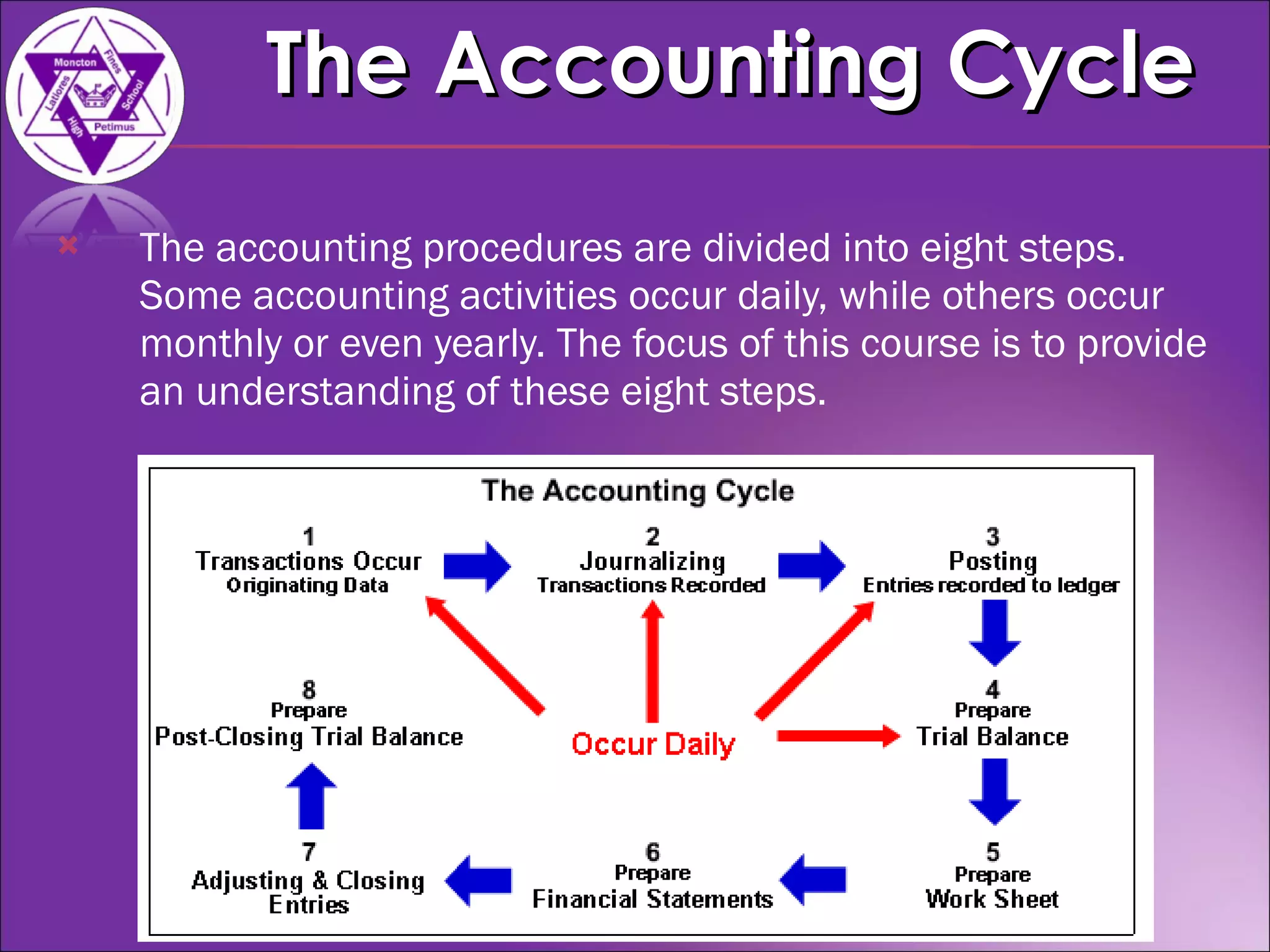

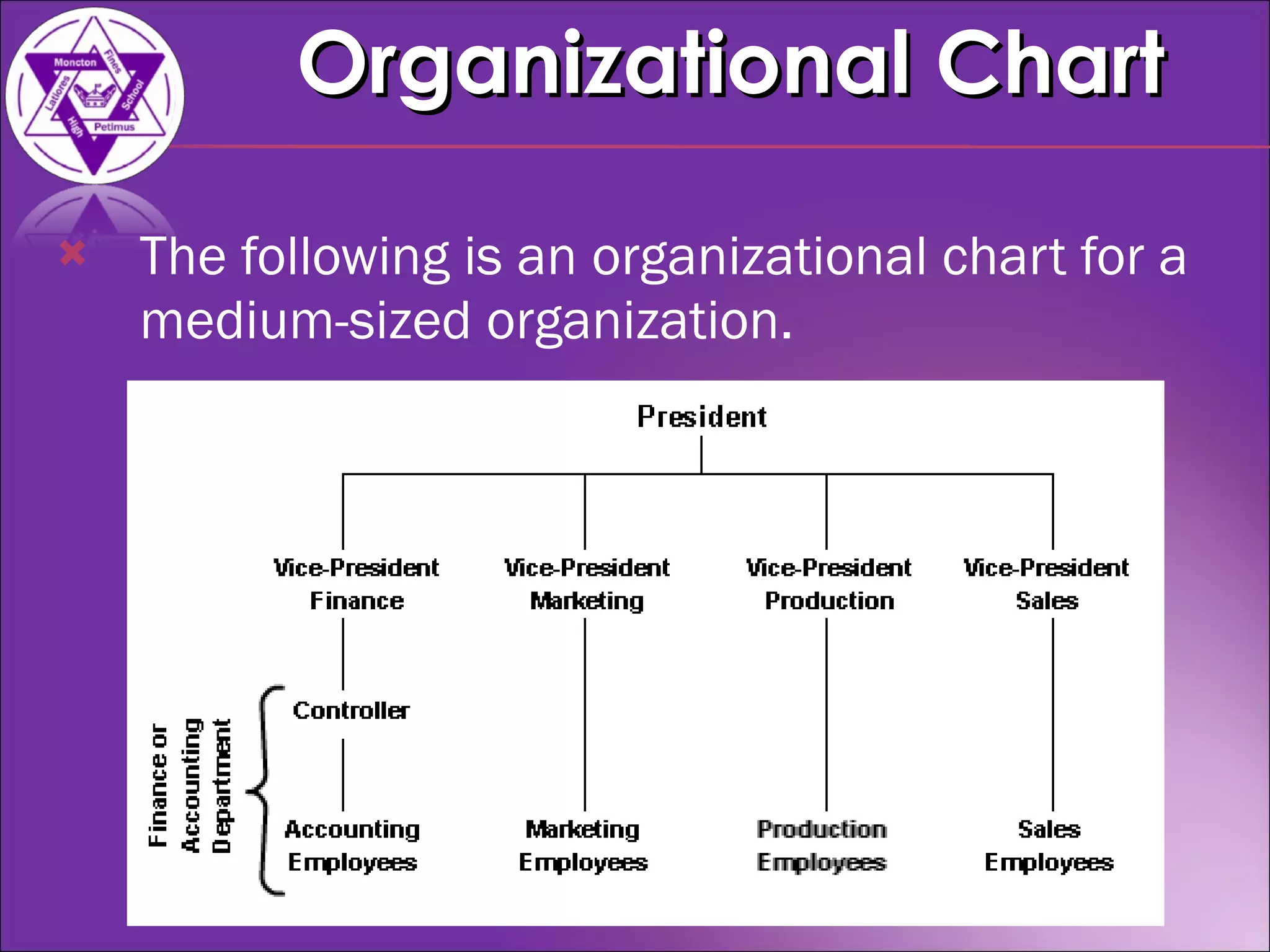

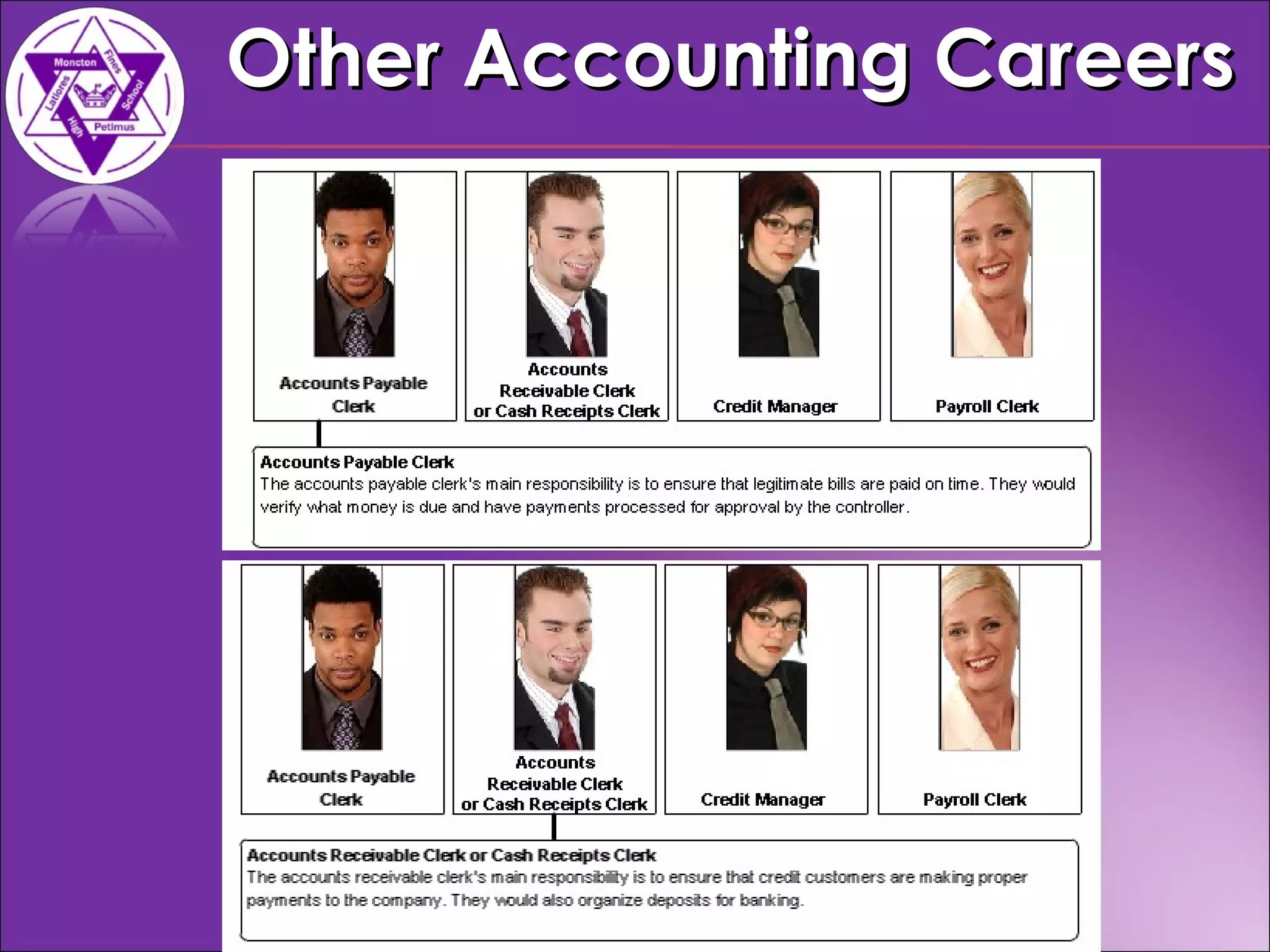

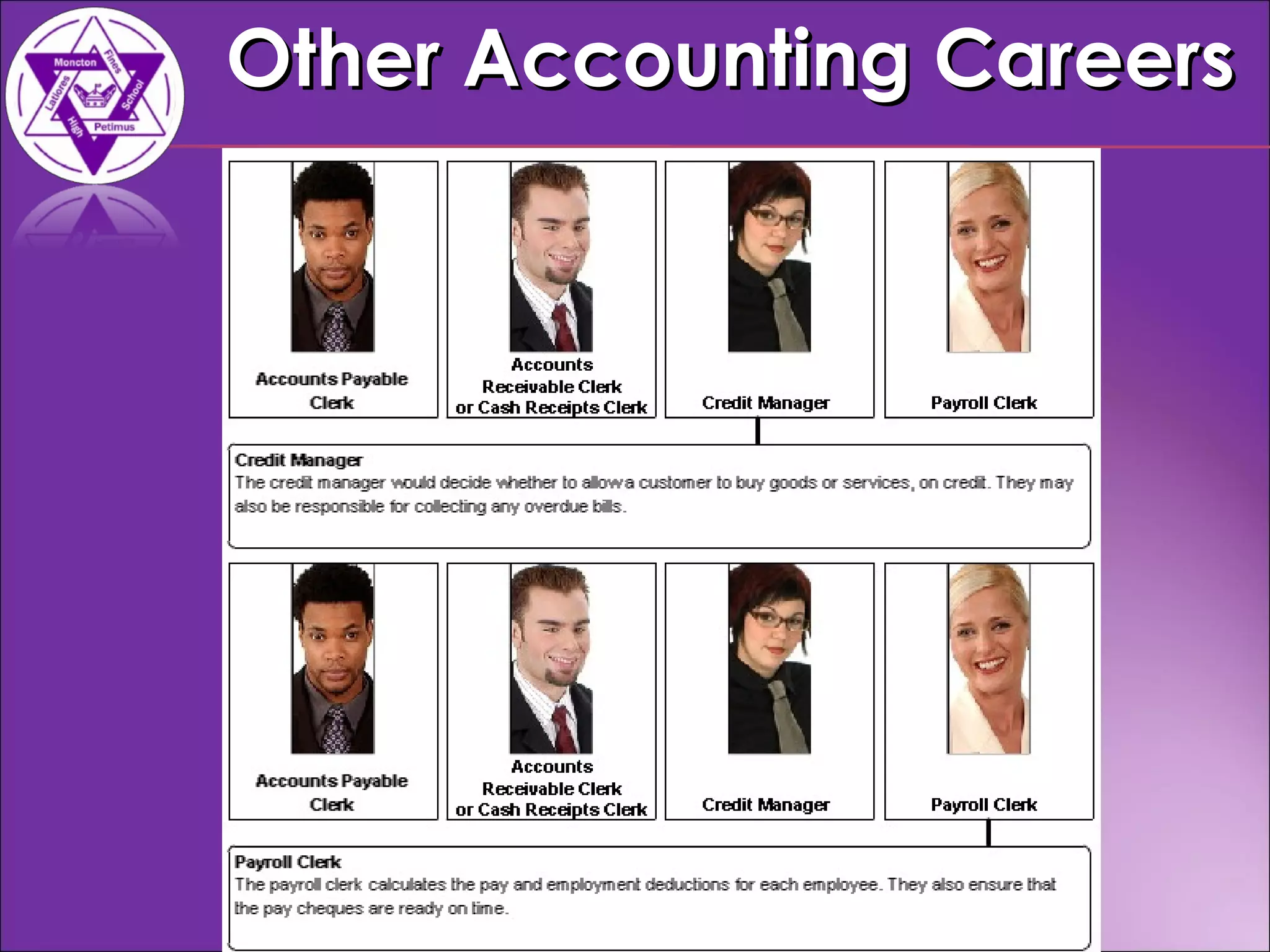

This document provides an overview of the accounting cycle, various accounting careers, and assignments for an Introduction to Accounting 120 class. It discusses the eight steps in the accounting cycle and examples of entry-level accounting roles like accounting clerks and bookkeepers. It also describes higher-level roles like accounting managers and controllers. Students are assigned to complete textbook questions on the accounting cycle and questions about the Enron accounting scandal.