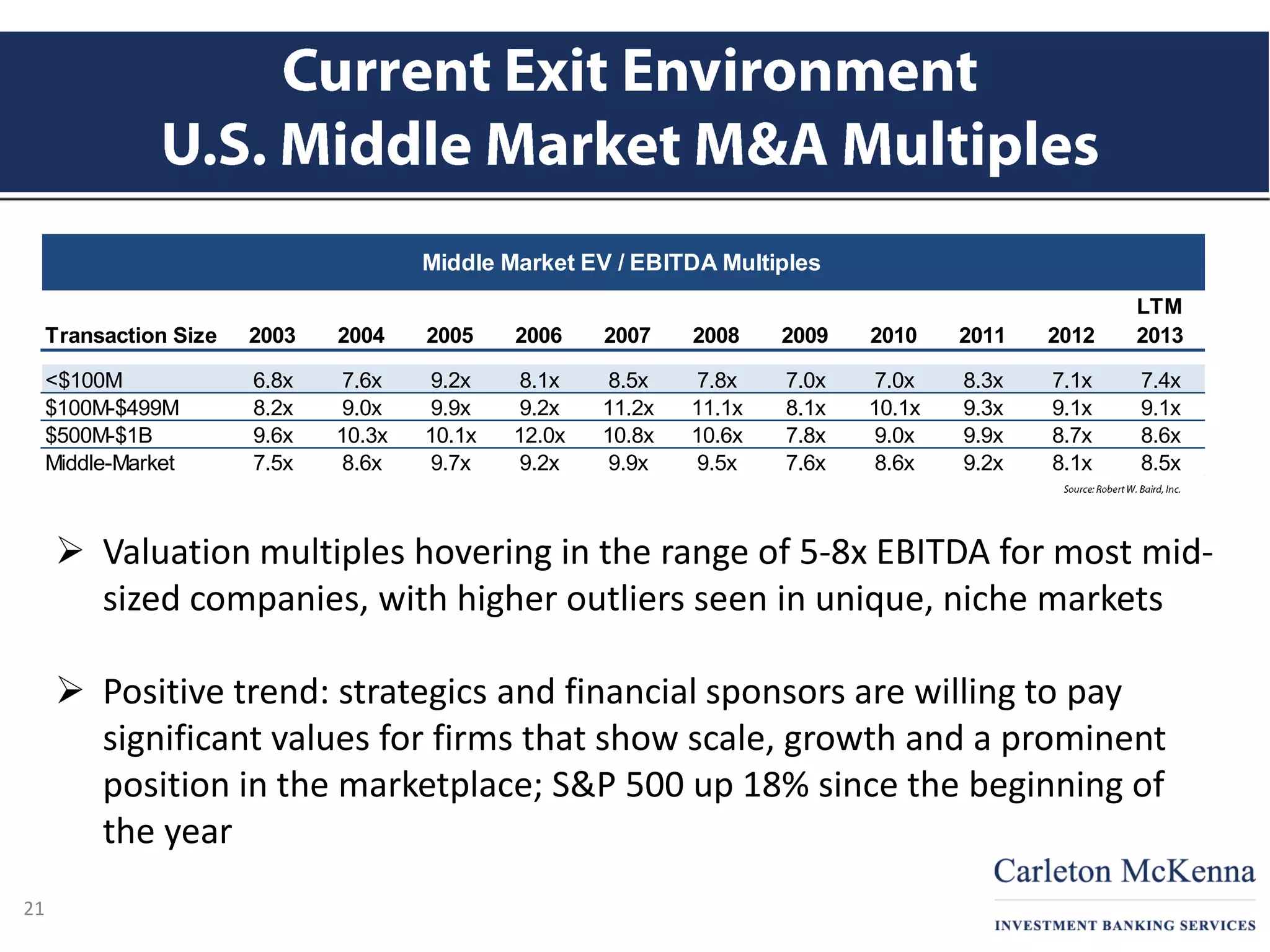

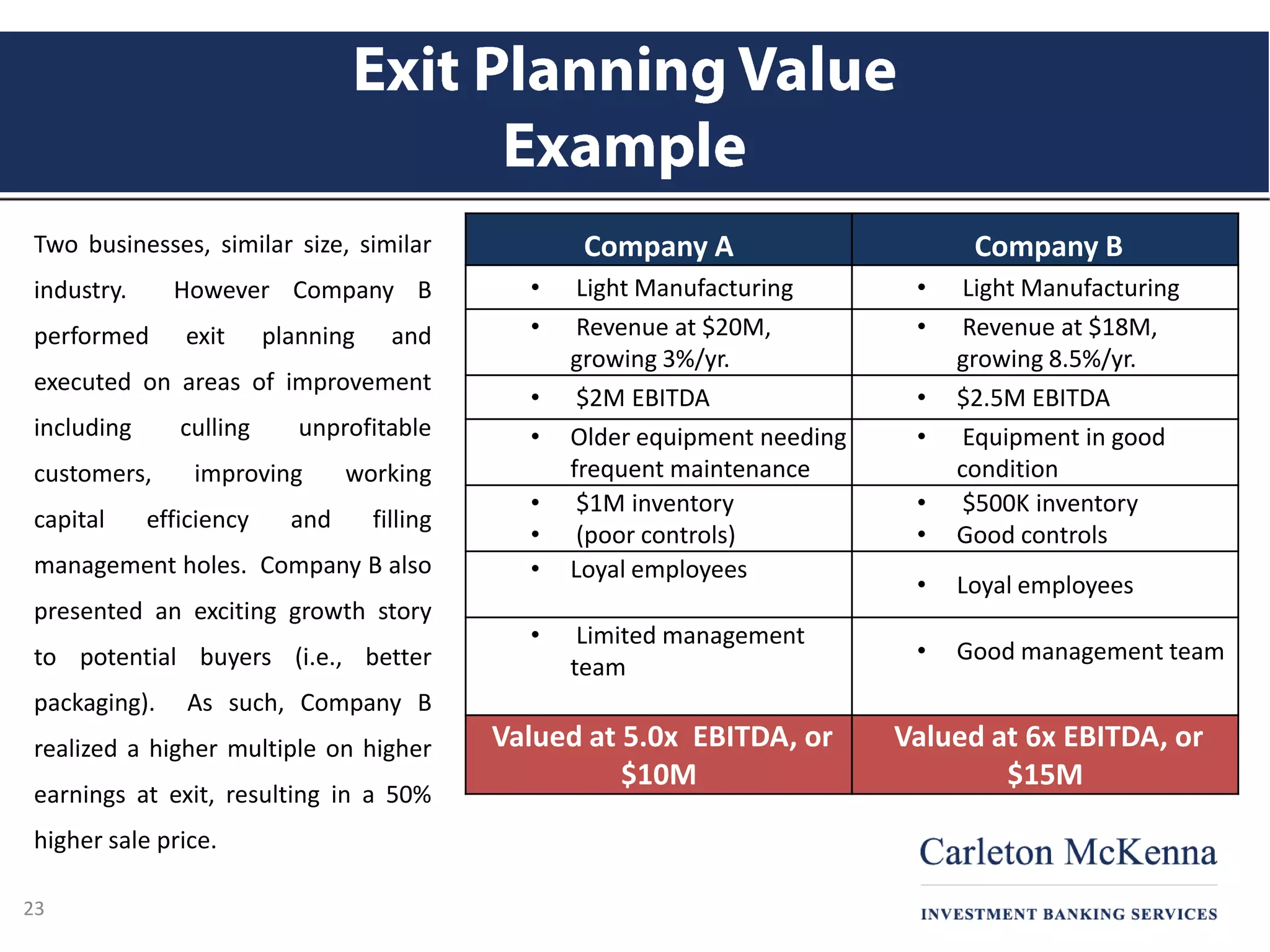

The document discusses the importance of business exit planning, particularly for small and medium-sized businesses owned by baby boomers who are nearing retirement. It highlights the need for a robust exit plan, the role of professional service firms, and outlines the potential market opportunity as many business owners prepare to sell within the next decade. Key components include understanding the business's value, succession planning, and assembling a team of experts to maximize sale outcomes.