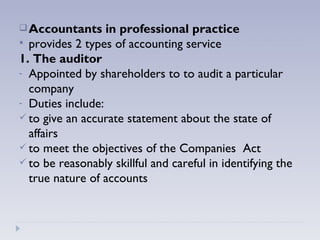

This document discusses ethical issues in accounting and finance. It outlines five ways that fraud can occur in financial statements, such as through fictitious revenue or concealed liabilities. It describes the roles of different types of accountants, including those employed by organizations and those in professional practice. The document also discusses the purpose of an ethical audit in assessing a business's compliance with standards and identifying necessary changes or training.