The document is an investigation report by an independent committee investigating accounting issues at Toshiba Corporation. It finds inappropriate accounting treatments that overstated profits across multiple business divisions, including power systems, semiconductors, PCs, and visual products. Key causes identified include strong pressure from top management to meet budgets and priorities of near-term profit over proper accounting. The report provides recommendations to reform governance, strengthen internal controls, and prevent recurrence.

![[Tentative Translation]

Investigation Report

Summary Version

20 July 2015

Independent Investigation Committee

For Toshiba Corporation

TRANSLATION FOR REFERENCE PURPOSE ONLY

This document is an English language translation of a document originally prepared in the

Japanese language and is prepared for reference purpose only. If there is any discrepancy

between the content of this translation and the content of the original Japanese document, the

content of the original Japanese document will prevail.](https://image.slidesharecdn.com/201507251-150728235614-lva1-app6891/75/Toshiba-Investigation-Report-Summary-1-2048.jpg)

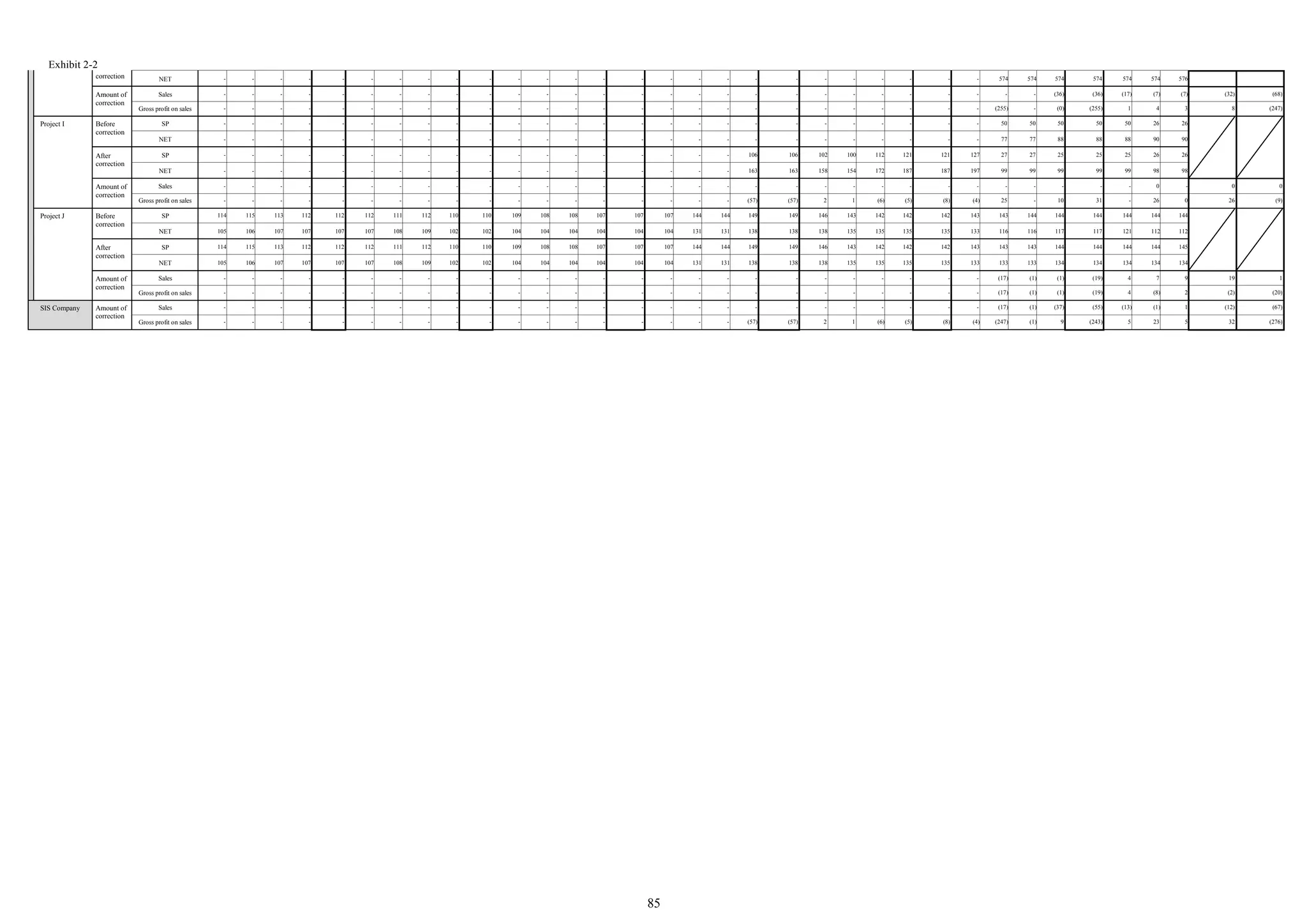

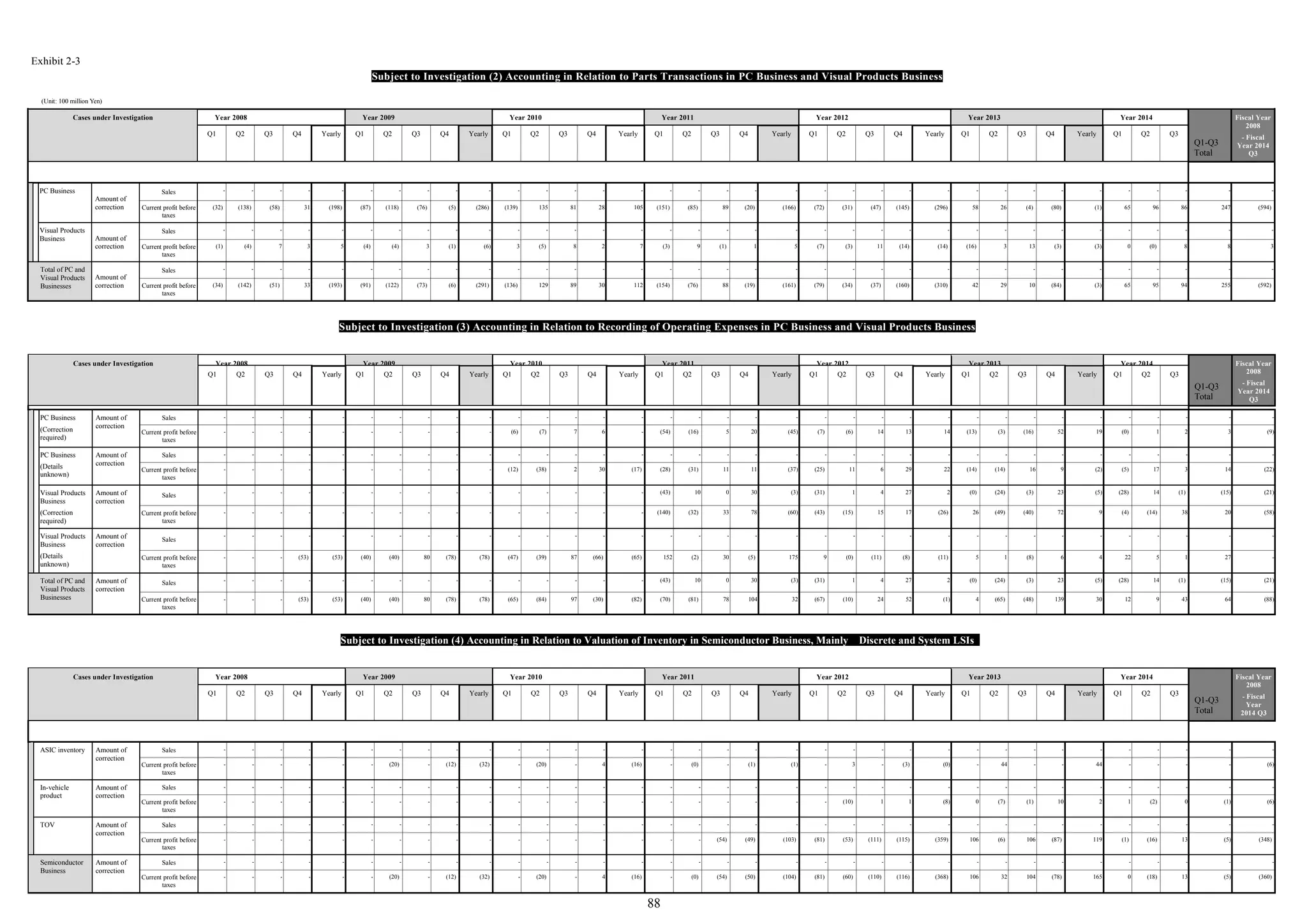

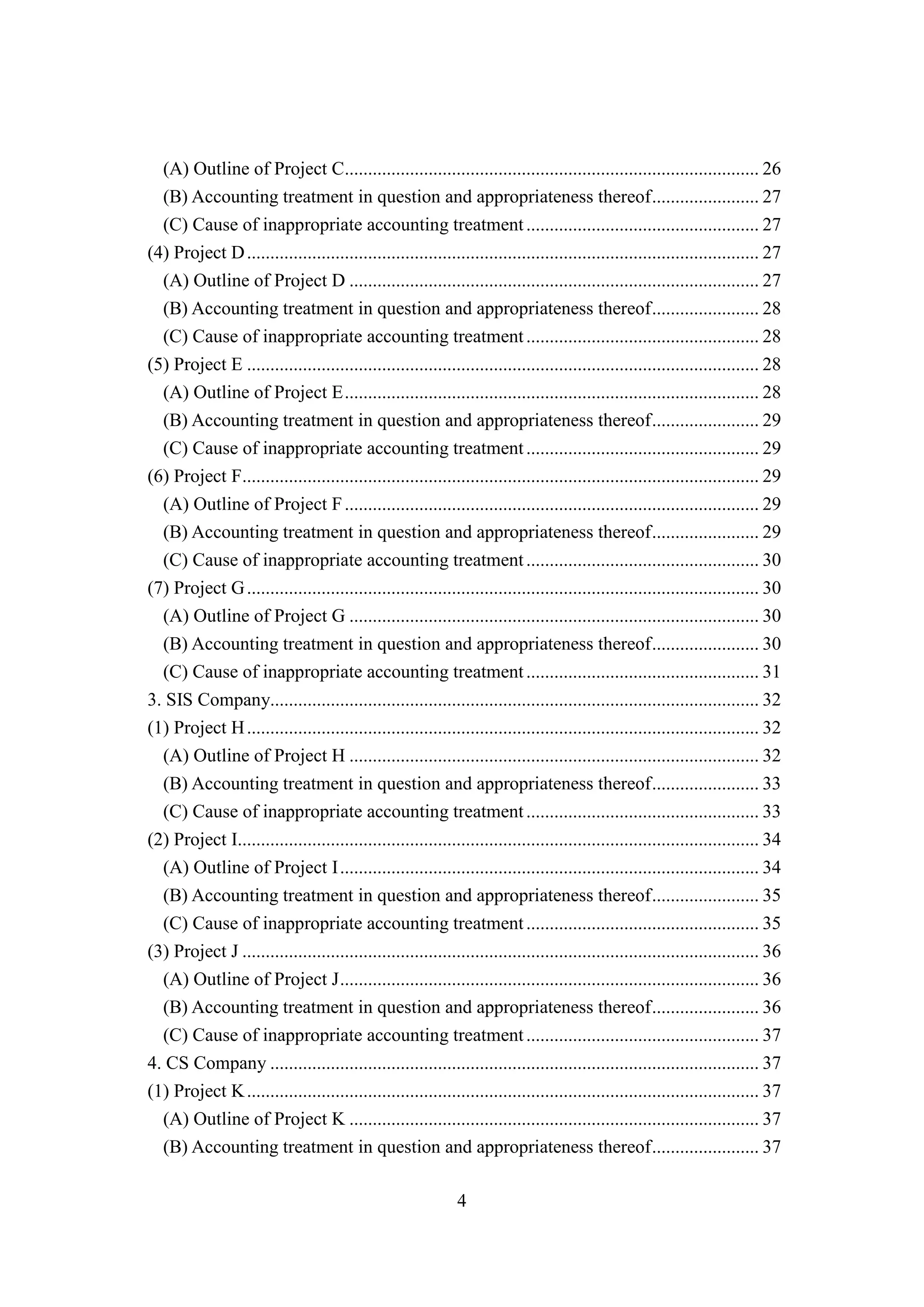

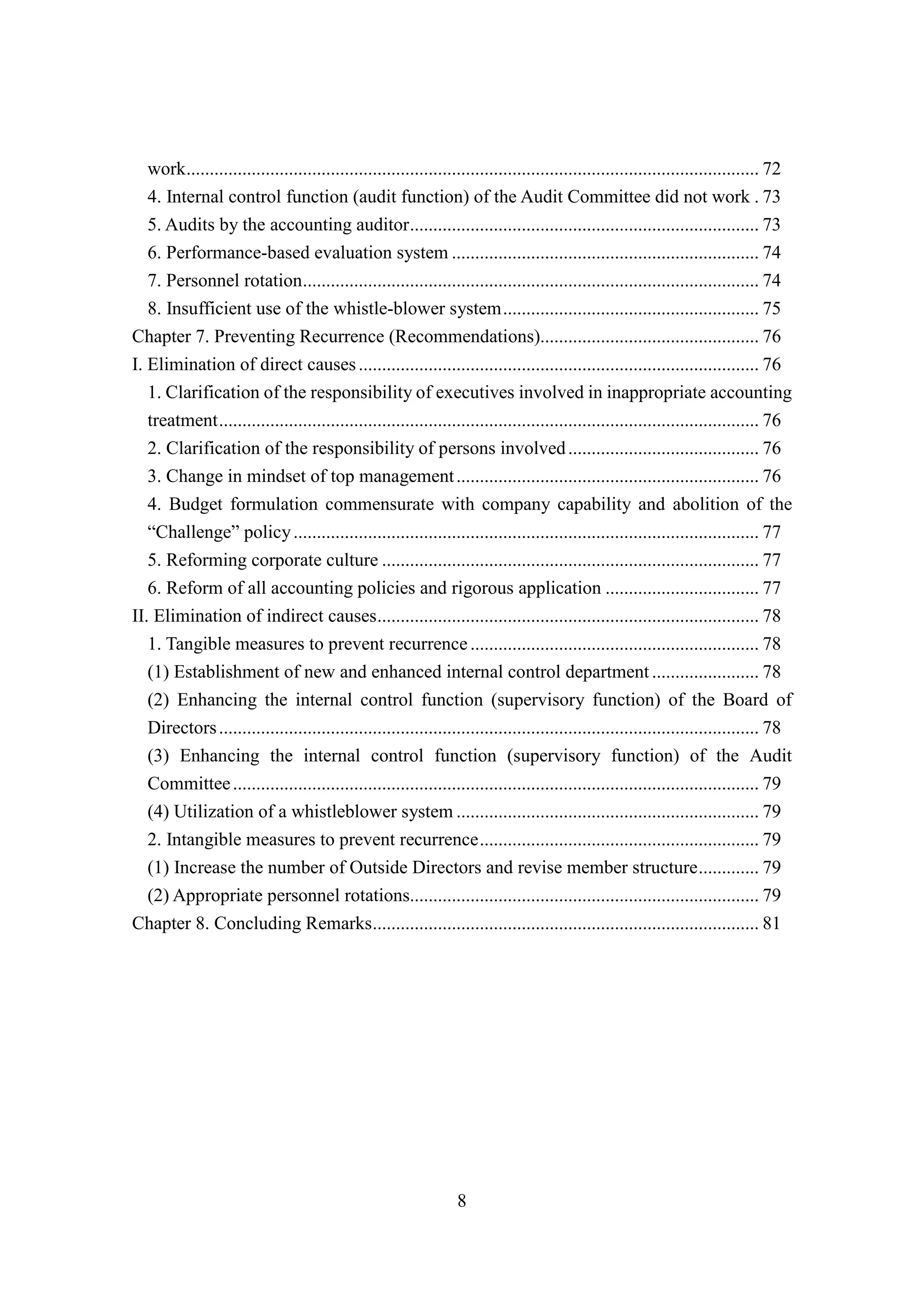

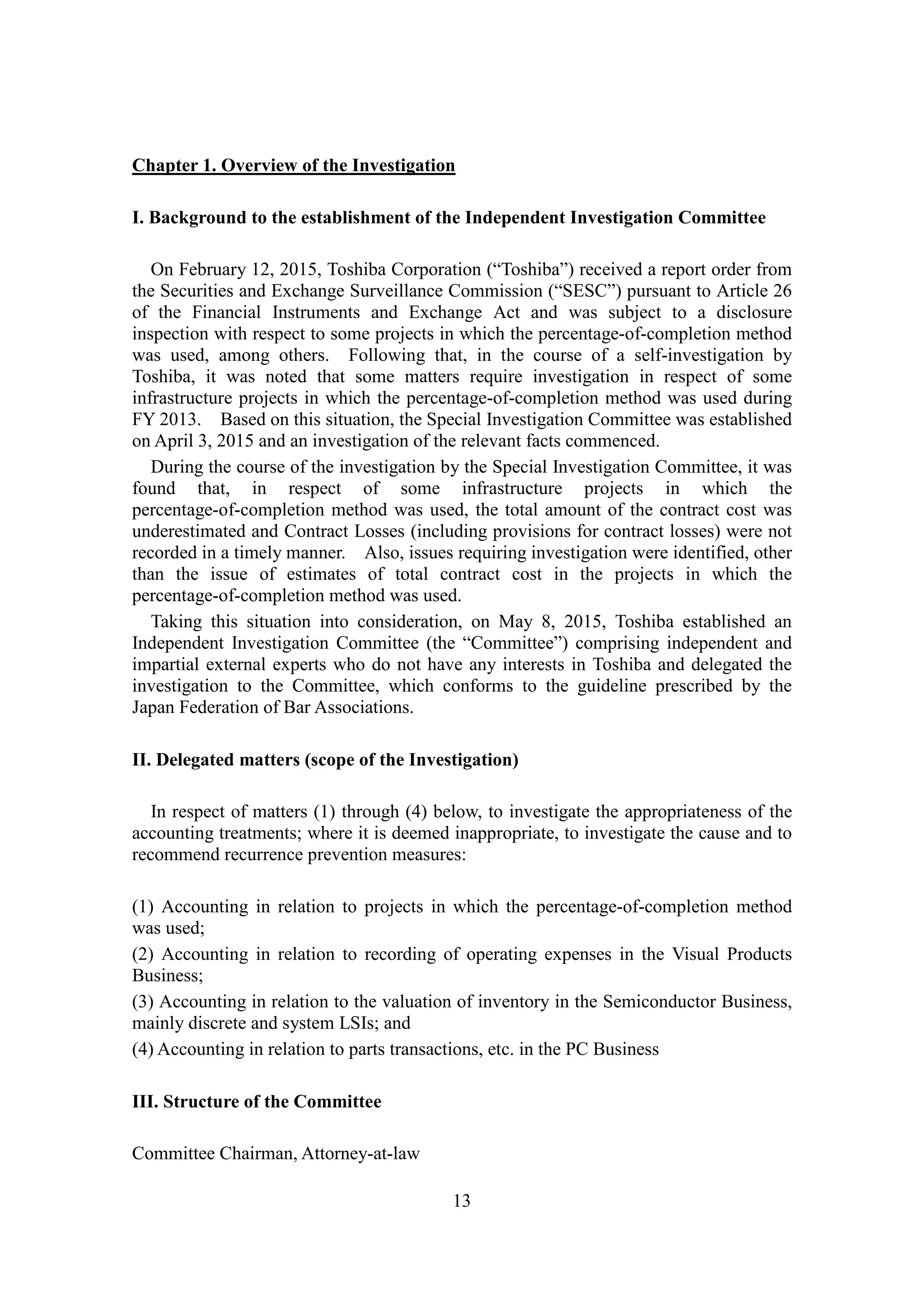

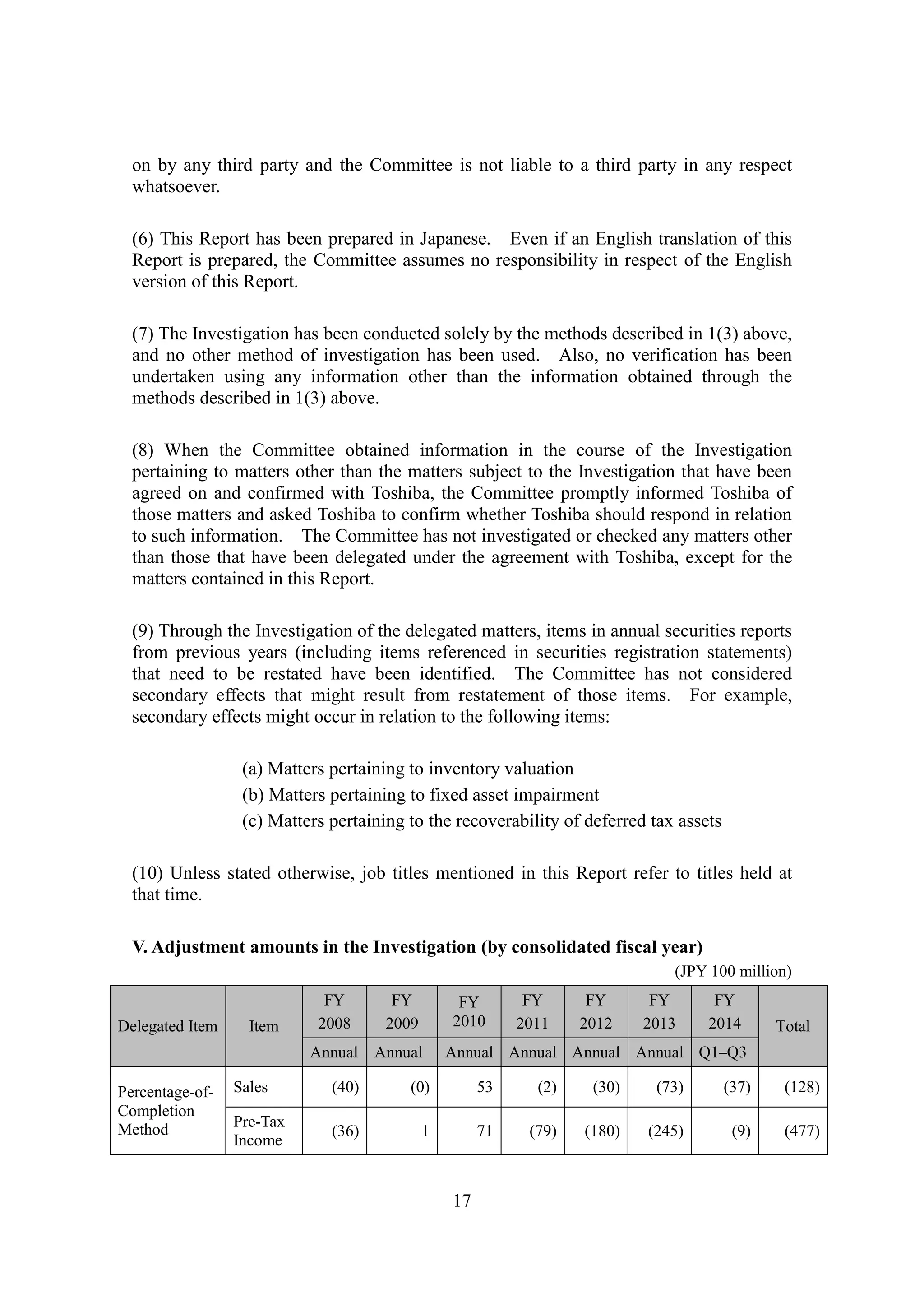

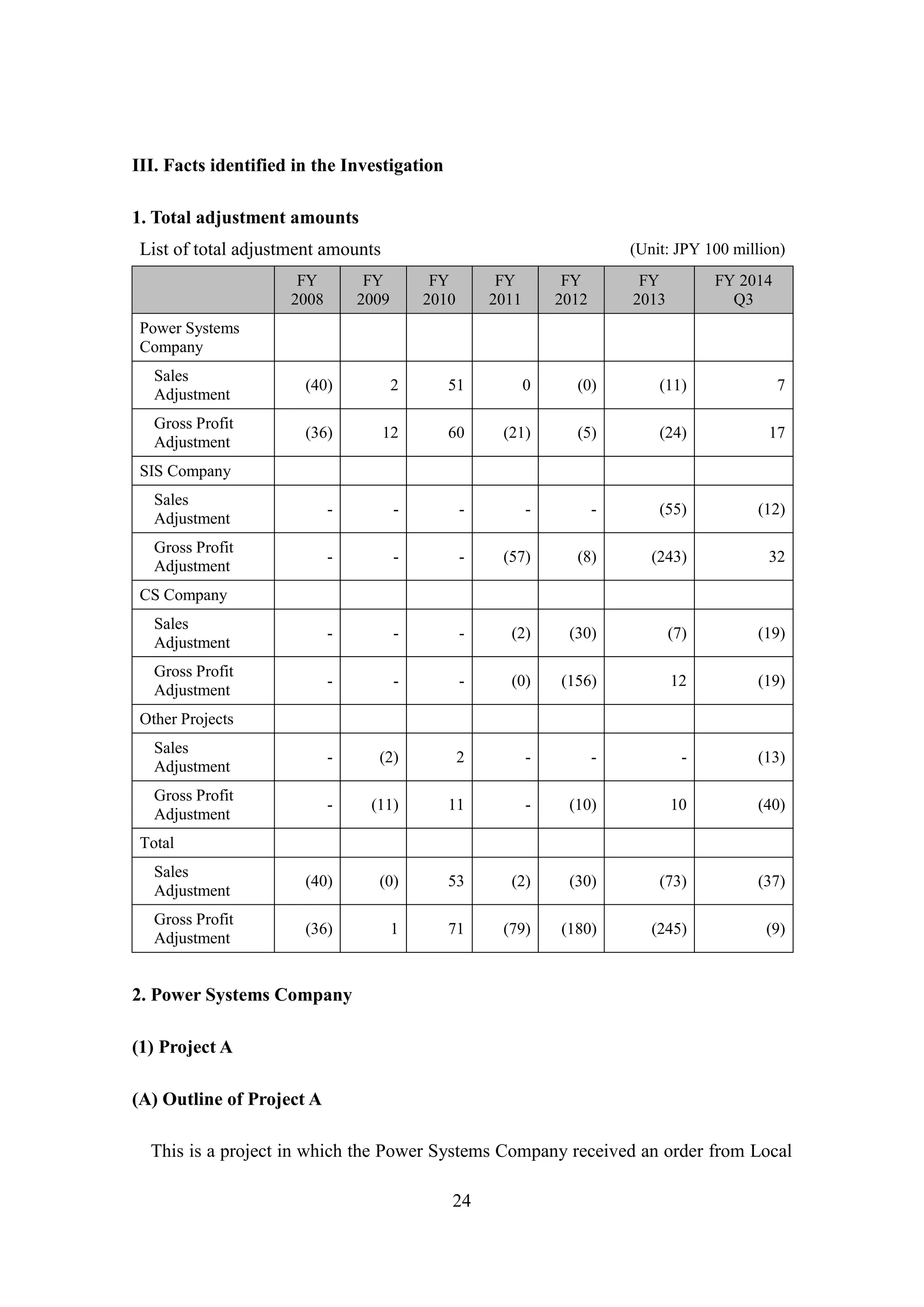

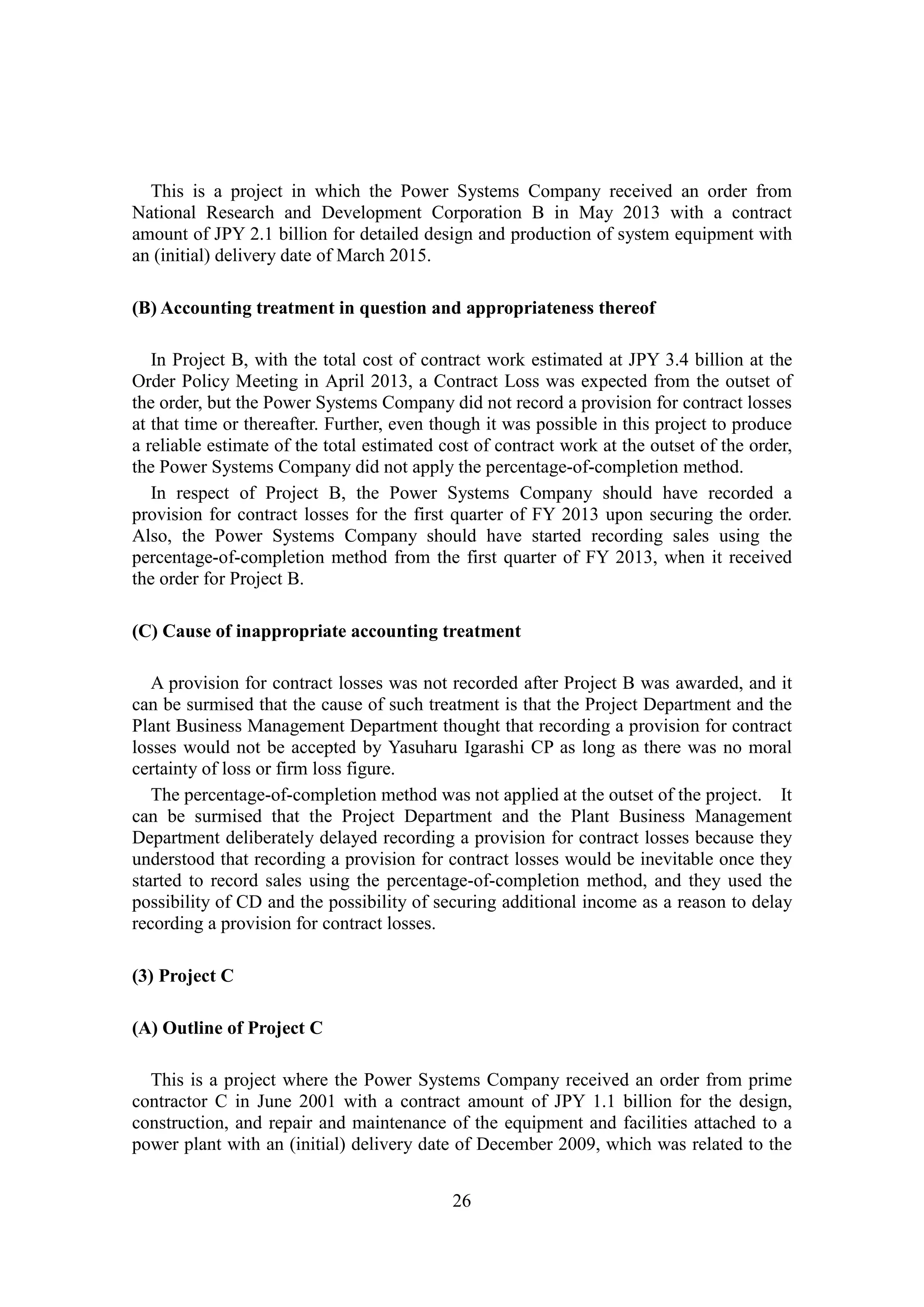

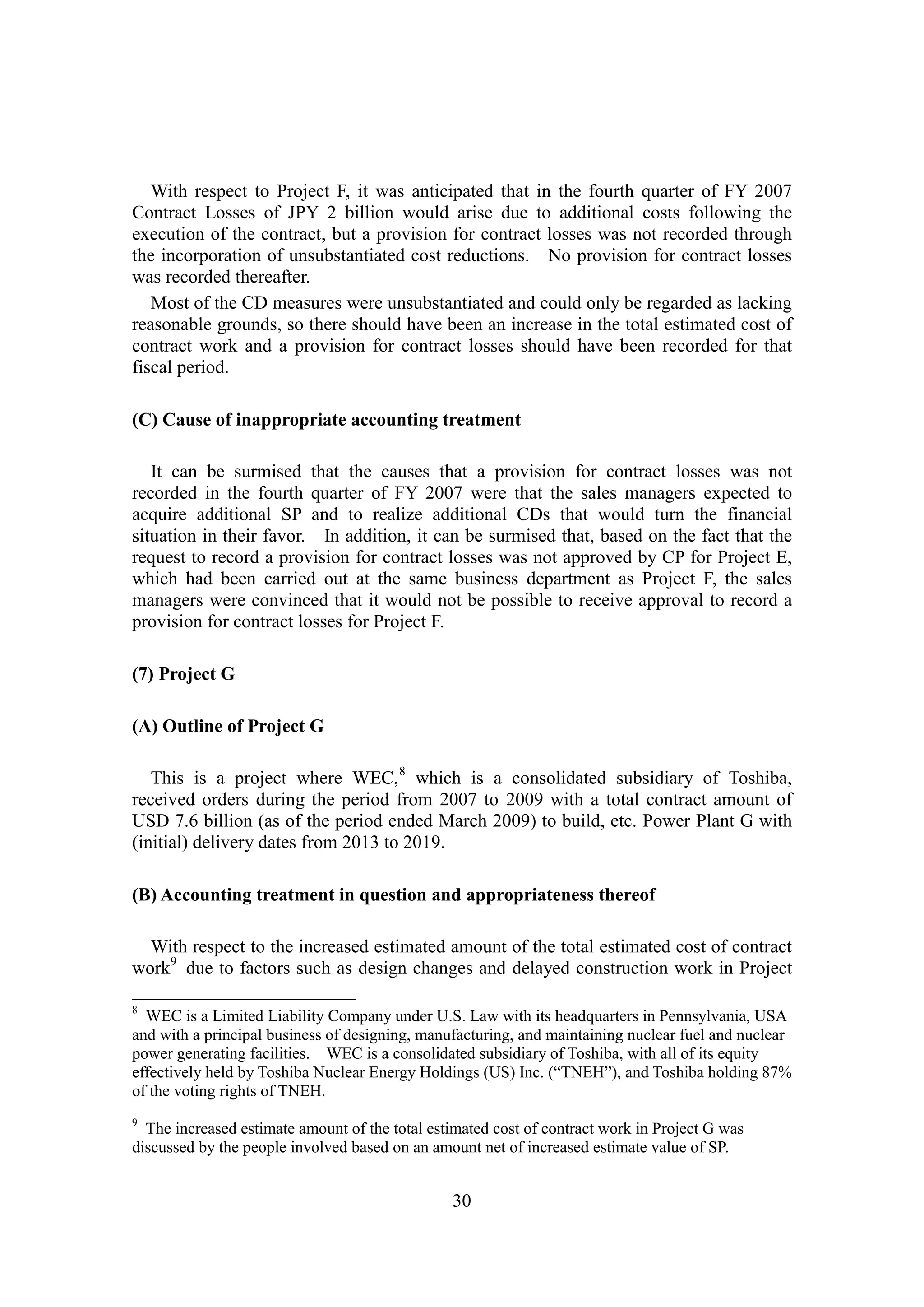

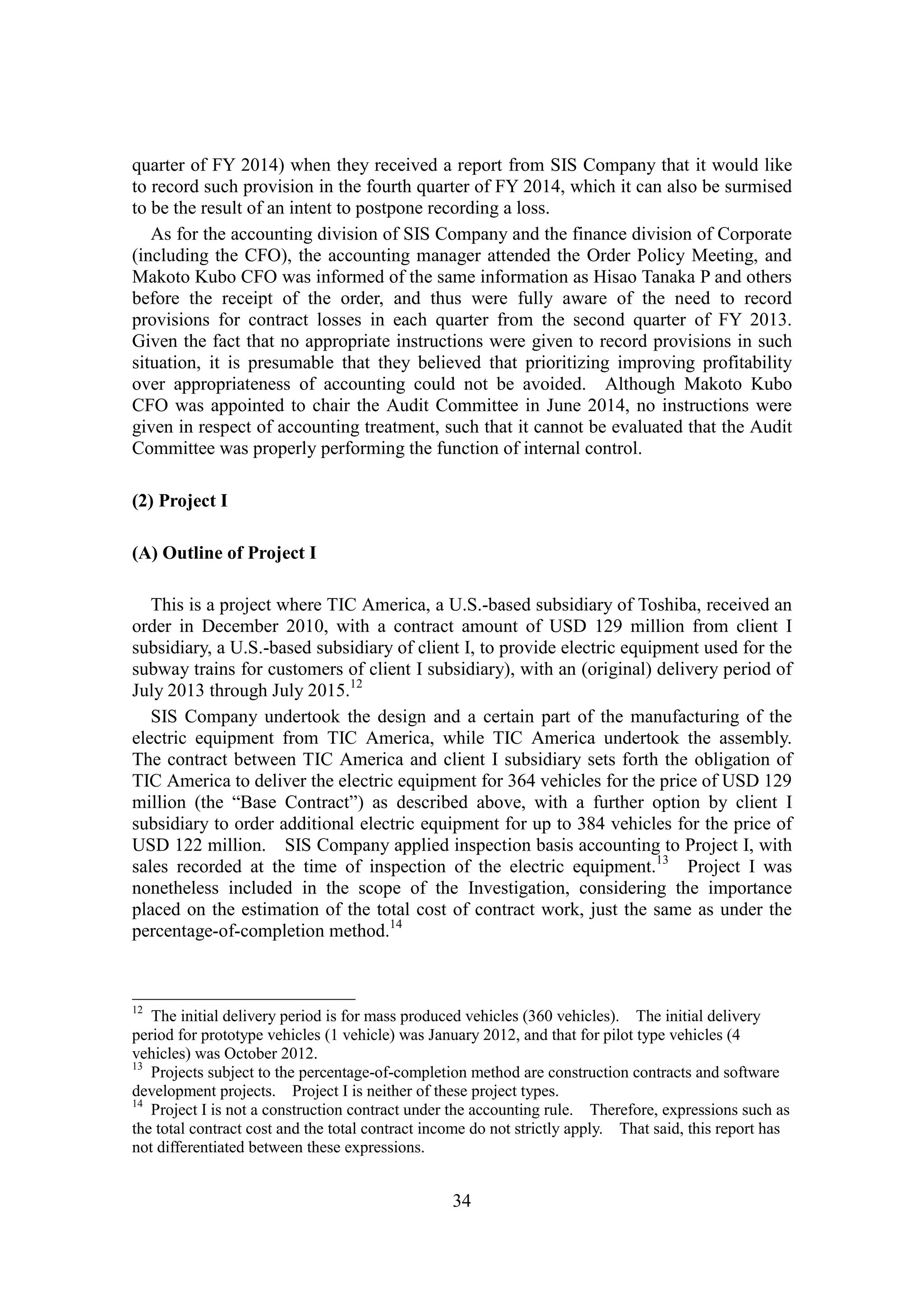

