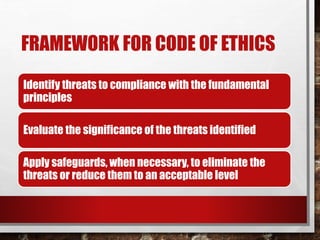

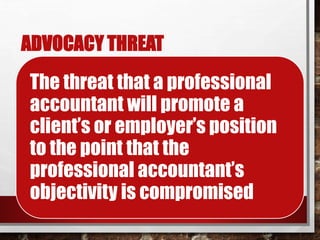

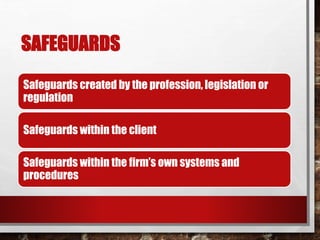

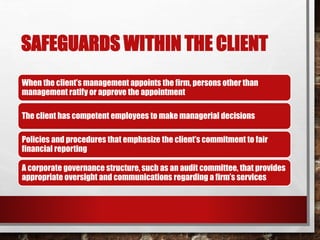

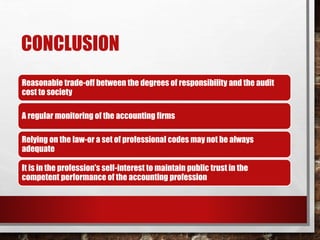

Accounting provides financial information and underpins fiscal systems. Accountants work individually, for firms, and in professional bodies. They perform audits, tax work, advisory services, and management roles. Several accounting scandals occurred due to falsified reports. Ethics are moral principles and values that laws incorporate. Professionals are expected to adhere to high ethical standards. Regulators set auditing standards and codes of ethics to ensure threats like self-interest, bias, or intimidation do not compromise an accountant's independence or objectivity. Safeguards like oversight, training and reviews aim to protect the public interest.