This document outlines various methods for valuing stocks and equity, including:

1) Balance sheet valuation methods like book value, liquidation value, and replacement cost.

2) Dividend discount models that value a stock based on the present value of expected future dividends.

3) Free cash flow models that value a company based on the present value of expected future free cash flows discounted at the weighted average cost of capital.

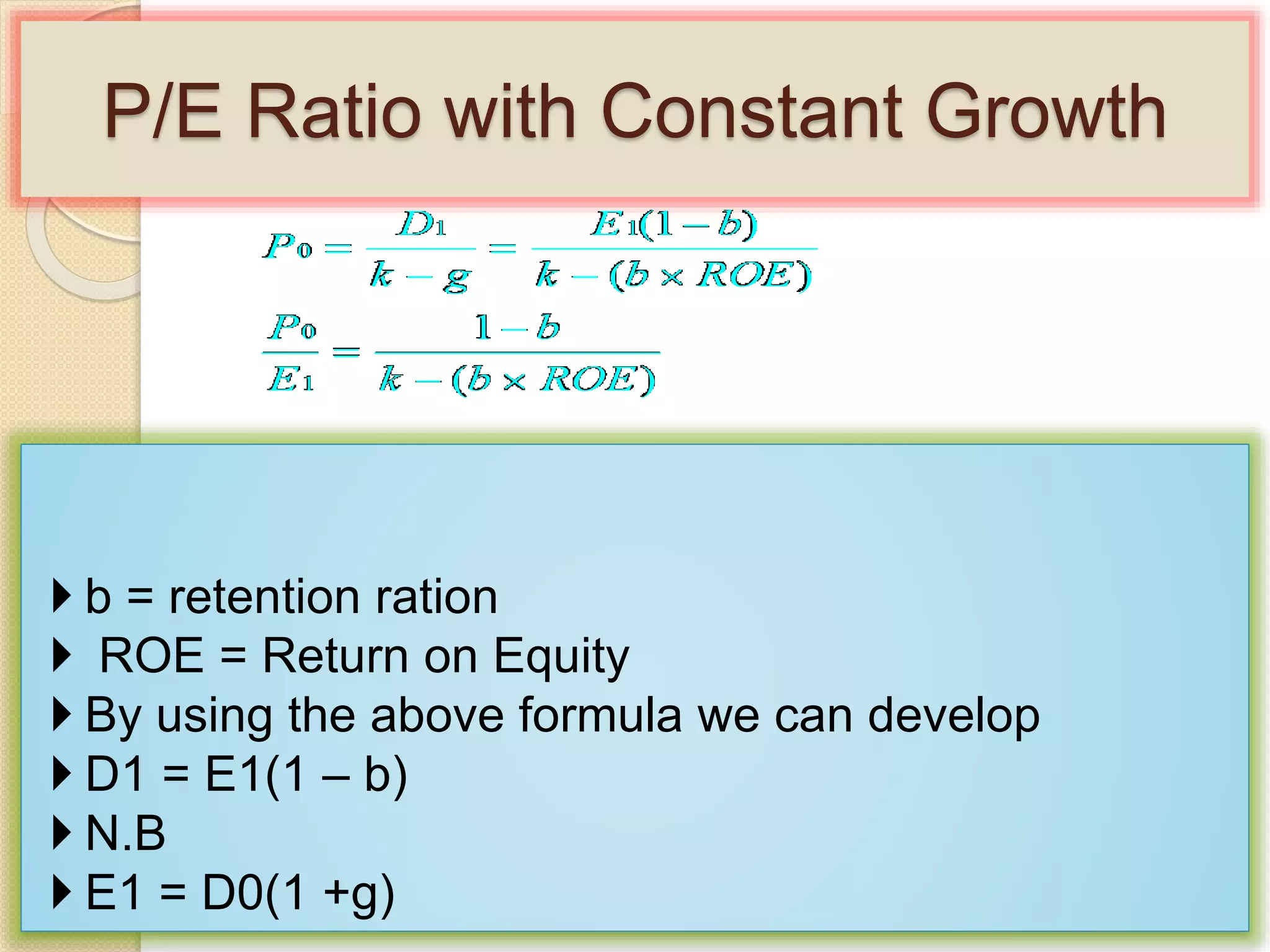

4) Earnings multiplier approaches that value stocks based on price-to-earnings or enterprise value-to-EBITDA multiples.