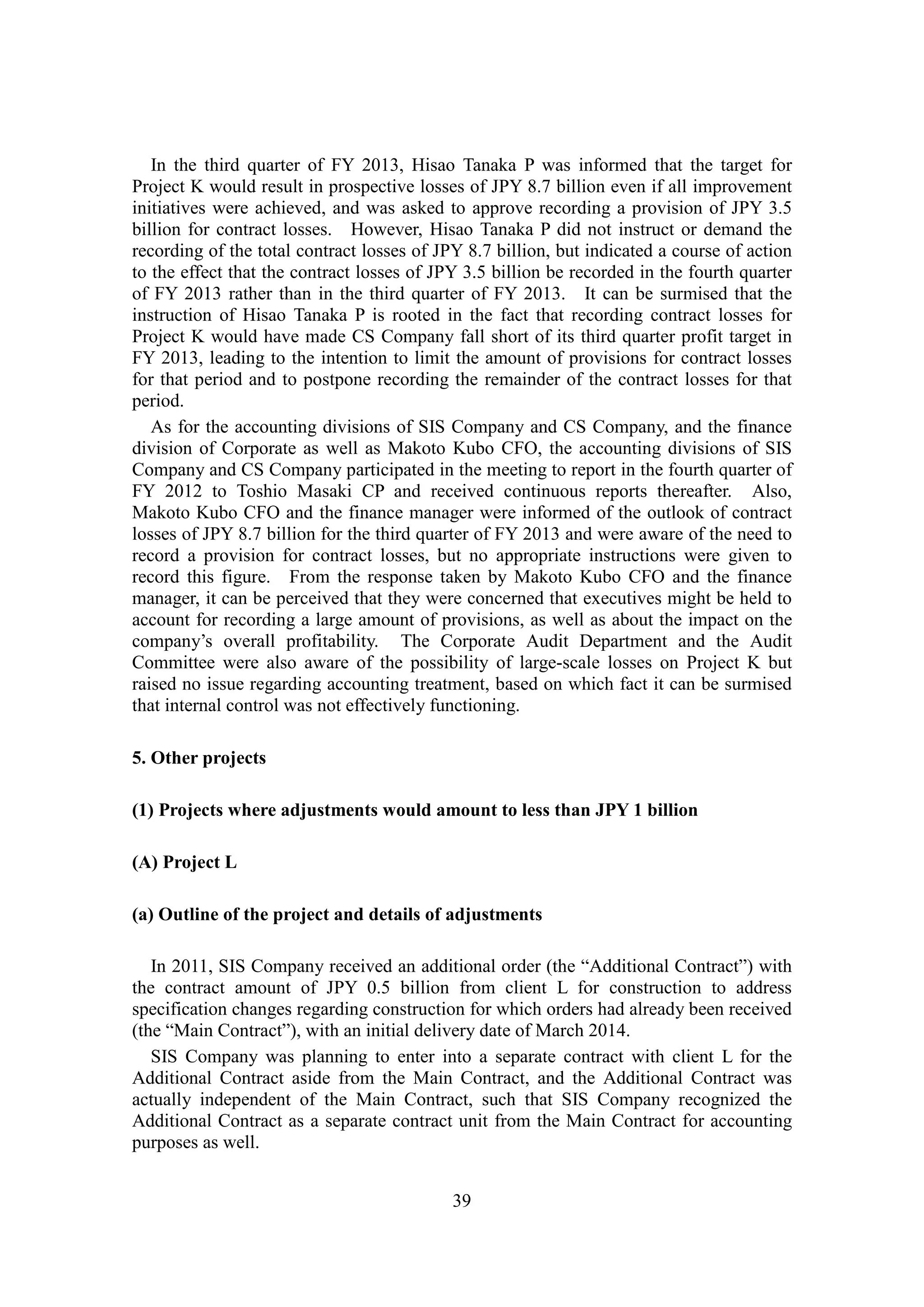

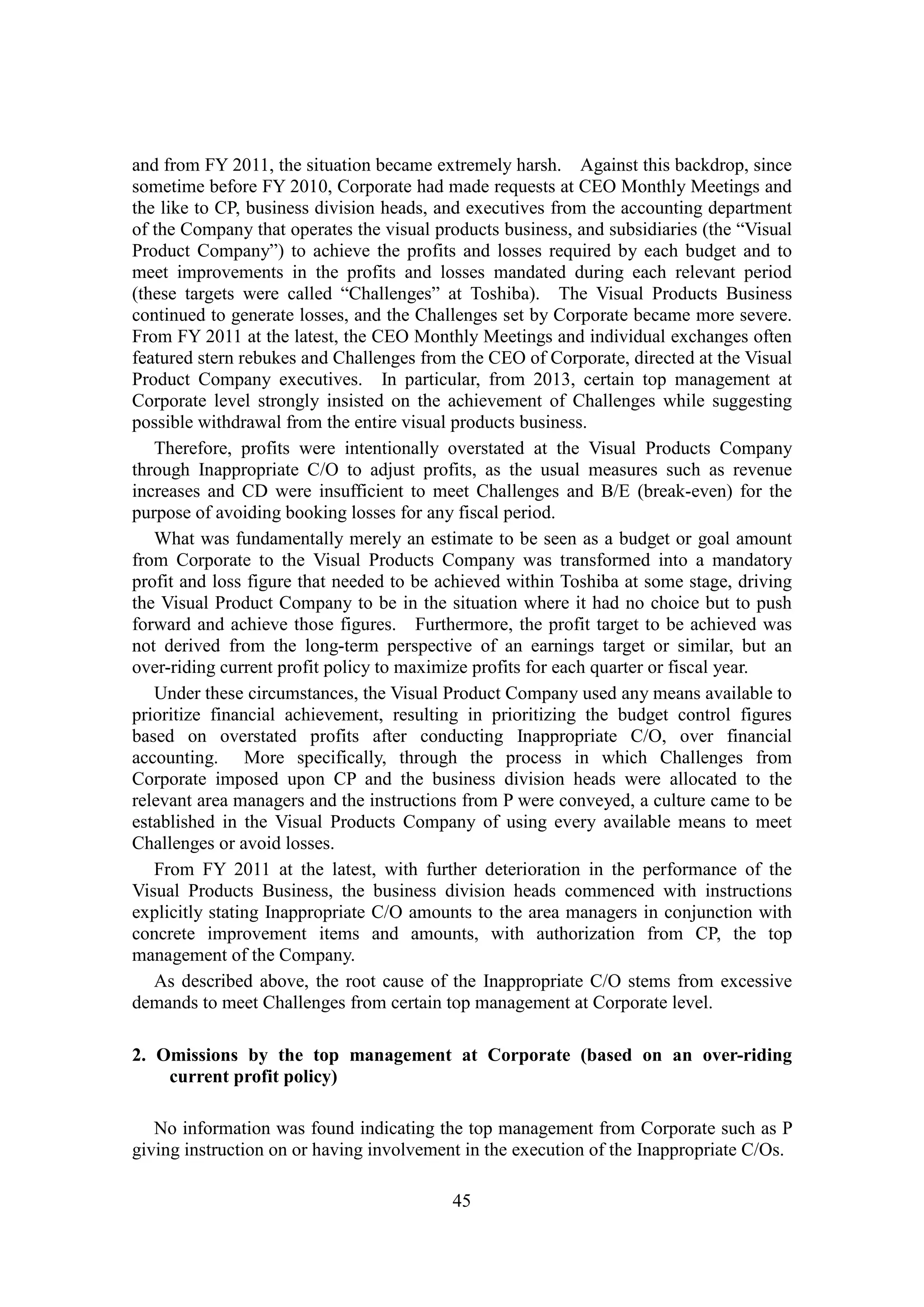

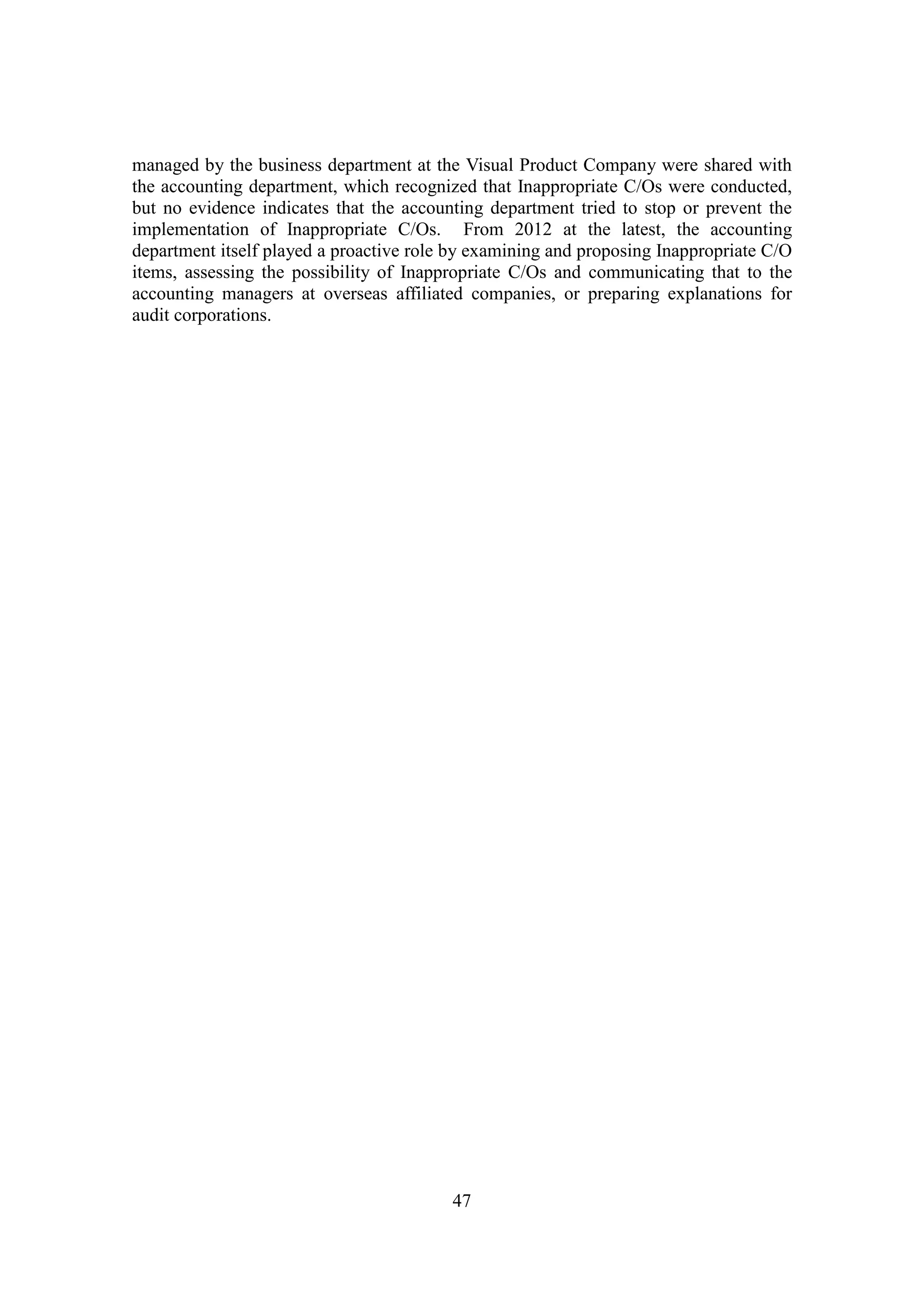

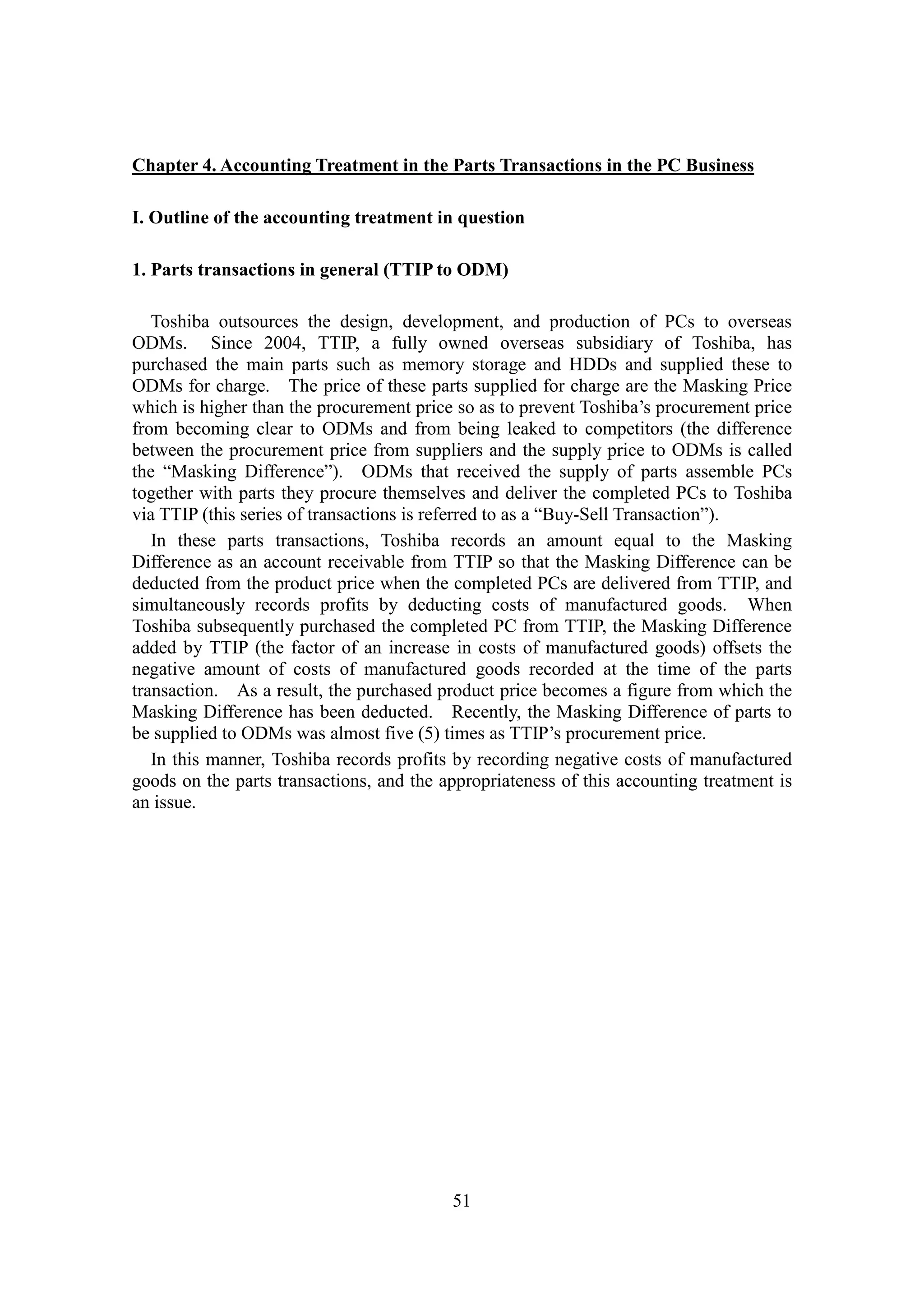

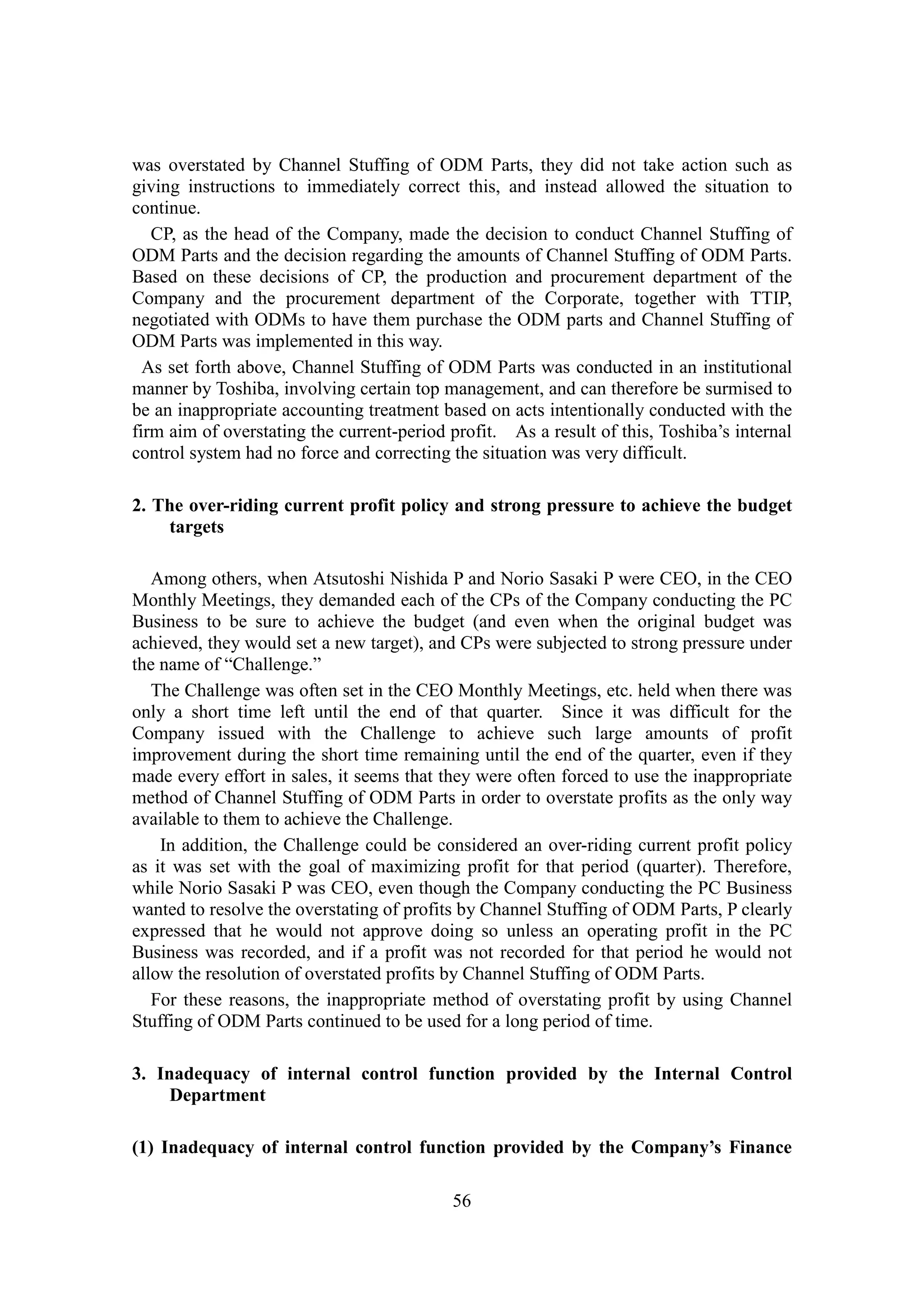

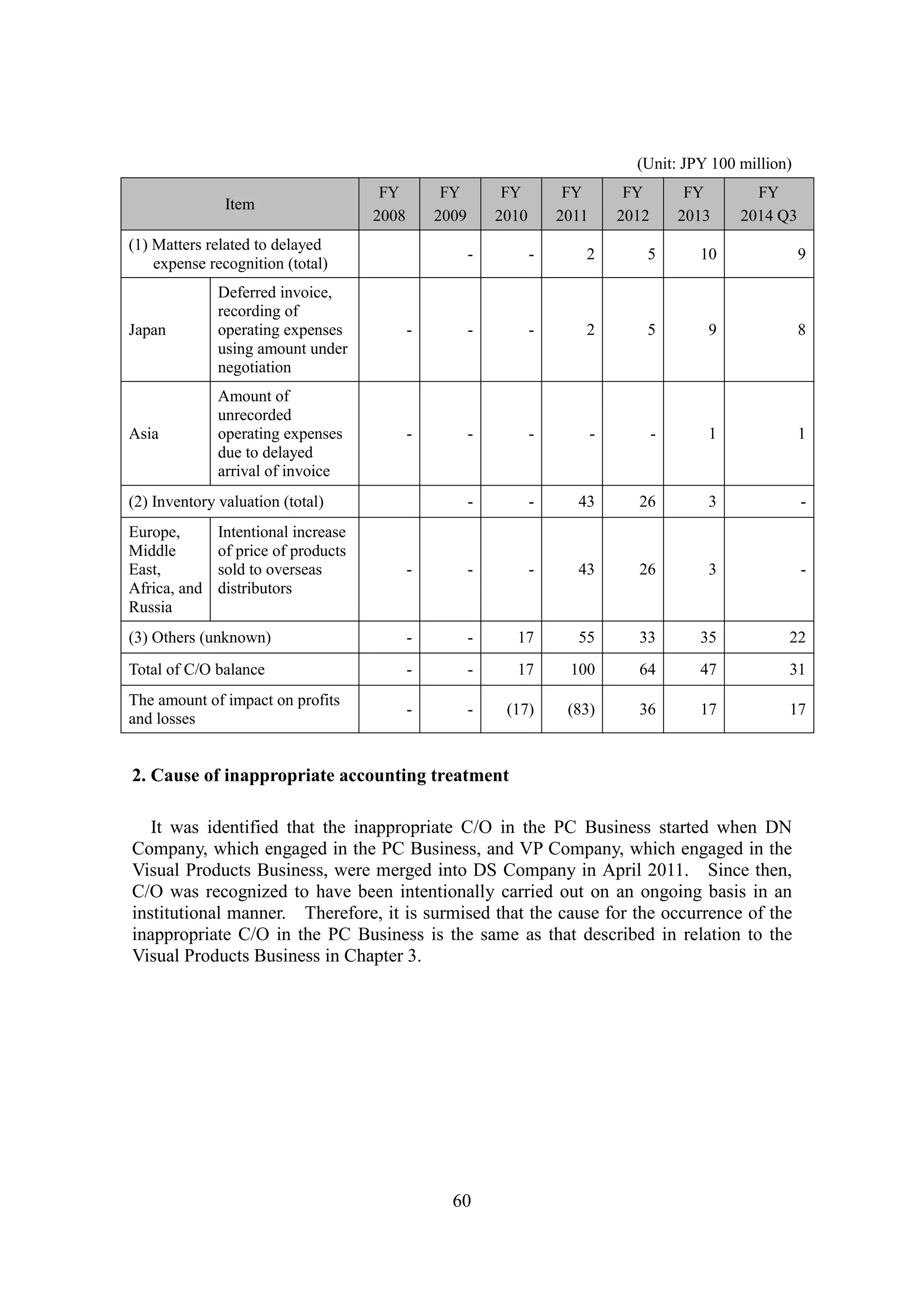

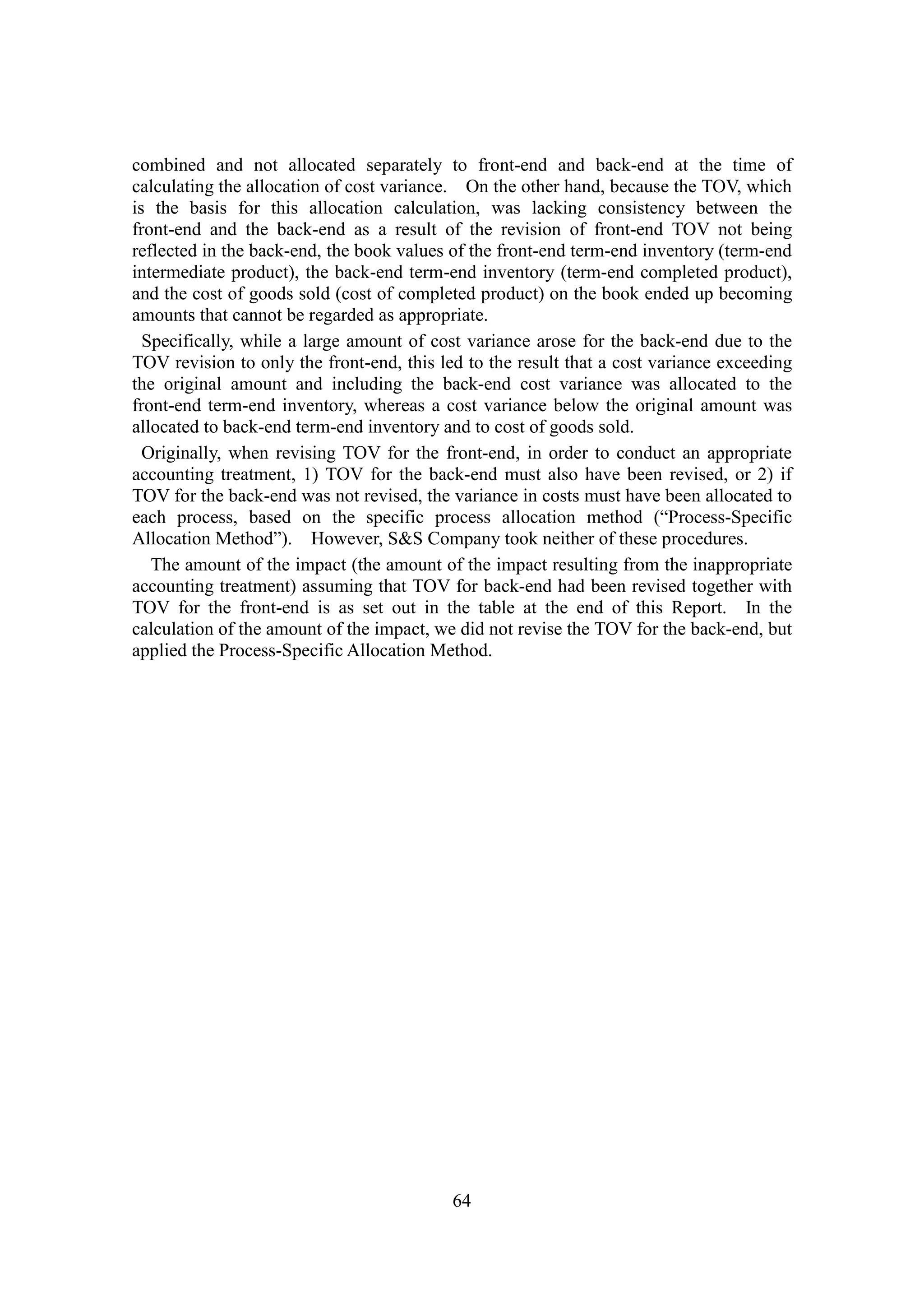

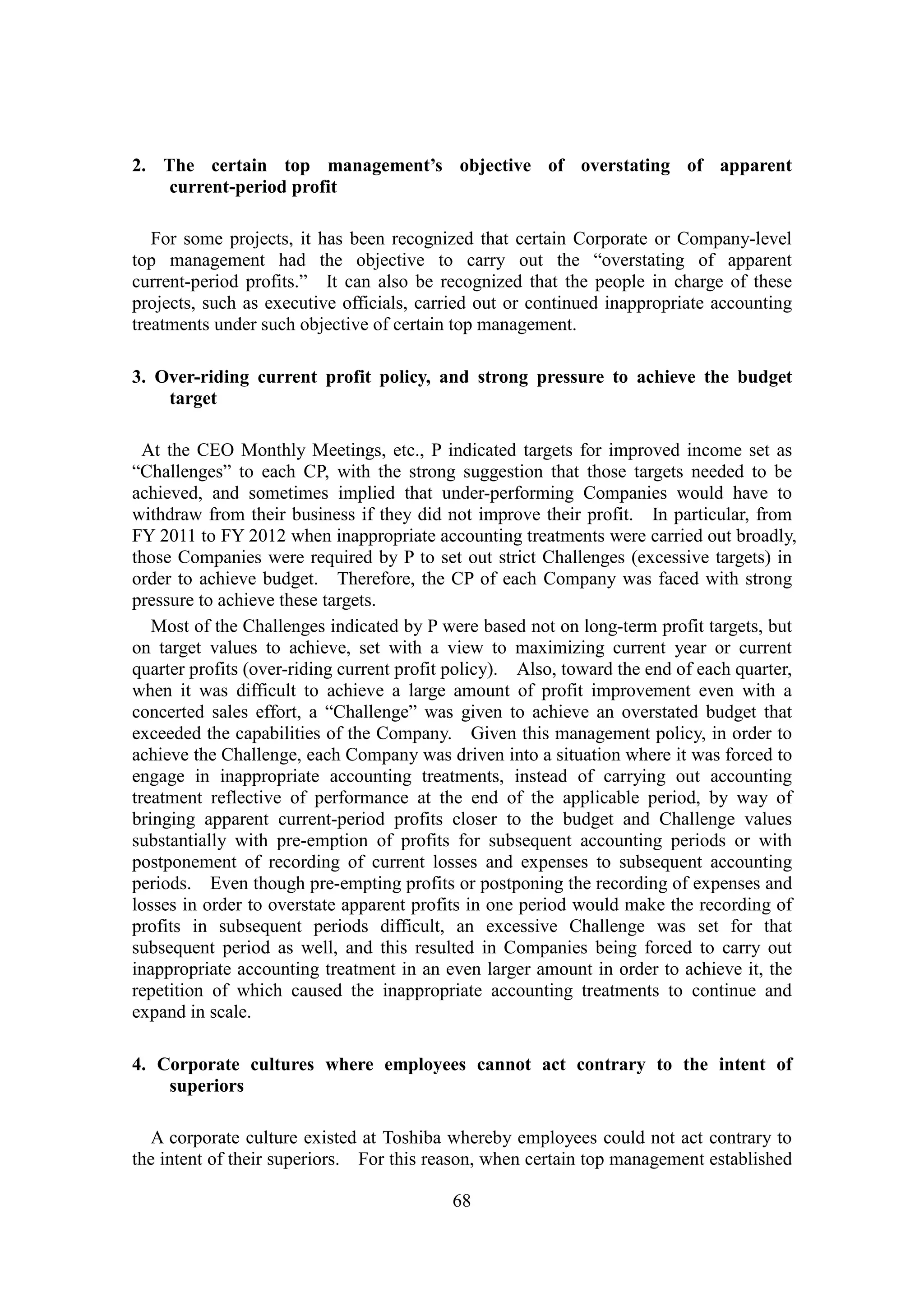

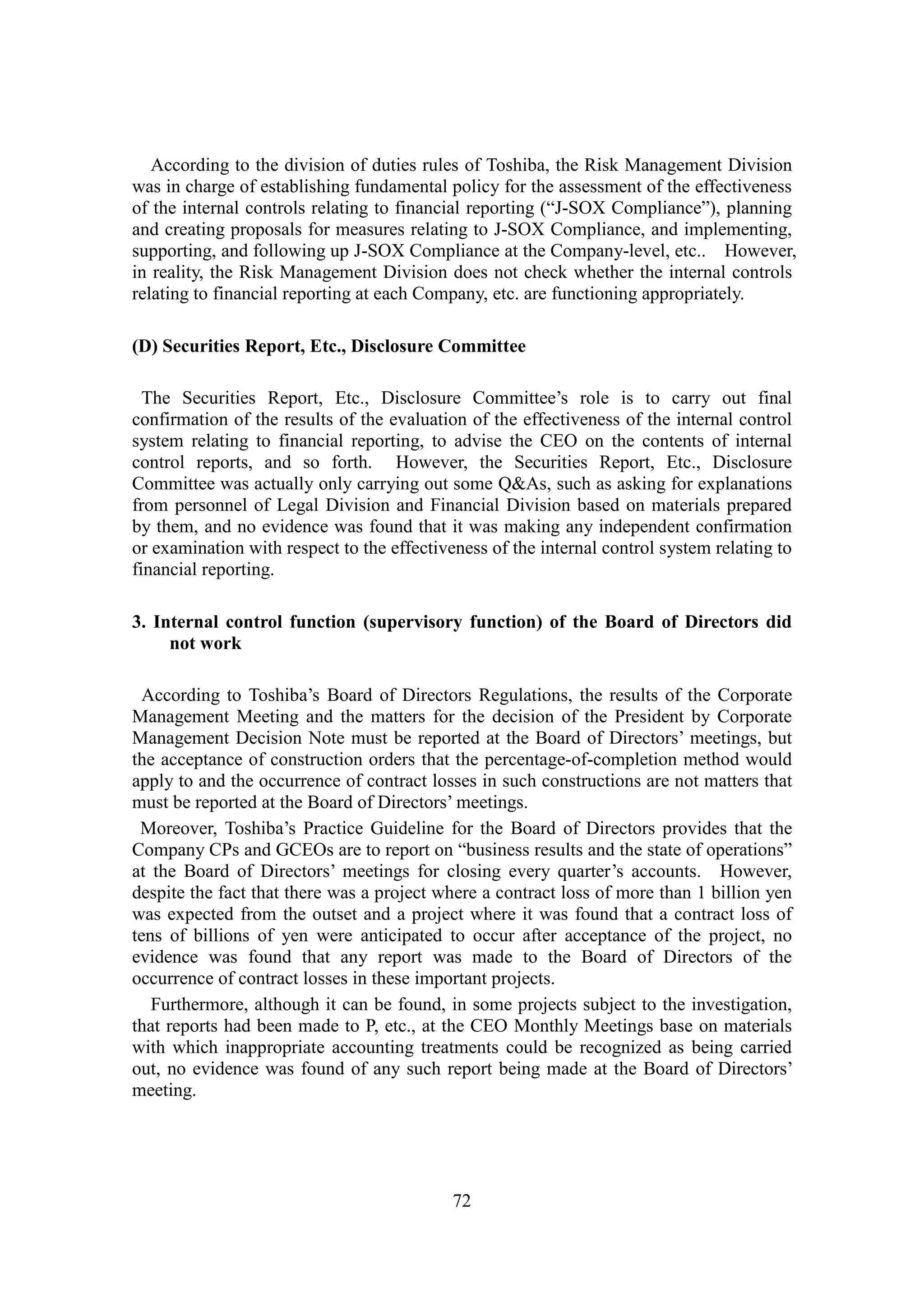

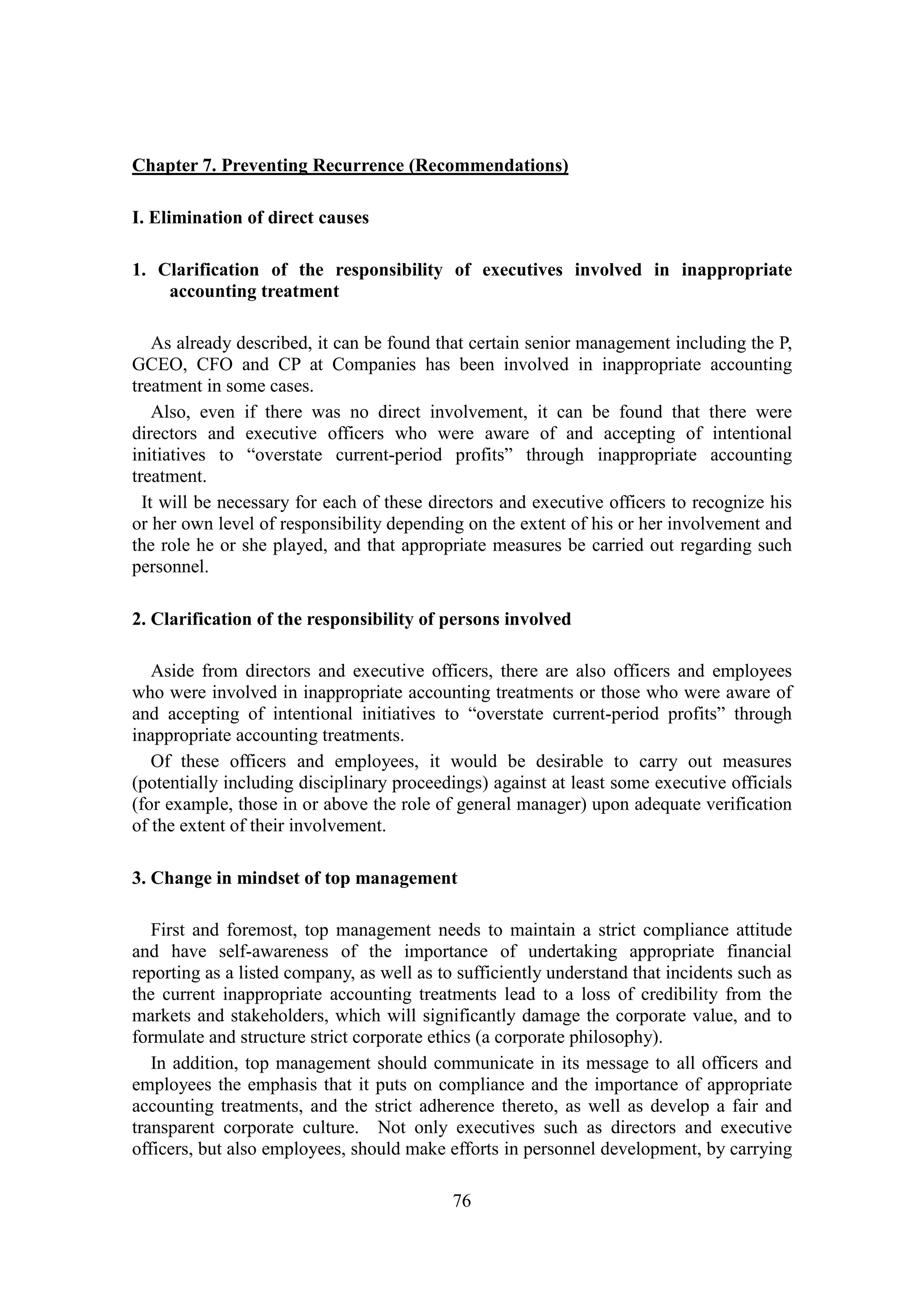

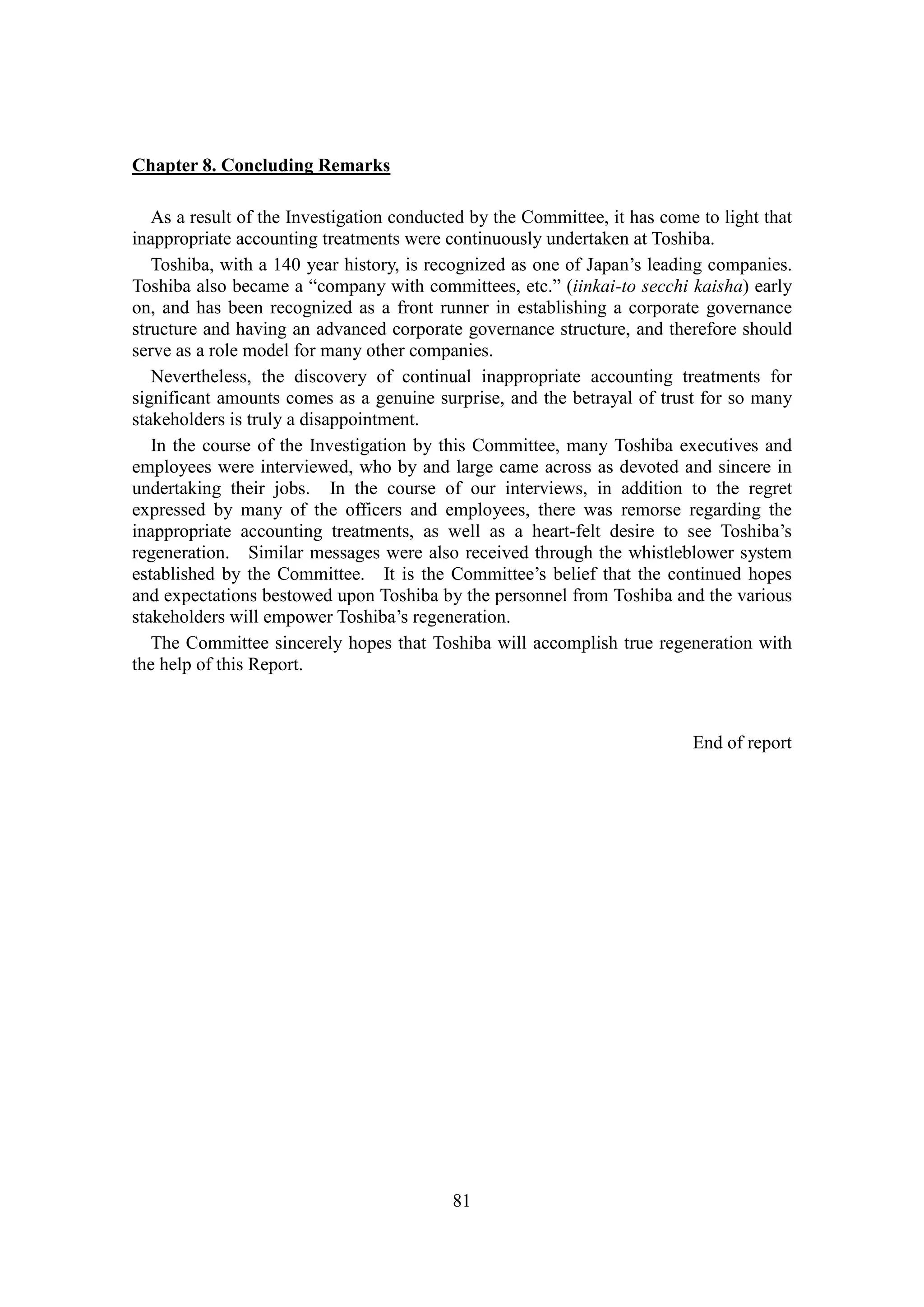

![[Tentative Translation]

Quarterly Correction List

(Unit: 100 million Yen)

