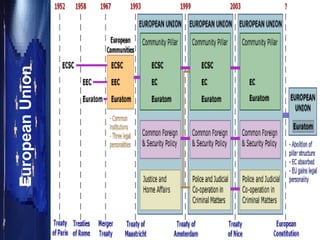

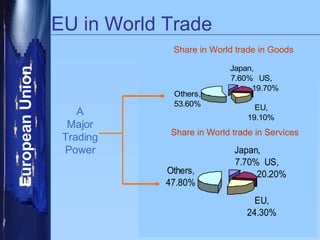

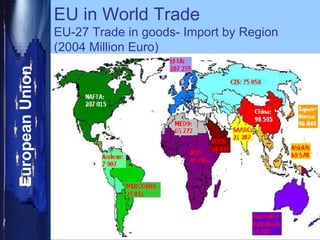

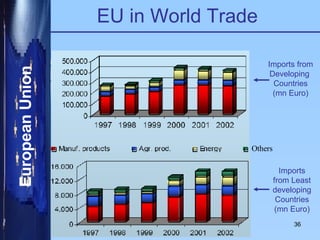

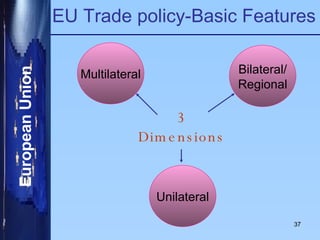

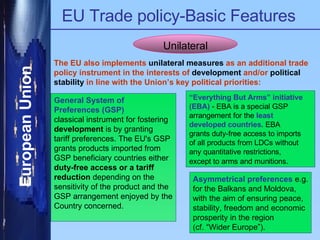

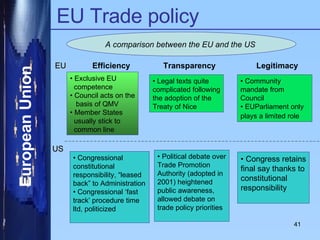

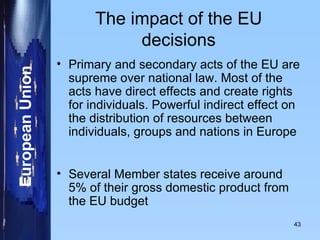

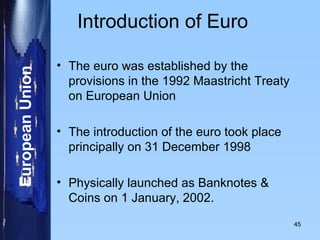

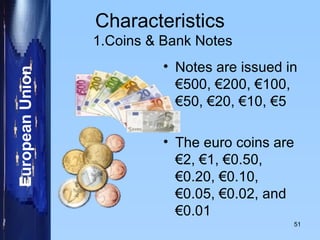

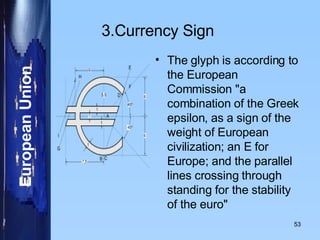

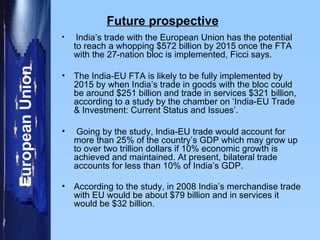

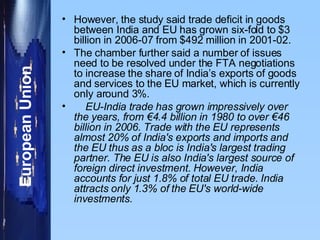

The document provides an overview of the history, structure, and policies of the European Union (EU). It discusses the origins and evolution of the EU from the 1950s agreements that formed the European Coal and Steel Community. It describes the main EU institutions like the European Parliament, Council of the EU, European Commission, and courts. It also summarizes some of the EU's key policies and initiatives like the Euro currency, trade relations, and current issues around enlargement.