Cases under Investigation Year 2008 Year 2009 Year 2010 Year 2011 Year 2012 Year 2013 Year 2014 Fiscal Year

2008

- Fiscal

Year 2014

Q3

Q1 Q2 Q3 Q4 Yearly Q1 Q2 Q3 Q4 Yearly Q1 Q2 Q3 Q4 Yearly Q1 Q2 Q3 Q4 Yearly Q1 Q2 Q3 Q4 Yearly Q1 Q2 Q3 Q4 Yearly Q1 Q2 Q3 Q1-Q3

Total

Percentage-of-co

mpletion method Amount of

correction

Sales 0 (5) (20) (15) (40) (4) 8 3 (7) (0) (1) 54 0 (0) 53 (0) 0 (0) (2) (2) (1) (6) (12) (11) (30) 11 (228) 142 2 (73) (31) (14) 8 (37) (128)

Net profit before taxes

and other adjustments 3 0 (39) (0) (36) 0 15 5 (19) 1 0 69 2 (0) 71 (0) (1) (1) (77) (79) (13) (12) (8) (146) (180) (18) (467) 130 109 (245) (9) (3) 3 (9) (477)

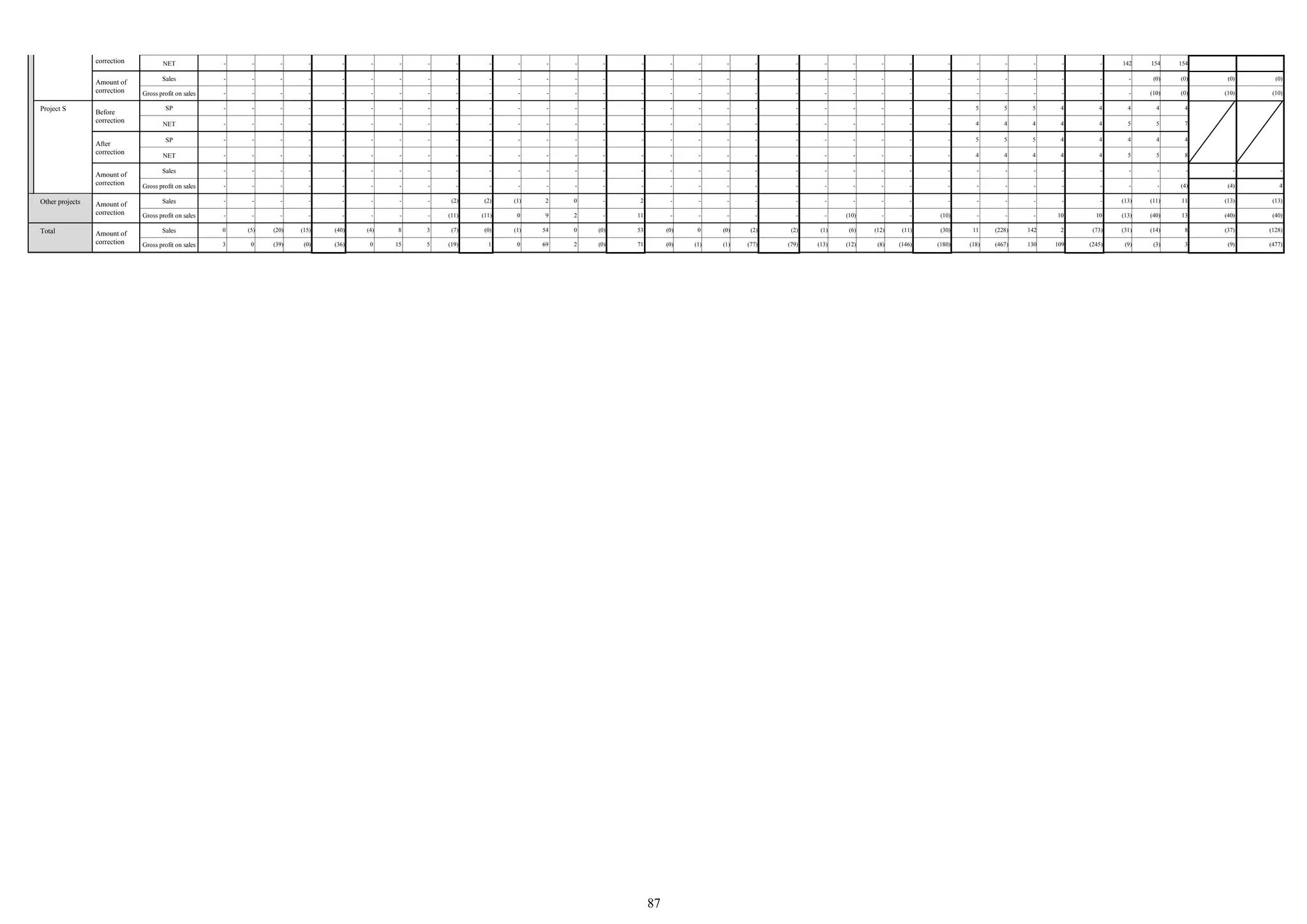

Parts transactions

Amount of

correction

Sales

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Net profit before taxes

and other adjustments (34) (142) (51) 33 (193) (91) (122) (73) (6) (291) (136) 129 89 30 112 (154) (76) 88 (19) (161) (79) (34) (37) (160) (310) 42 29 10 (84) (3) 65 95 94 255 (592)

Expense

processing Amount of

correction

Sales

- - - - - - - - - - - - - - - (43) 10 0 30 (3) (31) 1 4 27 2 (0) (24) (3) 23 (5) (28) 14 (1) (15) (21)

Net profit before taxes

and other adjustments - - - (53) (53) (40) (40) 80 (78) (78) (65) (84) 97 (30) (82) (70) (81) 78 104 32 (67) (10) 24 52 (1) 4 (65) (48) 139 30 12 9 43 64 (88)

Semiconductor

Amount of

correction

Sales

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Net profit before taxes

and other adjustments - - - - - - (20) - (12) (32) - (20) - 4 (16) - (0) (54) (50) (104) (81) (60) (110) (116) (368) 106 32 104 (78) 165 0 (18) 13 (5) (360)

Total

Amount of

correction

Sales

0 (5) (20) (15) (40) (4) 8 3 (7) (0) (1) 54 0 (0) 53 (43) 10 0 28 (5) (32) (5) (8) 16 (28) 11 (252) 139 24 (78) (59) 0 7 (52) (149)

Net profit before taxes

and other adjustments (31) (142) (90) (20) (282) (131) (167) 13 (115) (400) (201) 94 187 4 84 (224) (157) 112 (42) (312) (240) (116) (131) (371) (858) 134 (471) 196 87 (54) 69 83 152 304 (1,518)](https://image.slidesharecdn.com/201507251-150728235614-lva1-app6891/75/Toshiba-Investigation-Report-Summary-83-2048.jpg)